As we celebrate our 50th anniversary this year, we naturally reflect on the history of the firm and the important milestones we reached along the way. Nick Curtin discusses one of the most significant events in our history – the launch of our first unit trust, the Allan Gray Equity Fund, and delves into the core that powers us, our key differentiators, and what it takes to be contrarian.

The year 1998 was eventful. A liquidity crisis roiled financial markets after Russia unexpectedly defaulted on its foreign debt. The European Central Bank was established ahead of the launch of the euro in 1999, and in-orbit construction of the International Space Station began in earnest. A small American search engine company called Google was founded in California, while on the other side of the planet, a little-known Chinese technology company called Tencent came into being.

In South Africa, Nelson Mandela was still president and South Africa won the ICC KnockOut Trophy. The average prime interest rate was 21.5% and one US dollar cost R5.50. It cost about R126 to fill a 50-litre tank of petrol, and the cost of electricity was around 12 c per kWh (about R2.34 today). The JSE All Share Index was at 5 820 (versus around 78 218 today) and government bond yields averaged over 15%.

Closer to home, 1998 was also the year that Allan Gray celebrated its 25th anniversary – halfway to where we are today – and the year that we launched our first unit trust, the Allan Gray Equity Fund. Although at that point the firm had been successfully managing South African equities for 25 years, this marked the first time that retail investors could directly access our investment expertise. Now, 25 years later, is therefore an opportune time to reflect on the lifetime of the Allan Gray Equity Fund.

The myth of normal

As eventful as 1998 may have seemed, the reality is that it was not particularly different from any other year in the last 50. For most of us, our minds tend to anchor to some concept of “normal”, probably as a way to psychologically survive the endless news flow in the belief that things will soon settle down and we can then relax. However, the world has always been largely unpredictable and its capital markets volatile. This is why our long-term, valuation-driven, contrarian investment philosophy has not changed in 50 years and likely never will. It is what allows us to stay focused on the facts and cut through the noise, so that we can see things as they are and not as we might want them to be.

… the last 50 years have taught us that the best investment opportunities often present themselves when sentiment is bleakest – and this time is no different.

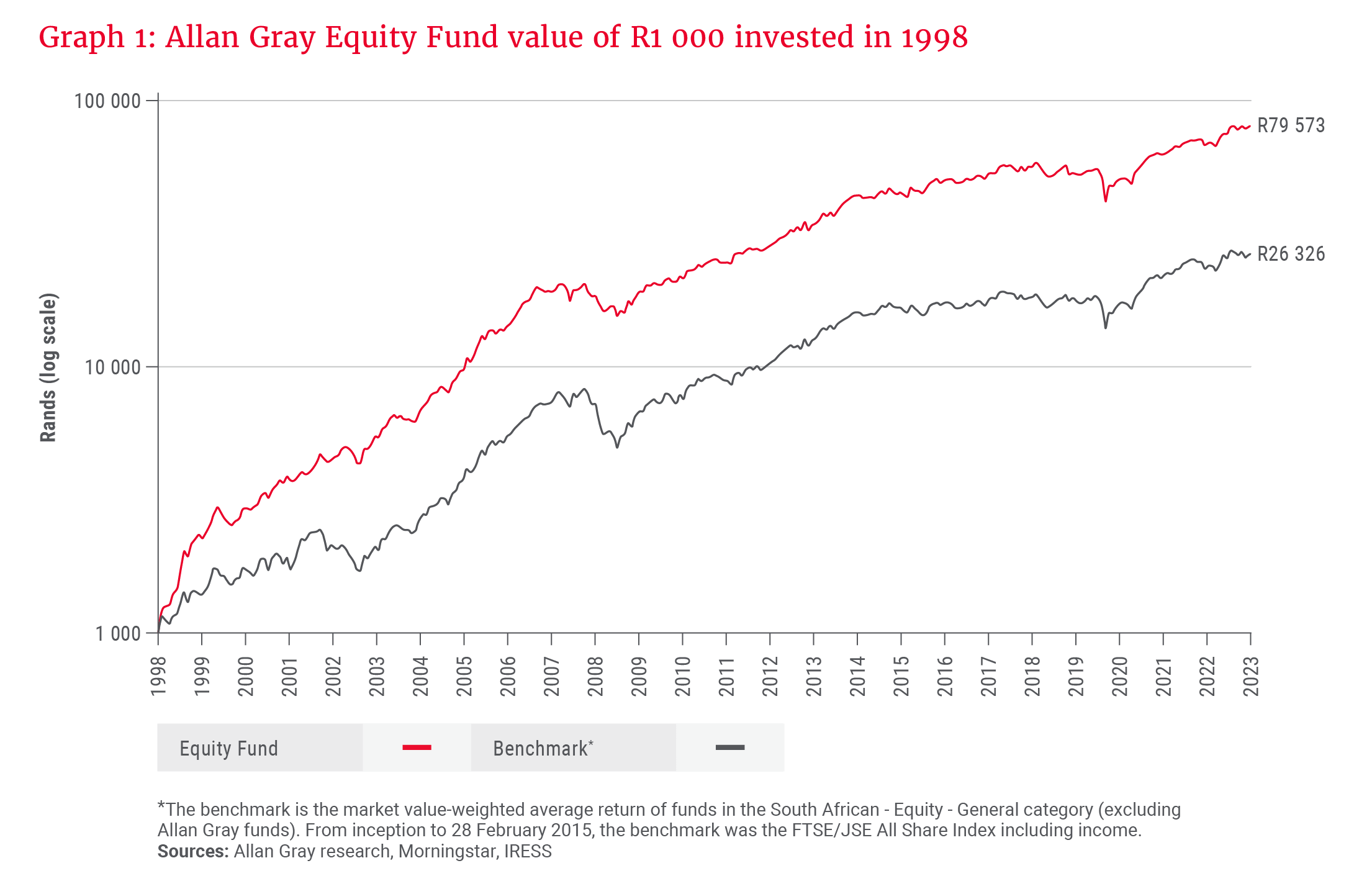

It is an approach that has delivered on its long-term promise. Since inception in 1998, our Equity Fund has achieved a return of 19.3% per year, net of all fees and expenses, versus the benchmark’s return of 14.1% and inflation of 5.4%. Over 25 years, the compounding effect is powerful: R1 000 invested in the Allan Gray Equity Fund on 1 October 1998 would be worth R79 573 today – more than three times the amount had you been invested in the benchmark (see Graph 1).

The stock selection core

Graph 1 only shows half the picture, though. Today, Allan Gray is well known for its security selection abilities across all major asset classes and geographies. Security selection is the beating heart of the firm, but it is important to remember that equity stock selection specifically is at its core. Managing equities has always been fundamental to our investment capabilities.

The Allan Gray equity investment core is hard at work.

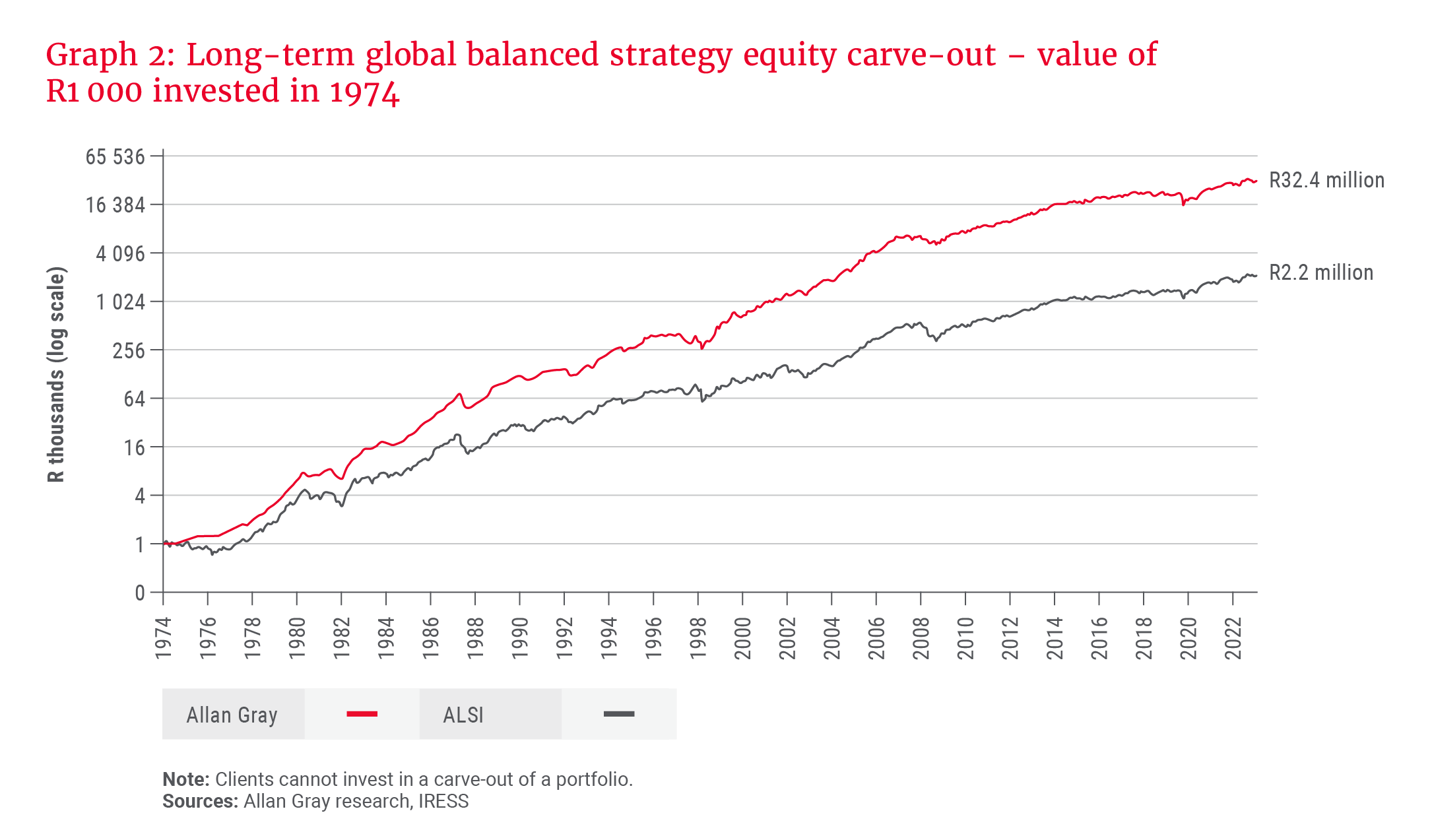

Notwithstanding our strong fixed interest capabilities, South African equities still comprise approximately two-thirds of all assets that we manage in South Africa. Graph 2 shows the return of the equity component of our balanced strategies (23.6% per year) against the FTSE/JSE All Share Index (ALSI) (16.9% per year) stretching back almost 50 years, i.e. well before the launch of our retail Allan Gray Balanced Fund. Although this is a carve-out from the multi-asset class strategy, the underlying equity core is fundamentally the same as that of the Allan Gray Equity Fund. Indeed, to a large extent, the asset allocation in our balanced strategies is the by-product of our bottom-up security selection process. That’s where everything starts.

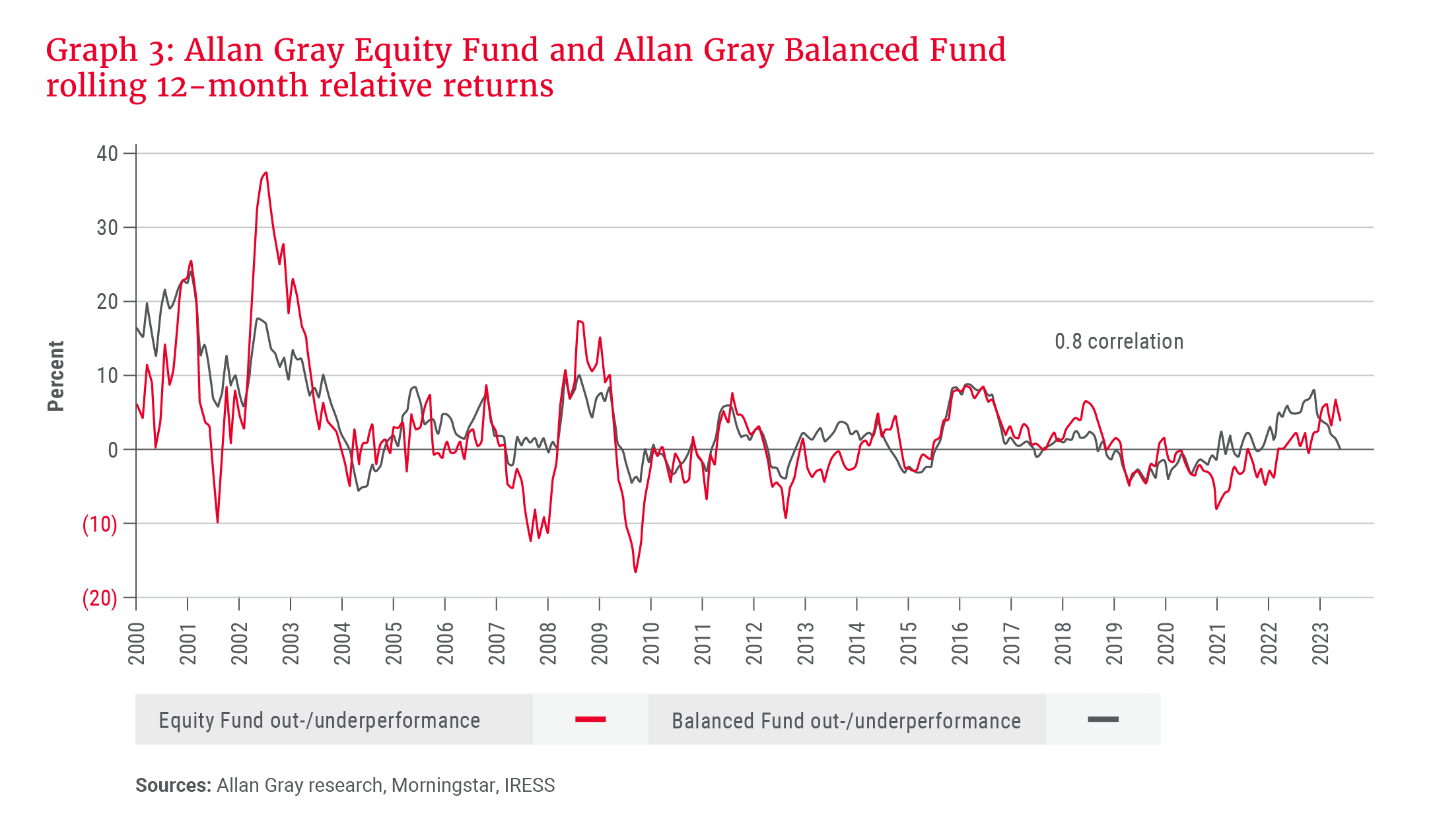

The Allan Gray balanced strategies and Allan Gray equity strategies tend to outperform or underperform at very similar points in time, as illustrated by Graph 3, which shows the rolling 12-month relative returns for the Allan Gray Equity Fund and Allan Gray Balanced Fund since 1998. This correlation of excess returns (i.e. performance relative to benchmarks) makes sense given the bottom-up share selection anchor to our investment philosophy, the relatively high-conviction positions we take and the average weight in the asset class. It is therefore very difficult for the bulk of Allan Gray’s investment strategies to do well if the South African equity core is not doing well. The South African equity capability is fundamental to our entire investment process, and has been for 50 years.

Key differentiators

While we consider our stock selection ability to set us apart, the key differentiator of our Equity Fund is the shape of returns over time. The combination of a long-term investment horizon and a genetic ability to take high-conviction, contrarian positions results in periods of outperformance when our investors need them most. We tend to deliver our strongest relative performance when markets and competitors are not performing very well.

In all but one of the seven largest ALSI market falls since 1974, Allan Gray’s equity strategy meaningfully outperformed the market and protected investor capital. Because our strategy fell by less than the market, it typically recovered much quicker and was then able to continue compounding positive returns while the market had not yet recovered to its starting point.

Prior to market falls, as the market rises to those extreme points, we often experience that our investment approach may not keep pace because one area is becoming very popular (see the 1997 example cited under “Dare to be different” below). Although we typically still deliver a reasonable absolute return given generally rising markets, it is harder (and arguably less necessary) to differentiate ourselves from others when the proverbial rising tide is lifting all ships. We believe delivering strong relative performance when markets are weak and absolute returns are low, is far more useful. In these circumstances, we can make a meaningful difference to clients’ outcomes by protecting their capital and growing it when the broader market lags. These performance patterns are fundamental to our equity strategy capabilities.

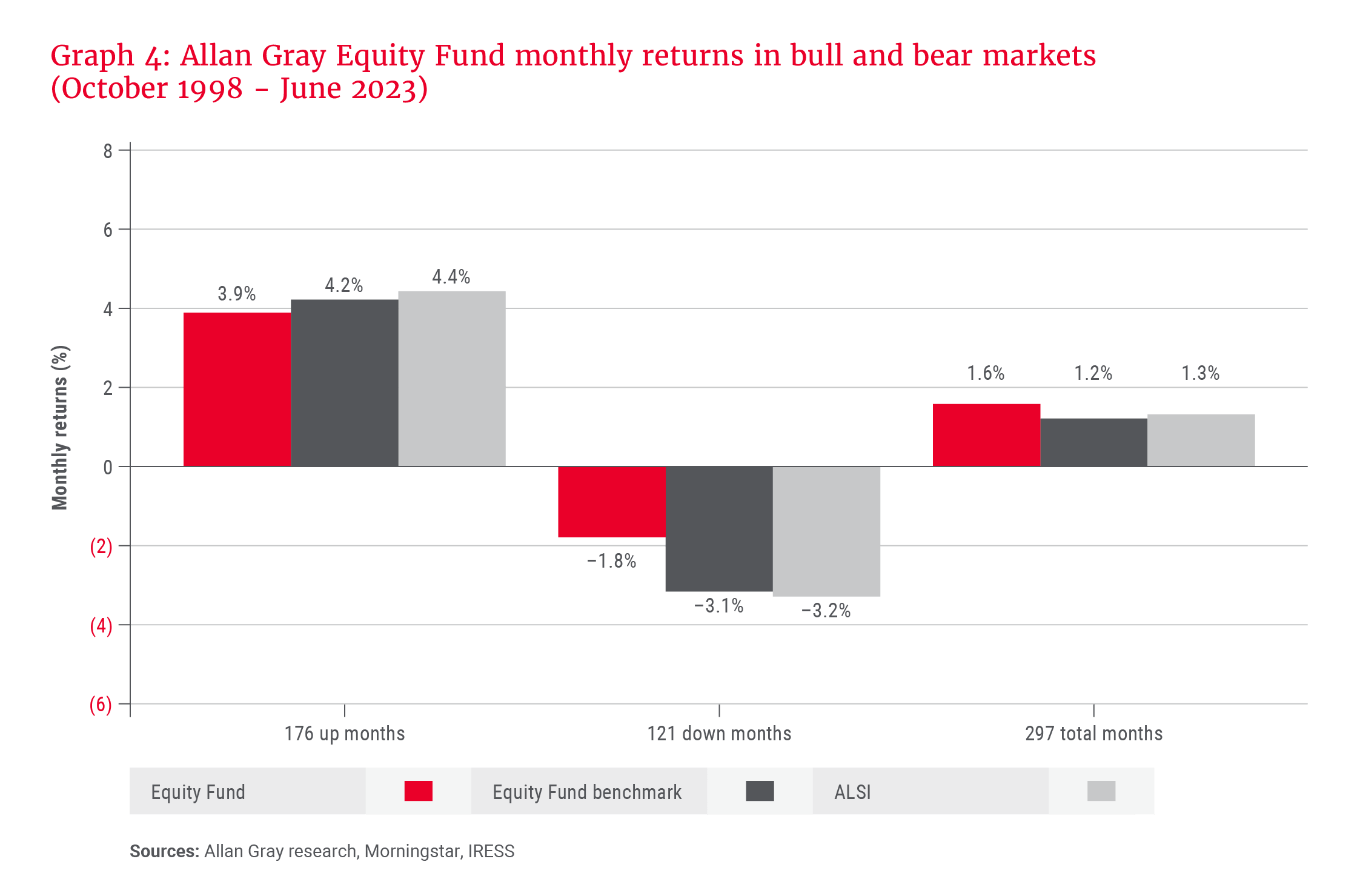

Graph 4 shows the average monthly return of the Allan Gray Equity Fund compared to its benchmark and to the ALSI during up months, down months and overall. In relative terms, this performance pattern underpins our diversifying position – we tend to look different from the market. In absolute terms, protecting returns on the downside has immense compounding power over the long term, which is the most important component of the wealth creation formula.

A crucial differentiating factor is therefore our focus on and understanding of the risk of capital loss. We are not simply trying to find shares whose prices will go up; rather, we look to invest in businesses where the share price is substantially below the intrinsic value of the company. The downside protection this valuation buffer provides is fundamental to our investment philosophy.

Dare to be different

It is easy to call oneself a contrarian, but much harder to actually be one. Our 50-year history serves up a smorgasbord of examples. In December 1997, Allan Gray did not hold a single share in the financial sector, while the index had an exposure of 28%. Instead, we were invested in much cheaper industrial and resource shares. It hurt performance in the prior years as the hot money continued to chase the expensive shares up, until the bubble finally burst in 1998, when Allan Gray investors were handsomely rewarded: Our equity strategy returned 67% for the period May 1998 to November 1999, while the ALSI delivered 5%.

We protect our organisational structure like the crown jewel that it is.

Today, the same preference for high-conviction contrarian positions is evident at the security selection level in our Equity Fund. For example, we hold no Anglo American, which comprises approximately 10% of the ALSI, while our combined weighting in Naspers/Prosus is about half their combined index weight. Similarly, we hold significantly higher-than-index weights in shares such as British American Tobacco, Anheuser-Busch InBev, Glencore and Woolworths. In addition, the ability to invest a portion offshore (since 2015) has also increased our ability to differentiate. We are very comfortable with a portfolio that looks quite different from the index and peers.

The ability to execute on contrarian positions like these requires a lot more than just a high-conviction investment idea. An important factor that enables us to follow through on our approach is the structure of our firm. Several generations of people repeating the same process over 50 years of market cycles has created an organisational DNA that is very difficult to replicate. The firm has been intentionally designed this way so that we can harness the power of compounding returns over long periods of time for our investors. The track record is not just a number – it’s a testament to repeatability. We protect our organisational structure like the crown jewel that it is. Delivering on our promise to investors over the decades ahead depends on it.

Back to the future

While our Equity Fund’s 1998 birth year was an eventful one, we have had many trials and tribulations in the markets every year since. Twenty-five years later, most South Africans may be feeling shell-shocked. Having barely recovered from the pandemic-era trauma, we are deep in the throes of a national energy crisis and struggling with a stagnant economy. The world seems to be changing more rapidly than ever. But the last 50 years have taught us that the best investment opportunities often present themselves when sentiment is bleakest – and this time is no different.

While we are not totally immune to the distractions of sentiment, what may feel like a rollercoaster ride to investors really is familiar territory for the Allan Gray team. While caution is appropriate, the prevailing market environment is very well suited to how we manage money. Risk is high, but there are good opportunities. The Allan Gray equity investment core is hard at work.