Finance Minister Ipumbu Shiimi, MP delivered his Budget speech on Thursday, 24 February 2022. He noted that there is an urgent need to reignite economic growth, create jobs, and to invest in creating opportunities and activities for the youth.

The Budget policy focus has shifted towards entrenching sustainable economic growth. Government is committed to redirect much of the revenue increases in the coming years, as the economy recovers, towards debt redemption and reducing the borrowing requirement.

In keeping with the theme from the previous year’s Budget of “Boosting resilience and recovery”, Minister Shiimi has taken the decision to delay the implementation and/or announcement of any tax proposals that could stifle economic recovery and will fast track the implementation of the measures that could potentially provide some relief to taxpayers.

The fiscal policy stance proposed in this year’s Budget is a continuation of the measures and strategies outlined in the 2021/22 Fiscal strategy and those reinforced in the Mid-Year Budget Review Policy Statement. It is expected that the next Medium-Term Expenditure Framework (MTEF) will focus on developing strategies to support the economy and return to a long-term path of sustainability.

Below we highlight some of the 2022/2023 Budget reforms that may impact investors.

What has not changed?

Individual (including trusts and deceased estates) income tax rates

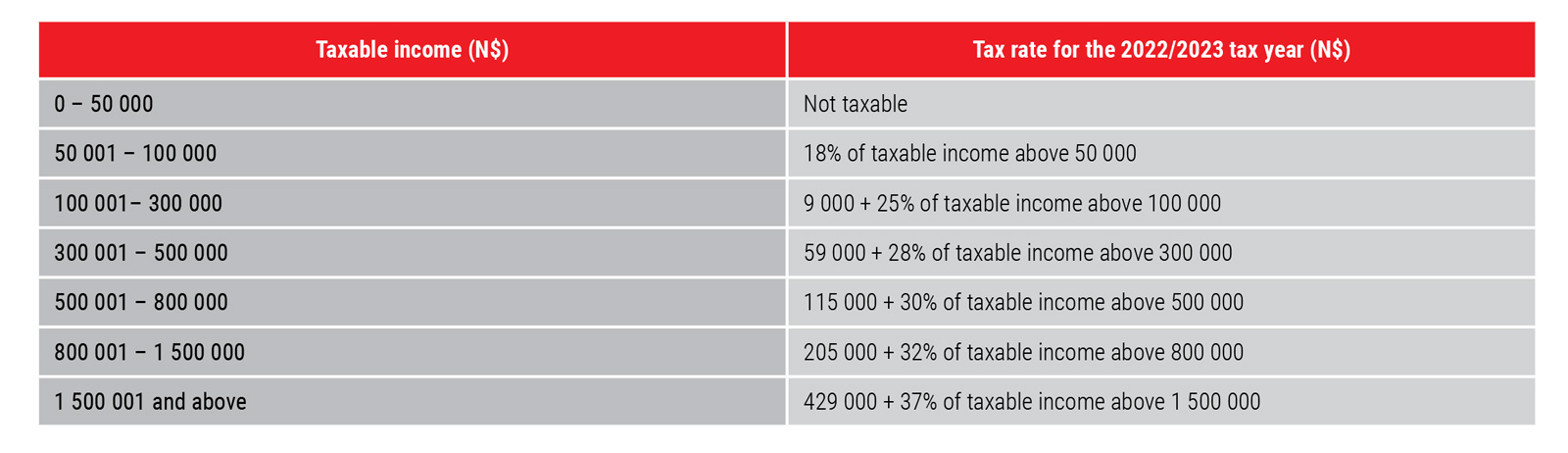

There were no adjustments to the tax brackets or the tax-free thresholds. The highest marginal tax rate for individual taxpayers remains unchanged at 37%. The personal income tax rates for the 2022/2023 tax year are listed below.

Tax thresholds

Tax thresholds have remained the same at N$50 000 per annum for all individuals.

Estate duty and donations tax

There continues to be no estate duty or donations tax in Namibia.

Interest withholding tax

The Namibian Inland Revenue Authority continues to impose a 10% withholding tax on taxable interest earned from Namibian banks and unit trusts paid to any person other than a Namibian company.

Interest exemptions

The following interest earnings remain exempt from interest withholding tax:

- Interest earned on NamPost Savings Bank deposits

- Interest earned on stocks or securities (including treasury bills) issued by the Government of Namibia, or any regional council or local authority in Namibia

Dividends

Dividends, other than those received from a building society, remain exempt from income tax.

Capital gains

Namibia does not generally impose a tax on capital gains. Where capital gains are taxable, they are taxed as ordinary income.

Value-added tax (VAT)

The standard VAT rate remains unchanged at 15%.

Companies

The income tax rate for companies remains unchanged at 32%.

What has changed?

Increase in excise levies and duties

The following increases were implemented from 23 February 2022:

- A 340ml can of beer or cider will cost an extra 11c

- A 750ml bottle of wine will cost an extra 17c

- A bottle of sparkling wine will cost an extra 76c

- A bottle of spirits will cost an extra N$4.83

- A packet of 20 cigarettes will cost an extra N$1.03

- 25 grams of piped tobacco will cost an extra 37c

- A 23-gram cigar will cost an extra N$6.77

Future tax proposals

Tax relief

A modified Electronic Filing Tax Relief Programme will be introduced for a period of 12 months to replace the tax relief programme which ended on 31 January 2022.

Companies

The Government is still exploring options to reduce non-mining company tax, with consideration to effect it in the later years of the MTEF.

Tax deductibility of pension fund and educational policy contributions

The Government aims to finalise proposals to increase the tax deductibility of pension fund contributions and educational policy deductions from N$40 000 per annum to a maximum of N$150 000 to encourage individuals to save more for retirement and invest in education.

Dividend withholding tax

The introduction of a 10% withholding tax on dividends paid to Namibian tax residents is still under consideration and is likely part of the delayed tax proposals.

Interest withholding tax

The withholding tax on interest on unit trust funds as it relates to Namibian companies will be reviewed for implementation in the MTEF.

Management fees

No direct mention is made on the introduction of VAT on income (management and administrative fees) of listed asset managers. It is likely part of the delayed tax proposals as the Value-Added Tax Amendment Bill is still under stakeholder consultation.

We expect to receive further detail on these proposed tax amendments during the mid-year Budget review, which is expected in October/November 2022.