While the US stock market represents about 70% of the FTSE World and MSCI World indices, just half of the Orbis Global Equity Fund is invested in American shares. The reason is simple – the US market is much more expensive than its international peers in aggregate, and our offshore partner, Orbis, has found more ideas elsewhere.

But the US is also a big place, with nearly 2 000 companies valued at over US$1bn each. Many of those companies are excellent, and where Orbis can find great companies at good prices, they are delighted to own them. Two businesses that fit that description are the managed care organisations UnitedHealth Group and Elevance Health. Povilas Dapkevicius and Matteo Sbalzarini take us through their investment theses.

Managed care organisations (MCOs) serve the vast US healthcare market, which is more complex than those elsewhere. In the US, most working people get health insurance through their employer, and decades ago this was the MCOs’ core business. For these plans, relationships with local hospitals matter far more than national bargaining power, so local scale is essential.

A smaller portion of working people buy insurance individually. Those who cannot afford private insurance get coverage through Medicaid, which is run by individual states with additional funding from the federal government, and most older people receive at least part of their care through the federal government’s Medicare scheme. Both Medicare and Medicaid plans can be administered by the MCOs. But the MCOs are not just insurers – they increasingly own and manage physician practices, care centres, and pharmacies, making them better placed to connect the dots for patients across this complex system.

... we remain confident that the companies can continue to deliver as they have in the past.

Dealing with that complexity is hard. Insurance underwriting skill is important but insufficient. A successful MCO needs good local scale to negotiate prices with care providers and good national scale to negotiate drug prices. To meaningfully improve the efficiency of the overall system, MCOs also need to be plugged into care providers to help the system shift from fee-based care, which incentivises activity regardless of outcomes, to value-based care, which aligns costs with outcomes for patients.

UnitedHealth’s Optum unit has been especially successful in integrating parts of the healthcare chain to lower costs and improve care for patients. For new entrants, the healthcare market has been a tough nut to crack: Amazon, J.P. Morgan and Berkshire Hathaway announced to great fanfare that they were entering the health insurance market in 2018, only to abandon the venture three years later.

With this industry setup, the MCOs benefit from two long-term tailwinds: an ageing population, and increased outsourcing of Medicare and Medicaid administration. Propelled by the ageing population, US healthcare spending is growing by about 5% per annum, a little faster than the wider economy, and the MCOs are getting exposure to more of that growth as they administer more Medicare and Medicaid plans and build out their health services businesses.

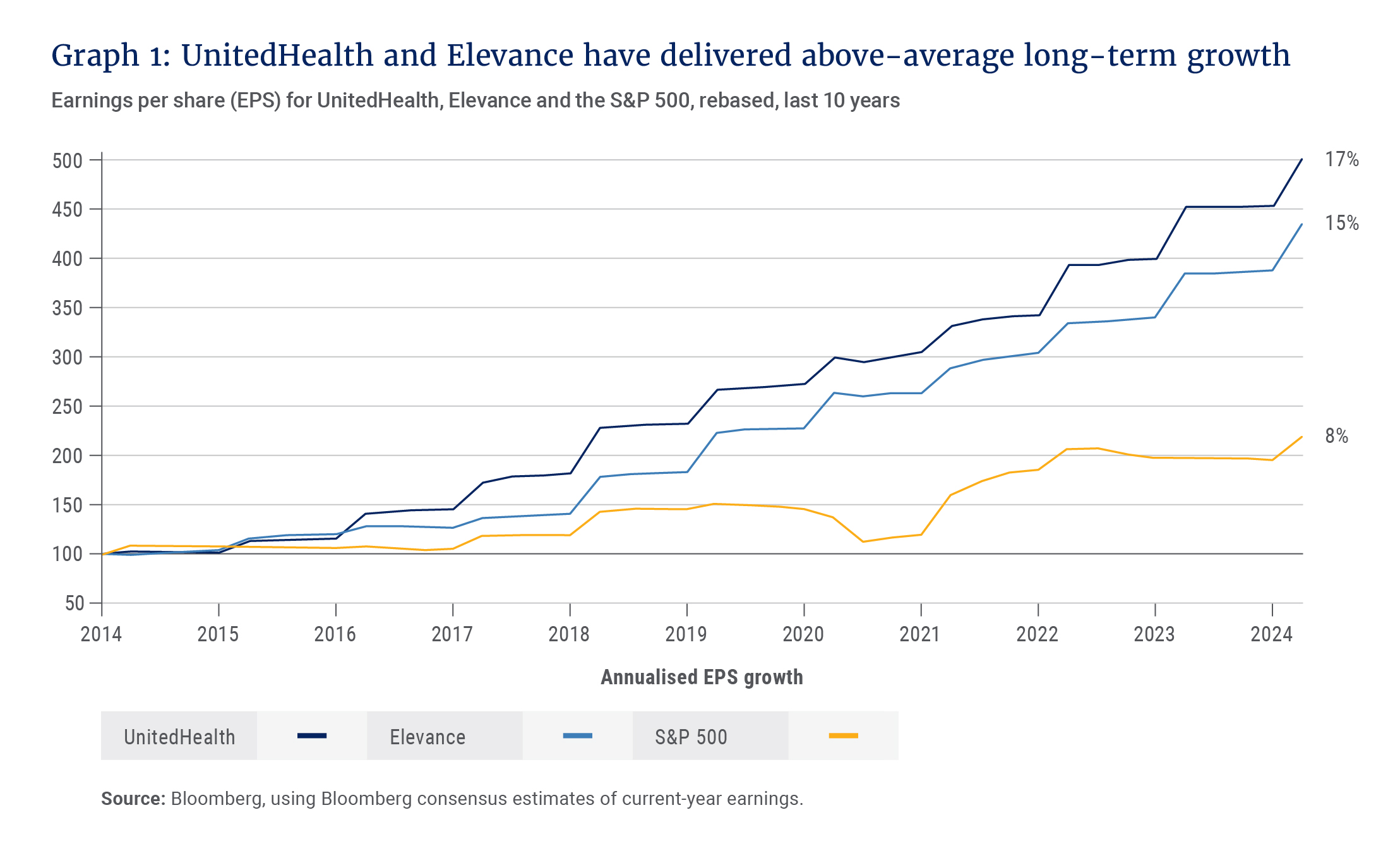

This has been a winning formula historically, with UnitedHealth and Elevance growing earnings per share by 15-17% per annum over the last 10 years, as shown in Graph 1. Indeed, we find the two companies rather special investment opportunities when comparing their moats, growth runways, returns on capital, historical track records and management quality with how the stocks are priced by the market.

Three factors weighing on sentiment

Today those prices look reasonable, due to pessimism we see as excessive. Concerns focus on three things: political risk, Medicare Advantage cost pressure and negative headlines for UnitedHealth. We will take each of these in turn.

1. Political risk

Political risk is a persistent worry for the companies. Plenty of countries have socialised healthcare, and that has often been seen as a risk for the MCOs. Leaning against that pessimism let us build our first positions in the companies when President Barack Obama was initially elected in the US, and we have held UnitedHealth and Elevance continuously since 2017.

We continue to believe that MCO-destroying political changes are extremely unlikely. Republicans have no interest in socialising healthcare, and Democrats would need control of the presidency, House of Representatives and 60% control of the Senate to push through such a major societal change – even if they had a unified view internally on the best approach, which they do not. Neither Donald Trump nor Joe Biden is focused on healthcare in their campaigns ahead of the upcoming election.

2. Medicare Advantage cost pressure

While the US infamously spends more than other countries on healthcare, that is not because of the MCOs, but because healthcare professionals, drugs, medical devices and facilities cost much more. High prices for branded drugs in the US subsidise pharmaceutical research for the whole world, the average doctor in the US makes 3.7 times as much as their UK counterpart, the typical American hospital room is private rather than having multiple beds, and average wait times are far shorter in the US than in most other places. That level of care is great for patients, but it comes with costs.

The MCOs’ role is to make the system more efficient – as evidenced by the government, states, and individuals increasingly choosing MCO-administered plans for Medicare and Medicaid. In 2008, a fifth of people with Medicare and Medicaid used plans administered by MCOs. Today the companies manage half of Medicare enrolment and more than half of Medicaid enrolment. The profits on these businesses are hardly rapacious, with operating margins of 2-4% for Medicaid and 3-5% for Medicare plans.

Recently, MCO-managed Medicare plans, called Medicare Advantage, have become a concern for investors. Last year, Humana, a competitor of UnitedHealth and Elevance, saw a sharp uptick in medical costs for its Medicare Advantage business. The cost increases were far in excess of how Humana had priced its policies, severely hurting its margins. Humana attributed the pressure to a resumption of procedures following a lull during the COVID-19 pandemic, warning of an ongoing hit to profits for 2024 and 2025. Investors worried that UnitedHealth and Elevance would suffer similar problems, hurting their share prices.

Having met with all three companies since Humana’s announcement, we think those worries are excessive. The reality seems simpler: Humana offered lower prices than UnitedHealth and Elevance in 2023, and that now looks like an underwriting mistake. We don’t expect MCOs we are holding in the portfolio to see pressure to the same extent as Humana. Further, the MCOs reprice their policies annually, and having been bitten once, Humana now plans to keep its pricing higher for the next two years. That gives UnitedHealth and Elevance scope to maintain their pricing while potentially winning market share.

3. Negative headlines for UnitedHealth

Recently, UnitedHealth has had its own problems. In February, one of its recently acquired units suffered a cyberattack, threatening patient data and necessitating a halt in billing and payment services to some care providers. The episode reveals a threat to the broader healthcare industry, as patient data is seen as highly valuable to bad actors. To its credit, UnitedHealth advanced more than US$3bn from its own balance sheet to help providers suffering through the outage, and it has since restored payment services. While the cyberattack was serious, we believe its perceived impact on UnitedHealth’s intrinsic value will be short-lived.

... we believe the companies can grow earnings per share by 12-15% per annum for years to come.

UnitedHealth is also the subject of a US antitrust investigation. We struggle to see an argument that UnitedHealth has harmed its customers. Its Optum care provider business helps achieve better outcomes for patients at a lower cost. UnitedHealth connecting the dots from government programmes to plan administration to care providers has been a net positive for patients and for the financial soundness of the US healthcare system.

The long-term potential

Looking through each of those bear points, we remain confident that the companies can continue to deliver as they have in the past. Healthcare spending should continue to grow a little faster than the US economy, and the companies should continue to grow moderately faster than wider US healthcare spending as more people adopt MCO-administered Medicare and Medicaid plans, and as the leading companies take market share from their competitors within those plans.

Meanwhile, we see Elevance and especially UnitedHealth taking intelligent risks in building out their own care networks, positioning them to drive better efficiency and outcomes across the system – and to be rewarded for it. Stacking those up, we believe the companies can grow earnings per share by 12-15% per annum for years to come.

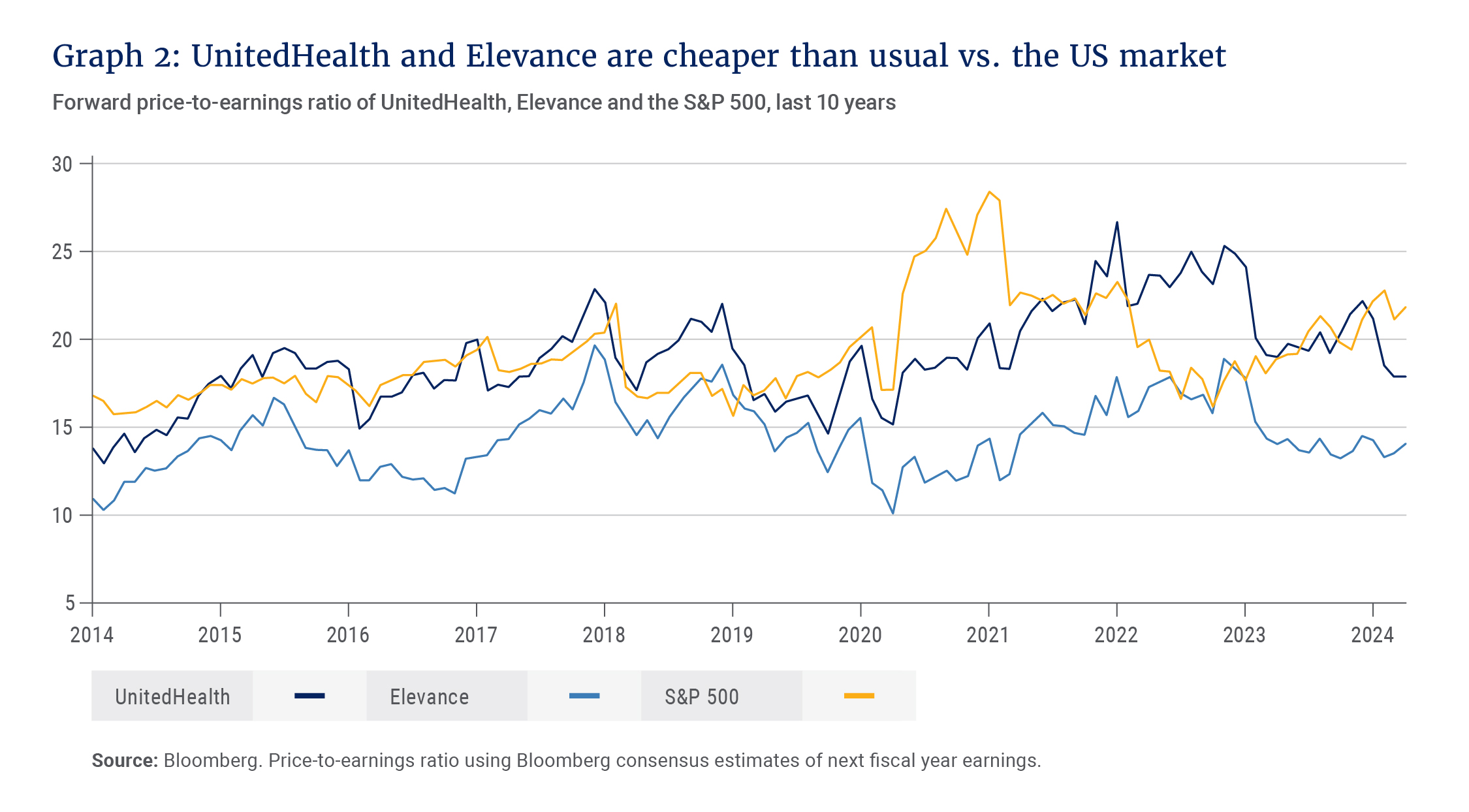

In the short term, the path might look less smooth. Healthcare reform could rise to the top of the election news cycle, and weakness in Medicare Advantage plans could depress sentiment. But as long-term investors, we think those risks are reflected in the companies’ prices. UnitedHealth normally trades at a similar price-to-earnings multiple to the S&P 500. It now trades at a discount. Elevance, which has somewhat lower returns on capital than UnitedHealth, trades at an unusually large discount to the US market, as shown in Graph 2. In both cases, that is despite long-term growth prospects that we believe are above average. At the portfolio level, the MCOs are also appealingly defensive, as their profits have little to do with the broader economic cycle.

In aggregate, the US market looks expensive, but it is home to thousands of companies, and hundreds of good ones. Some of those good companies, like UnitedHealth and Elevance, trade at reasonable valuations. This, to us, is the benefit of being a bottom-up investor. We can own the compelling shares, and we don’t have to own the rest.