The market has several concerns about brewer Anheuser-Busch InBev which are currently weighing on its share price. We believe the company’s fundamentals are robust, and have used the opportunity to build a material position for our clients. Jithen Pillay explains why investors could be missing out on a cheap round.

“Without question, the greatest invention in the history of mankind is beer. Oh, I grant you that the wheel was also a fine invention, but the wheel does not go nearly as well with pizza.” – Dave Barry, American author

Anheuser-Busch InBev (AB InBev or ANH) is the world’s largest and most profitable brewer, with more than 500 beer brands and operations in nearly 50 countries. ANH brews one in four beers globally – more than twice that of its nearest rival, Heineken.

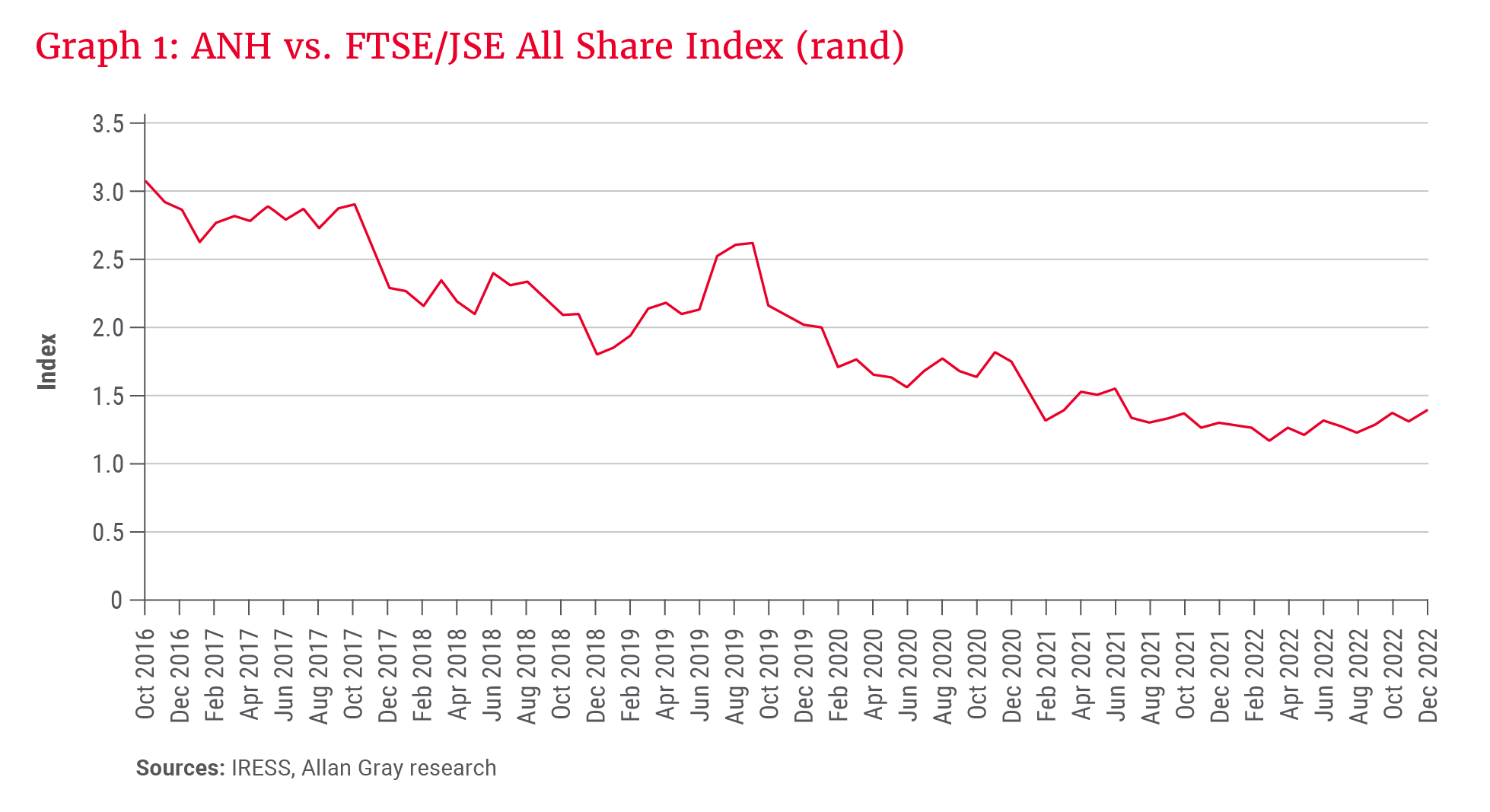

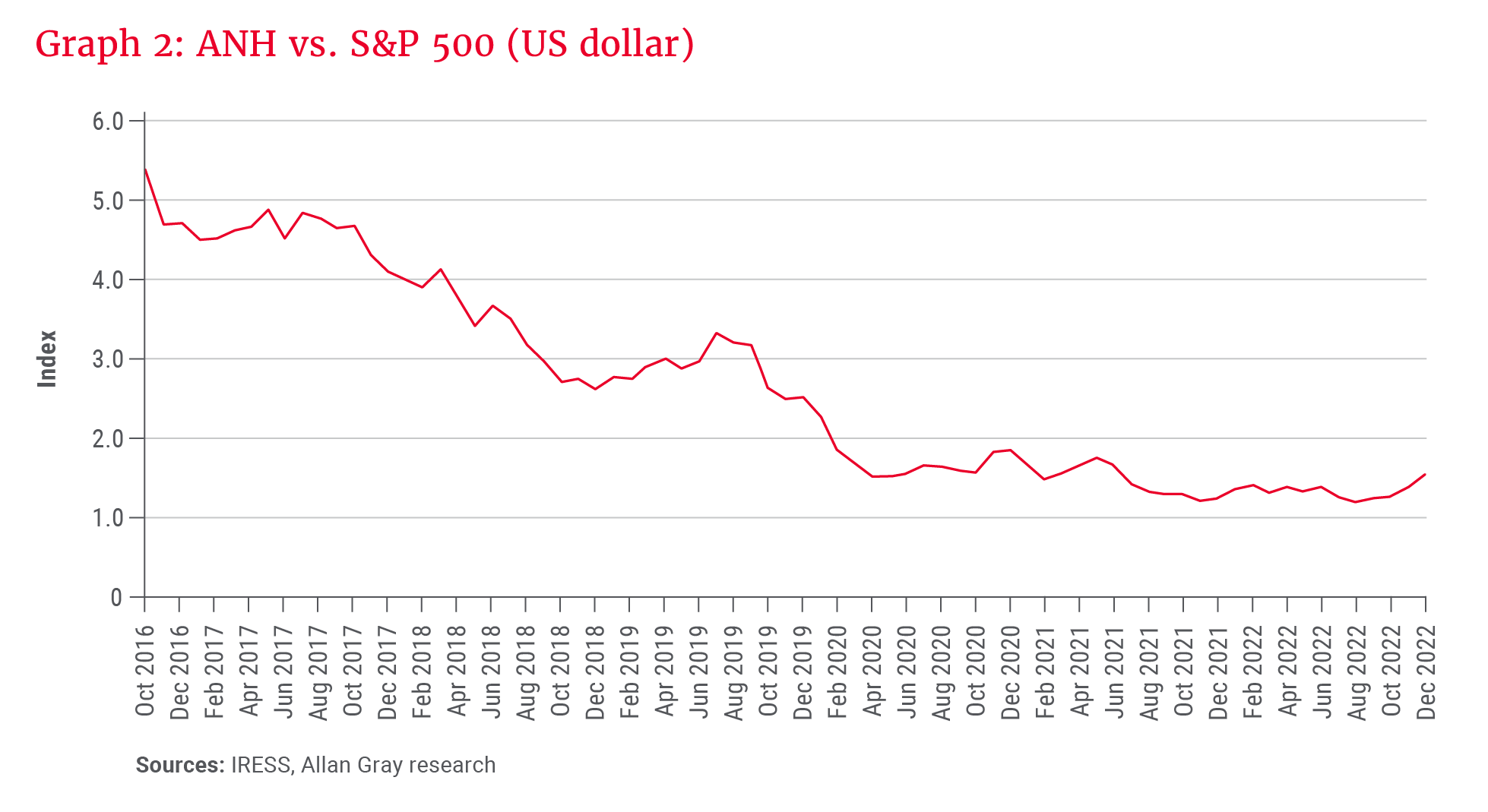

Local consumers will be very familiar with South African Breweries (SAB), which ANH acquired in October 2016 for US$103bn. Since the acquisition, ANH has been a poor investment in both absolute and relative terms, as shown in Graphs 1 and 2: The share is down 34% cumulatively in rands versus the FTSE/JSE All Share Index (ALSI), which is up 44% over the same period. The picture is even worse in US dollars: ANH is down 48% for the period, in contrast to the S&P 500, which is up 81%.

Our clients were material SAB shareholders at the time of acquisition by ANH. However, we did not reinstate a position in ANH immediately. At the time, it was our view that ANH paid a full price for SAB (taking on substantial debt to do this) and ANH’s valuation appeared expensive relative to its fundamentals. Notwithstanding this, we recognised ANH as a world-class brewer. As a result, we used the March 2020 COVID-19 sell-off to build a position for our clients.

… we believe ANH is a useful addition to our clients’ portfolios, particularly given a local market that is heavily exposed to South Africa- and China-specific risks …

Dispelling the market’s unease

Below we outline three of the market’s main concerns, and why we believe these risks are too severely discounted in ANH’s current share price.

Concern 1: Slim growth prospects for ANH’s beer volumes

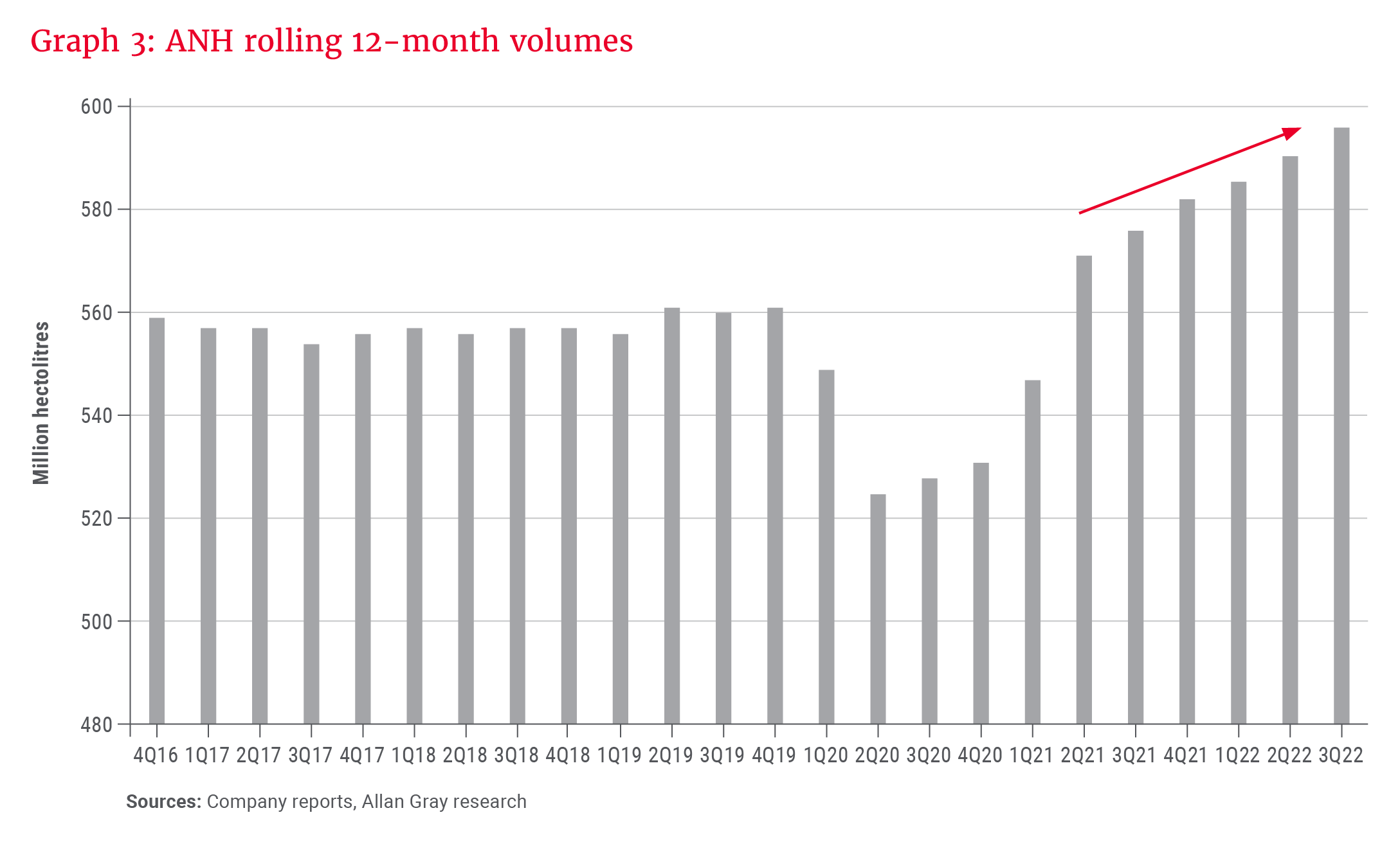

Graph 3 shows ANH’s rolling 12-month organic sales volumes (per quarter). Volumes were flat in the three years following the SAB acquisition – a poor outcome given ANH’s mostly emerging market focus. However, there has been a step change since Michel Doukeris took over as chief executive officer in July 2021.

There are two main reasons for the change in trajectory:

- Mindset change: The new management team is focused on organically growing ANH’s share of throat (both with new innovative beverages and promoting beer consumption in previously underserved areas). Colombia is a good example of this: ANH dominates the market and beer consumption per capita is high by emerging market standards. Despite this dominance, the company continues to grow volumes strongly, recently achieving the highest beer per capita consumption in 25 years.

- E-commerce and marketplace platform: ANH launched its e-commerce app (called BEES) in 2019. Beer sales to customers still occur largely via physical channels, with salespeople visiting retailers regularly to take orders. The BEES app removes the administrative burden from the interaction and allows salespeople to focus on sales development. The main volume benefits are better retention (customers can be targeted with specific offers) and the ability to upsell (both new products and larger order sizes). Shifting customers onto BEES also lowers the cost to service. BEES is live in 19 markets, comprising 57% of ANH’s revenue. There is material runway for BEES to further grow ANH’s volumes.

While it is true that spirits took volume share of throat globally from beer in the decade to 2016, in the five years thereafter, beer grew its volume share ahead of both spirits and wine (driven by new innovations such as hard seltzer).

Concern 2: High input cost inflation will squeeze ANH’s margins

Barley and aluminium are material inputs in producing a can of beer. From their closing 2020 prices to their 2022 peaks, the barley and aluminium prices rose 134% and 77% respectively in US dollars. ANH also sells its beer mostly in emerging markets, whose currencies have been weak relative to the US dollar.

Given beer price increases tend not to reverse, longer term this is favourable for ANH’s margins.

The above were headwinds for ANH: Its gross profit margin for the nine months to September 2022 was 7% lower than 2019 (a period not impacted by COVID-19). However, we believe ANH is better positioned to weather high input cost inflation (that all consumer packaged goods companies are faced with) for the following reasons:

- Price/mix: Owing to strong brands and disciplined pricing, in most years, ANH achieved price/mix increases ahead of realised cost inflation. A tiered-price portfolio of beer brands has resulted in a limited impact on volumes thus far.

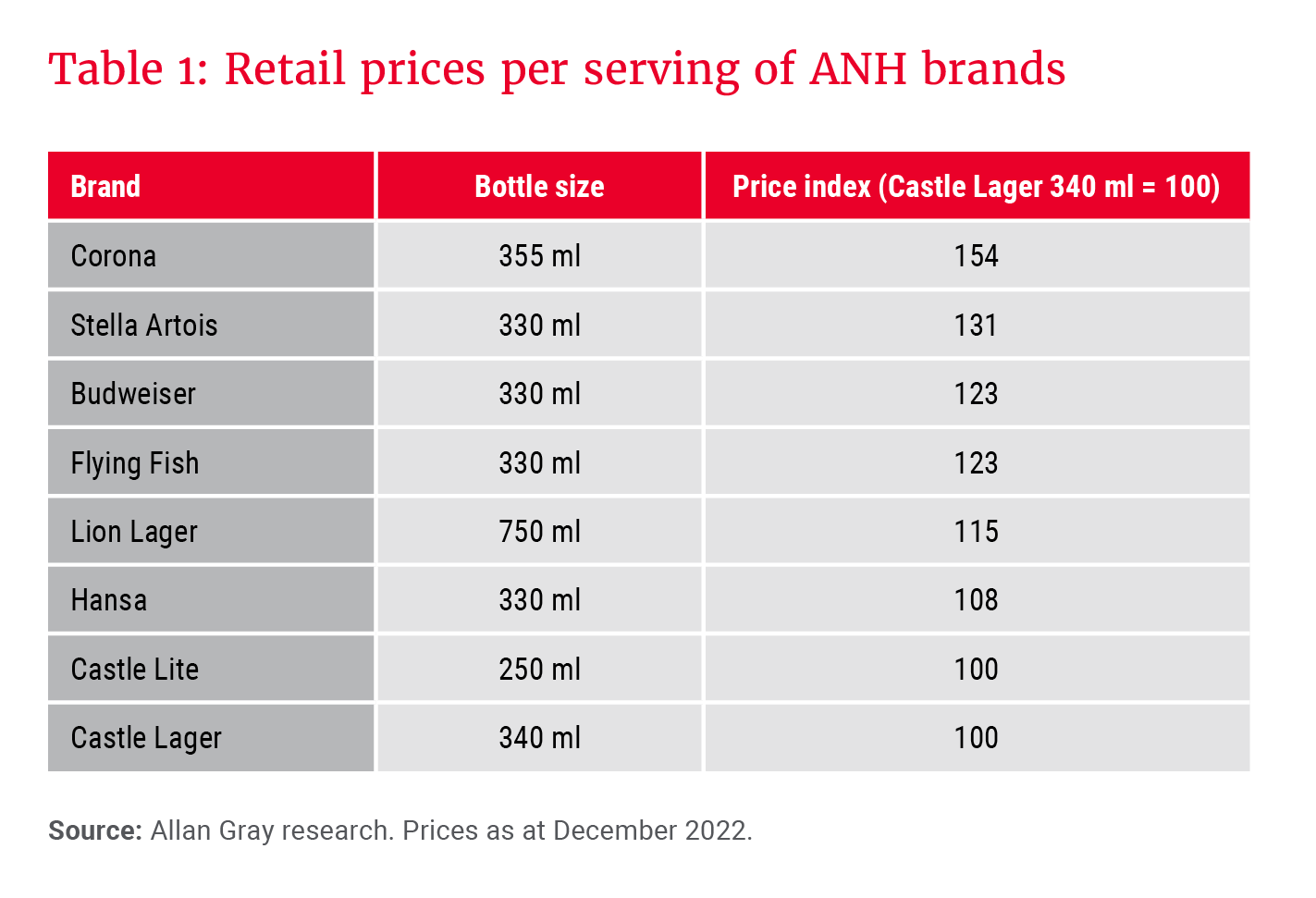

Table 1 shows retail prices of single-serve ANH beers from a sample South African retailer. On the lower end, a variety of brands and pack sizes allows a consumer to trade down within the ANH portfolio in tough times (e.g. from a 750 ml Lion Lager to a 340 ml Castle Lager), rather than switching into home-brews. Middle- to higher-income consumers are migrating up ANH’s pricing ladder to its global brands, such as Corona (a trend referred to as “premiumisation”). All else being equal, a shift to premium beer earns ANH a higher dollar profit per litre.

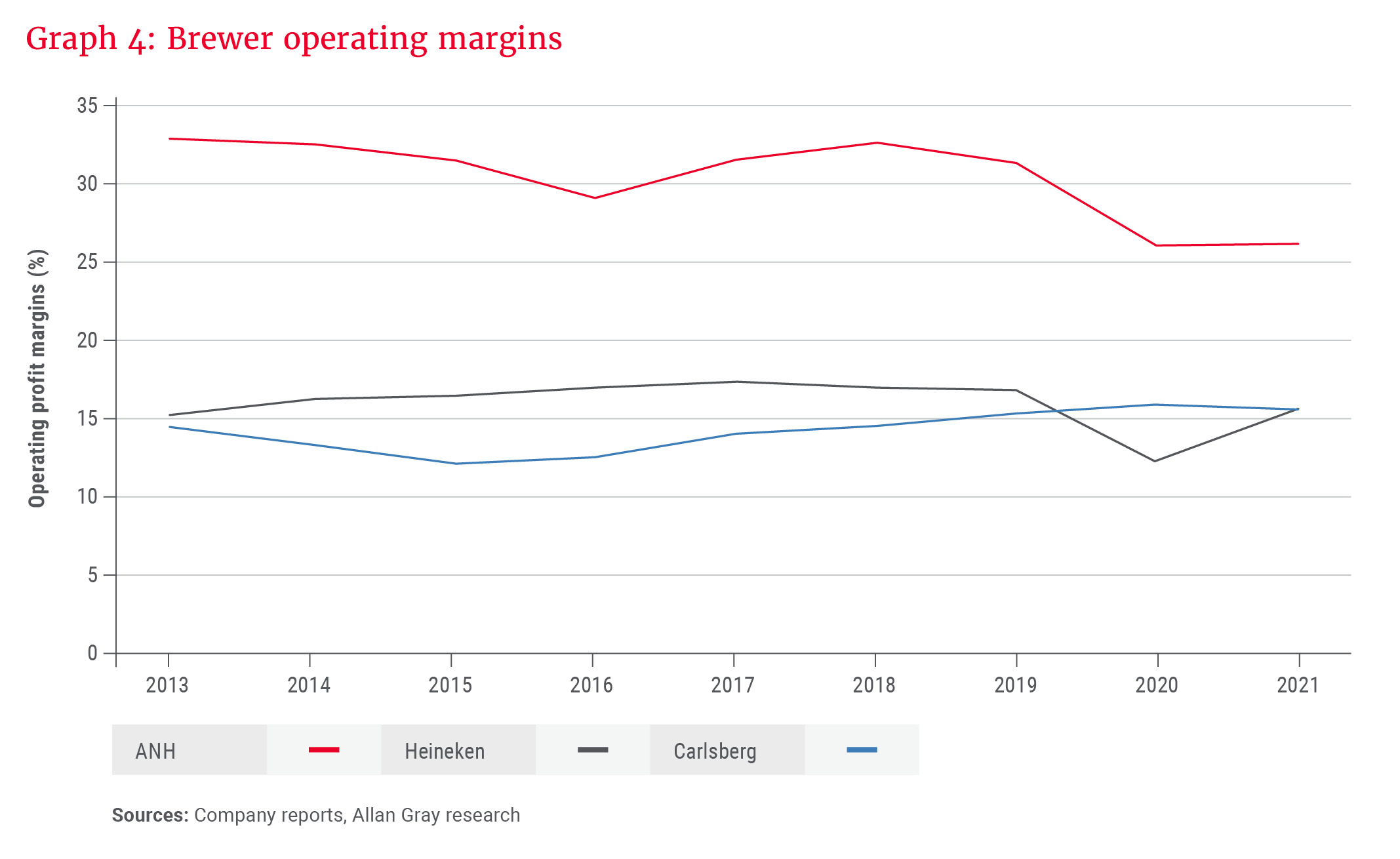

- Costs: From their peaks earlier in 2022, the barley and aluminium prices are each down more than 30% at the time of writing. As supply tensions ease, so too will ANH’s input cost pressures. Given beer price increases tend not to reverse, longer term this is favourable for ANH’s margins. ANH is also relatively insulated from Europe (where cost pressures may continue) versus peers: ANH derives approximately 5% of operating profit from Europe versus 33% for Heineken and 58% for Carlsberg. ANH also earns much higher operating profit margins compared to its main rivals, as shown in Graph 4.

Concern 3: ANH has too much debt

ANH’s net debt is high (US$76bn at end-June 2022) following its purchase of SAB. However, the terms of its debt are extremely favourable. It is low-cost (4% coupon) and almost fully fixed-rate. The debt is also long-dated (16-year weighted average maturity) with negligible near-term expiries. Lastly, the debt has no financial covenants attached to it.

We believe ANH could reduce its debt quickly if desired, given the company converts more than 100% of its earnings into cash flow (ANH only needs to pay suppliers after it receives payment from its customers). It is less likely that this cash flow would be wasted on expensive acquisitions going forward, given the company’s stated focus on organic growth. Emerging market currencies look overly weak compared to the US dollar; if this reverses, it will also be a tailwind for ANH, given most of its debt is US dollar- and euro-denominated.

In a high-inflation and rising interest rate world, a large quantum of cheap, fixed-rate and far-dated debt could be an advantage for ANH rather than a hindrance.

ANH’s prospects

On balance, we believe the market is overly pessimistic about ANH’s prospects. Current earnings are not high, and ANH can generate strong organic cash flows (which are more uncertain in other industries). Trading on less than 15 times our assessment of the company’s normal earnings, we believe ANH is a useful addition to our clients’ portfolios, particularly given a local market that is heavily exposed to South Africa- and China-specific risks (ANH earns 4% and 9% of its revenue in South Africa and China respectively).

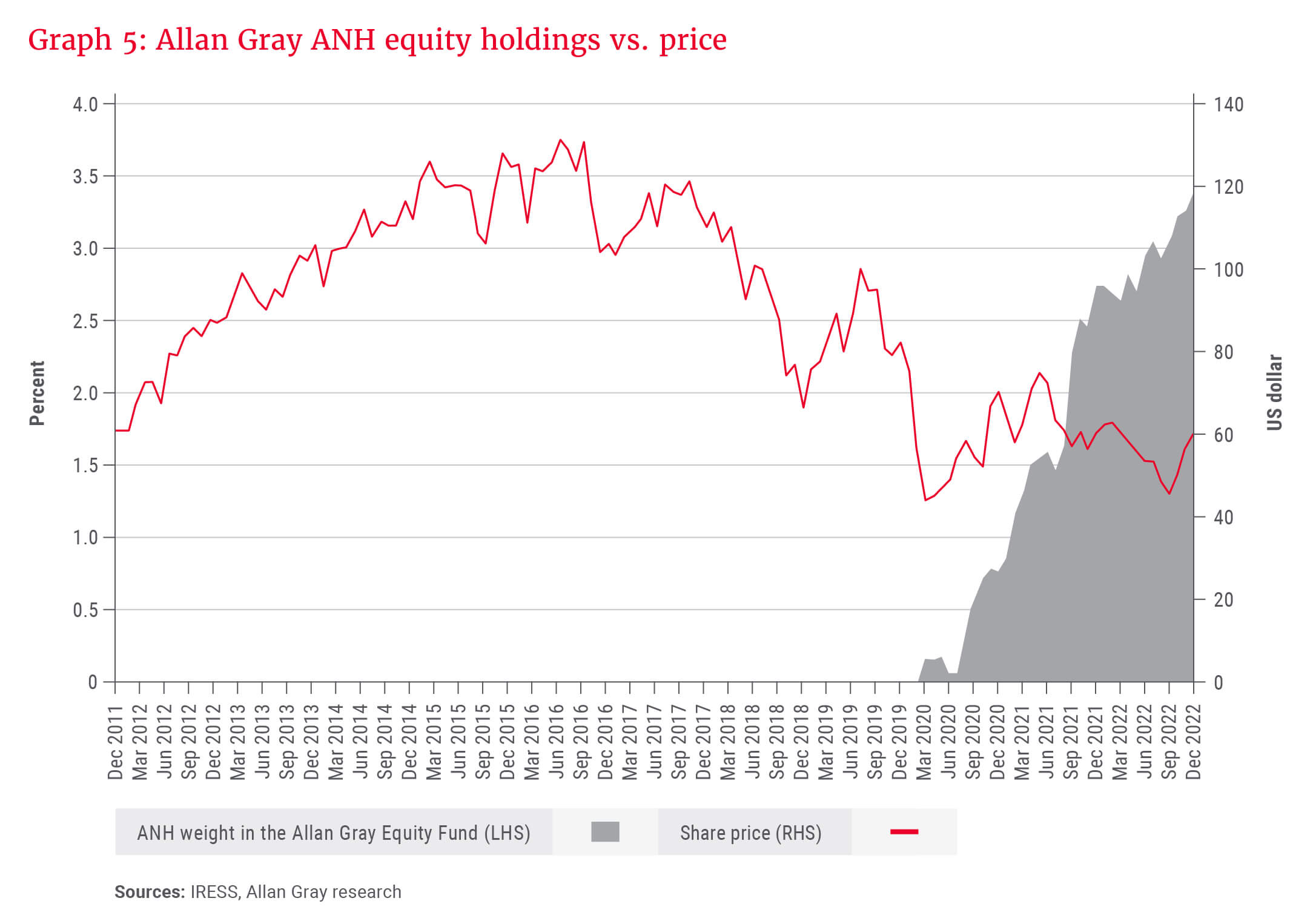

ANH’s share price (measured in US dollar) is the same today as it was in 2012, as shown in Graph 5. We took advantage of the share’s underperformance to build a material position for our clients, such that ANH is now a top 10 equity holding.