Prices are on the up in the wake of the COVID-19 pandemic. The question is, will deflationary conditions resume as global economic conditions normalise or is inflation going to be a feature for the foreseeable future? Sandy McGregor interrogates this conundrum.

In an article in our Quarterly Commentary of December 2019, I wrote about inflation being historically an abnormal phenomenon. The normal workings of a market economy favour price stability. Inflationary periods have been associated with disruptions caused by wars, natural disasters such as pandemics and the flawed conduct of monetary and fiscal policies by governments, which prevent markets from playing their normal stabilising role.

The economic recovery following the COVID-19 pandemic has been accompanied by a widespread surge in prices. The critical question for investors is whether this is a one-off adjustment, which will be followed by price stability as things return to normal, or whether, as a result of the response of governments to the pandemic, inflation is going to become a more enduring problem. Of particular importance is price stability in the United States. The dollar is the world’s reserve currency and anything that affects its value has important consequences for the entire global economy.

Only time will tell who in the great debate about inflation is correct. … we are on a journey not knowing where we are going, and when we get there, we shall not know where we are

The initial response to the pandemic

In March last year, as the magnitude of the COVID-19 crisis became apparent, widespread government-imposed lockdowns caused global economic activity to collapse. Investors dumped financial assets in a desperate scramble to raise cash. The global financial system is dollar-based, so the eye of the storm was in American markets. In the four weeks to 23 March 2020, the S&P 500 Index declined 33.4%. The US Federal Reserve (the Fed) responded aggressively, slashing short-term interest rates to zero, spending US$3tn on asset purchases and opening up its dollar-swap facilities to provide liquidity to other central banks.

The prompt actions of the Fed averted a damaging implosion of the global financial system. Other central banks also acted decisively. Since the onset of the pandemic, the combined balance sheets of the Fed, the European Central Bank and the Bank of Japan have grown by US$9tn, equivalent to 10% of the world’s annual GDP.

Governments responded to the pandemic with massive expenditures aimed at sustaining personal incomes. The scale and speed of the financial response to the pandemic by the United States far exceeded that of any other nation. In April 2020, Congress approved a US$2.5tn spending programme. This was followed by a further US$0.9tn in December 2020. Together, these two packages were equivalent to about 17% of GDP.

While the Fed’s initial response was prompted by concerns regarding financial stability, it also has a full employment mandate. To promote an economic recovery, it has continued to grow its balance sheet by US$120bn per month and ended the year with assets worth US$7.3tn, an increase over 12 months of US$3.2tn. This massive response to the pandemic was possible because the dollar is the world’s reserve currency: The Fed can print currency with impunity. No other country enjoys the inordinate privilege the dollar gives the United States.

The November US election

The outcome of the US election in November last year was that the Republicans held 50 Senate seats and the Democrats 48. Two seats in Georgia were subject to a run-off election early in January, but as Georgia had long been a Republican state it was widely expected that the Republican Party would hold at least one and probably two of these seats. Congress would then be deadlocked with a Republican-controlled Senate and a Democratic House of Representatives. The financial markets were comfortable with this outcome because a conservative majority in the Senate would impose fiscal discipline on the incoming Biden administration. The most prominent Republican proponent of financial imprudence was Donald Trump and he was about to depart the scene.

Accordingly, the outcome of the Georgia run-offs early in January was a surprise. The combination of a big turnout by African American voters and Trump’s bizarre attempt to overthrow the result of an election he clearly lost, gave both seats and, with the vice president’s casting vote, control of the Senate to the Democrats. American politics suddenly lurched leftwards.

Biden’s agenda

The Biden administration’s agenda is the most radical since Roosevelt’s New Deal in the 1930s. The new president has embraced the view of many Democrats that Obama failed to take advantage of the financial crisis of 2007/8 to substantially increase fiscal spending to promote social change. Obama was fiscally cautious and refused to expand what was then regarded as a bloated deficit.

What makes the present surge in inflation unique is that central banks in developed economies are continuing to keep short-term interest rates at or below zero

Now, following a year in which Congress authorised the unfunded spending of US$3.4tn on pandemic relief without apparent adverse financial consequences, there are far fewer proponents of the conventional wisdom that spending should be matched with revenues. The political system is reacting to the favourable response of voters to the COVID-19 relief payments they received. The senior leadership of the Biden administration is concerned that if they do not deliver a strong economy over the next 15 months, their party may lose its tenuous majority in Congress in the 2022 midterm elections. As a result, Biden’s first legislative initiative was the American Rescue Plan, which provided a further US$1.9tn of welfare payments. Those, such as former Secretary of the Treasury Larry Summers, who argued that the economy was recovering strongly and did not need this stimulus, were ignored.

The ease with which the American Rescue Plan passed through Congress encouraged Biden to seek Congressional support for other items on his agenda. He has proposed an American Jobs Plan, which involves spending US$2.3tn over 10 years on infrastructure and education, and a similarly ambitious American Family Plan, to give financial support to poorer households. He has submitted his 2021/22 budget which envisages a permanent increase in spending from US$4.5tn to US$6.0tn annually. This would be partially funded by increased taxation to be paid by business and the wealthy. However, once the exceptional pandemic expenditures end, the budgeted annual fiscal deficit, which in 2019 was US$1tn, increases by 50% to about US$1.5tn. The political pressures to increase fiscal deficits seem inexorable. Under the Republican administration of Donald Trump, tax cuts increased the deficit from 3% to 5% of GDP. Now Biden seeks to permanently increase this to between 6% and 7%.

As a consequence of razor-thin majorities in Congress, Biden is finding it increasingly difficult to obtain legislative support for his agenda. However, there are aspects of his proposals, notably regarding infrastructure, which command widespread support. While these will be enacted, a majority of the Senate are hostile to the way Biden proposes to pay for them.

Politics is like water: It flows downhill by the easiest path. Biden will be forced to accept a reduced expansion of expenditures but also a reduced increase in taxation. The easy path is to expand the fiscal deficit. For those who do not accept the arguments of the proponents of Modern Monetary Theory, who say deficits do not matter, the ever-increasing fiscal deficit is concerning.

The difficulty we all face is that we do not know the extent to which the post-pandemic world will differ from the past

A surge in prices

The major industrial blocs in the Northern Hemisphere have made good progress in vaccinating their populations and are rapidly recovering economically from the pandemic. Initially China took the lead and by the end of 2020 its GDP had returned to pre-COVID-19 levels. However, this year it is the United States which has made the largest contribution to global growth. During the northern summer, its economy will surpass where it was at the end of 2019. Europe is recovering more slowly but is clearly on the mend. The momentum of the recovery is strong. Household balance sheets have been protected by government grants and personal savings have soared. Consumers have the resources to spend.

The pandemic has severely dislocated global supply chains, with the consequence that inventories have been run down to unprecedently low peacetime levels. Companies are investing to meet growing demand and order books for capital goods are strong. The combination of strong demand and restocking inventories has triggered a wave of shortages, which continue to disrupt supply chains. Most notable are a shortage of silicon chips, which is adversely affecting the manufacture of computers, and a shortage of containers which has disrupted shipping. Mining companies have underinvested in recent years and lack the surplus capacity required to compensate for supply disruptions. With strong demand, commodity prices are at record levels. This is not restricted solely to metals and minerals. The Economist dollar-based food index is up 40% since June last year and world food prices are at risk from serious droughts in Brazil and the western United States.

A constant refrain of businesses seeking to ramp up operations is their inability to recruit the employees they require. There seem to be a variety of reasons for this. The closure of schools has forced some parents to remain at home to look after their children. Older people who were still working may have decided to retire. Government grants may have acted as a disincentive to return to work. However, even before the pandemic, labour markets in the major industrial countries were heading towards full employment. It would not be surprising that a resurgence of growth triggers a labour shortage.

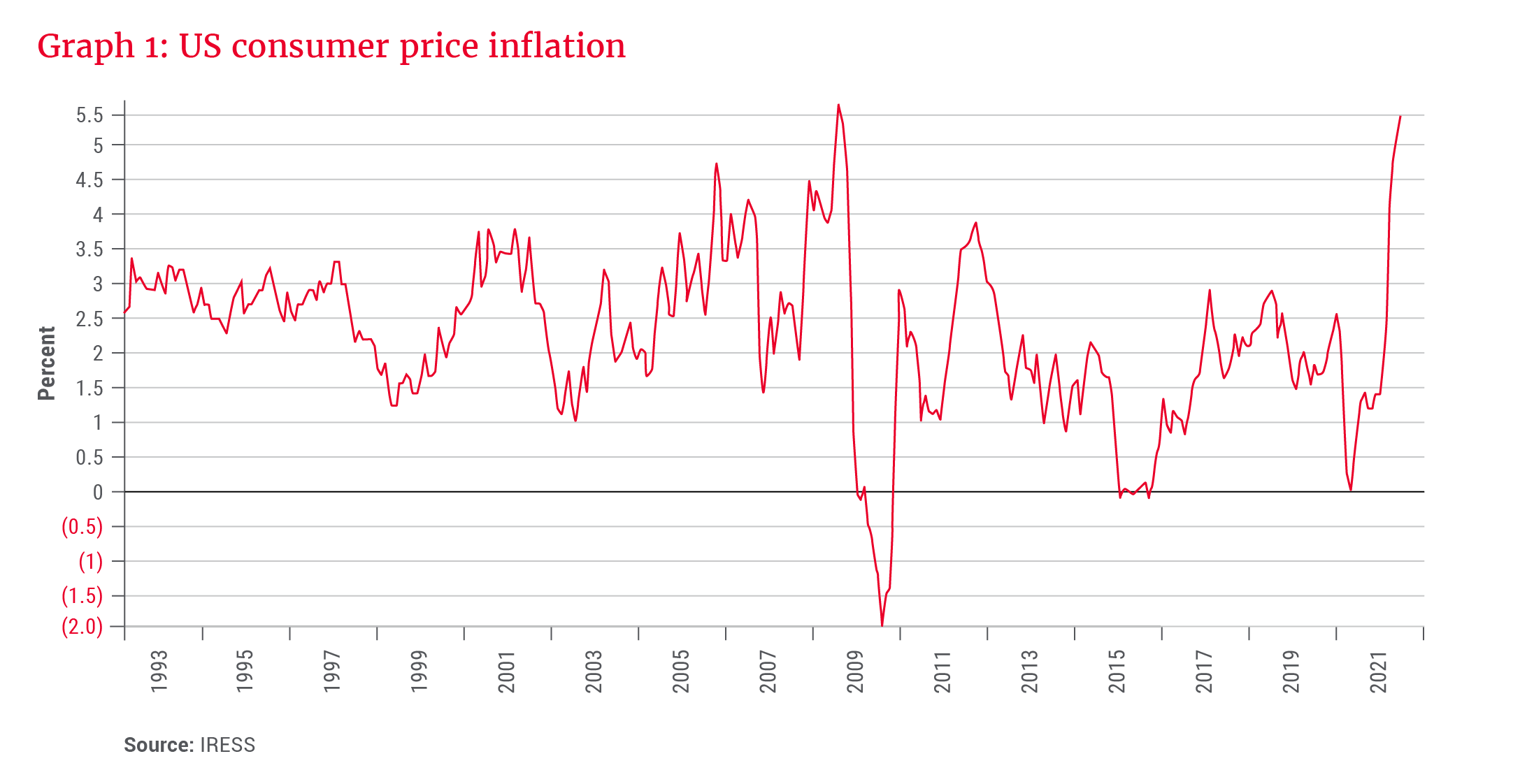

As is normal in a market economy, the business sector is responding to a labour shortage by increasing wages. Given strong final demand, business is able to pass on rising costs to the final consumer. Prices are going up. As shown in Graph 1, in June 2021 the US inflation print was 5.4%. Apart from a brief oil price-related blip in 2008, this is the highest level since 1991. Unlike in 2008, current inflationary pressures are diverse and widespread.

The Fed remains unconcerned

What makes the present surge in inflation unique is that central banks in developed economies are continuing to keep short-term interest rates at or below zero. Never before have they regarded a widespread rise in prices with such complacency. After the inflationary shocks of the 1970s, the basic rule determining monetary policy was that interest rates should not be less than the inflation rate, as monetary policy itself would then not be inflationary and the normal operation of market forces would ensure price stability.

After the financial crisis of 2008, central banks in developed economies responded to what they regarded as deflationary conditions by reducing interest rates to zero, or even less than zero. They are now unable to raise rates because they are trapped by their former decisions. By going to zero, they have gone to a place where they never should have gone and from which they fear to escape, because higher interest rates will have an adverse impact on asset prices, possibly precipitating a financial crisis, and will hugely complicate the funding of bloated fiscal deficits.

They justify sticking to their present position by arguing that the inflationary spike will be transitory and deflationary conditions will resume as global economic conditions normalise. However, some doubts are emerging. Whereas the Fed’s previous communications with the markets could be interpreted as meaning that the monthly purchase of US$120bn of assets and zero rates may continue almost indefinitely, its guidance is now that it will taper asset purchases in 2022 and that interest rates could increase slightly in 2023. Policies will be fine-tuned but not changed dramatically. Perhaps the biggest flaw in their thinking is the inflation outcome they expect requires the economic challenges of the present decade to be the same as in the decade following the financial crisis of 2008. It is uncertain whether this will be the case.

Increasing market concerns regarding inflation

What worries inflation pessimists is the explosive cocktail in the United States of an overheated economy, zero interest rates and growing fiscal deficits funded by the printing of money. They fear that market forces may be able to promote price stability if one or even two components of this toxic mix are present – but not when all three come together. These concerns are reflected in the price of US government bonds. As shown in Graph 2, the 10-year yield reached a pandemic low of 0.55% early in August 2020. It then gradually increased to end the year at 0.91%. Following the Democratic victory in Georgia, it spiked to 1.14% and continued upwards to peak at 1.74% at the end of March before retreating again. These yields are substantially below the inflation rate because the Fed is suppressing the yield curve by setting short-term rates at zero and pumping liquidity into the market through monthly purchases of US$120bn of bonds.

However, in the long run, investors seek a real return on bonds and, should inflation expectations increase substantially, the Fed will ultimately be forced to abandon its asset purchases and increase short-term rates. It cannot stand aside and allow inflation to get out of control as it did in the late 1970s. This would be a profound change from its present stance and the journey back to what previously was regarded as normal monetary policy could be turbulent. The current edifice of high asset prices, which is the direct consequence of current monetary policy, would be under threat.

There are articulate and knowledgeable proponents of opposing views. Some agree with the central banks that the present spike in prices will prove transitory; others maintain that inflation is going to be more entrenched. The difficulty we all face is that we do not know the extent to which the post-pandemic world will differ from the past. Expectations regarding the future are usually an extrapolation of the recent past. The market economy operates efficiently because it is an information system signalling opportunities and risks. However, central banks have so aggressively manipulated asset prices, seeking stability at any cost, that the way the economy is changing is more hidden than normal. Only time will tell who in the great debate about inflation is correct. Like Columbus setting out for the New World, we are on a journey not knowing where we are going, and when we get there, we shall not know where we are.

Even if the optimists prove right in the short term, there are worrying longer-term issues. There has been a widespread political shift favouring increased intervention by governments in the economy. Most such interventions increase the cost of doing business, which is passed on to the consumer and is inevitably inflationary. In particular, decarbonising the global economy poses a huge risk to the cost of living. Little effort has been made to quantify the costs of this project. The modern economy is energy-based. Replacing an existing system, which has developed over more than two centuries, with new technologies, many of which are less efficient, will involve massive capital expenditures which will consume global savings at a time when retirement and health costs are also soaring.

Inflation arises when the demand for resources exceeds the available supply. Over the past 40 years, globalisation and technology have created an abundance, which tamed inflation. It is not clear that this is going to last.