Capitec has been an incredible South African success story in improving access to affordable banking services, and in delivering value for its investors. Pieter Koornhof unpacks the key lessons from Capitec’s achievements over the decades and explains how high-growth, highly valued companies fit into Allan Gray’s valuation-based investment philosophy.

Capitec’s first slogan was “The way to bank”, but it could just as well have been “The way to build a bank”, given its phenomenal success. Since its founding in 2001, Capitec has grown to over 18 million clients, R8bn in annual profits, and a market capitalisation of R237bn, the third largest of the JSE-listed banks. This is astounding considering that it was founded more than a century after its main competitors.

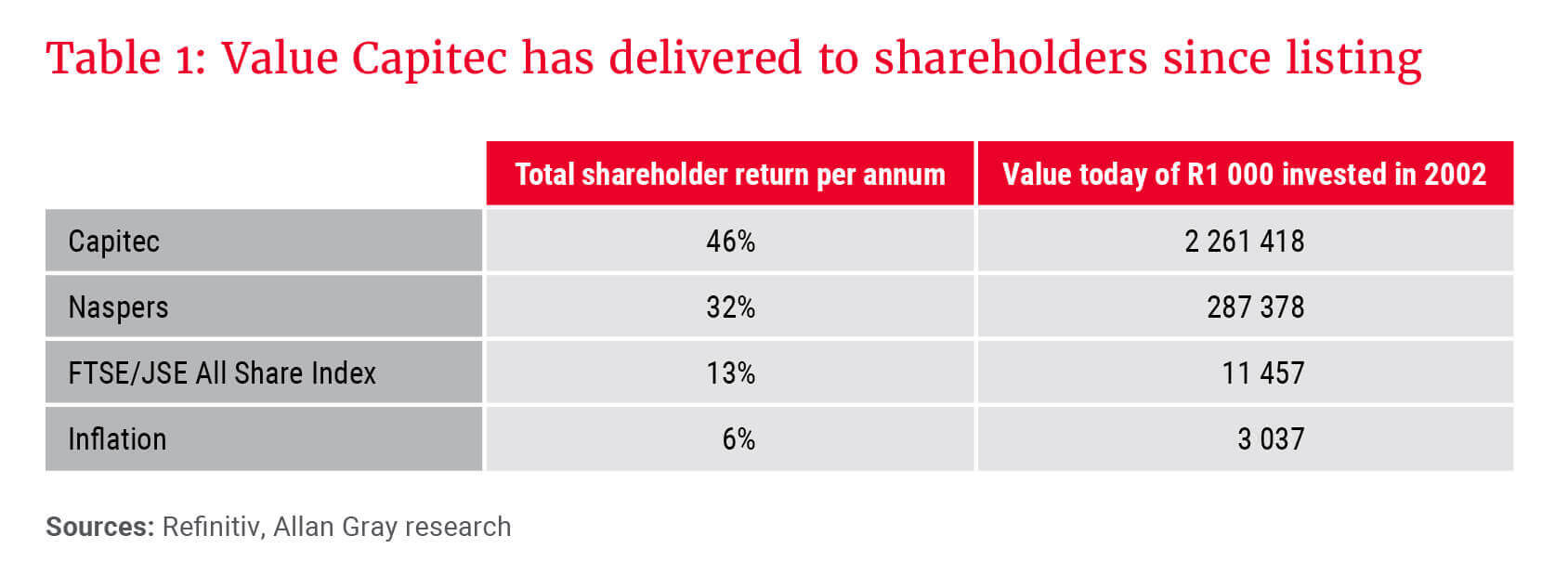

Since listing in 2002, Capitec has delivered a total shareholder return of 46% per annum (p.a.), dwarfing the 13% p.a. from the FTSE/JSE All Share Index (ALSI) and the 32% p.a. achieved by Naspers, the second-best performing share over the period.

For context, if you had invested R1 000 in the ALSI on the day Capitec listed and reinvested all your dividends since, your investment would be worth R11 457 today – a very respectable return that exceeded inflation by more than R8 000. A similar investment of R1 000 in Naspers would have grown to an impressive R287 378. However, as shown in Table 1, R1 000 investment in Capitec would be worth a staggering R2.3m!

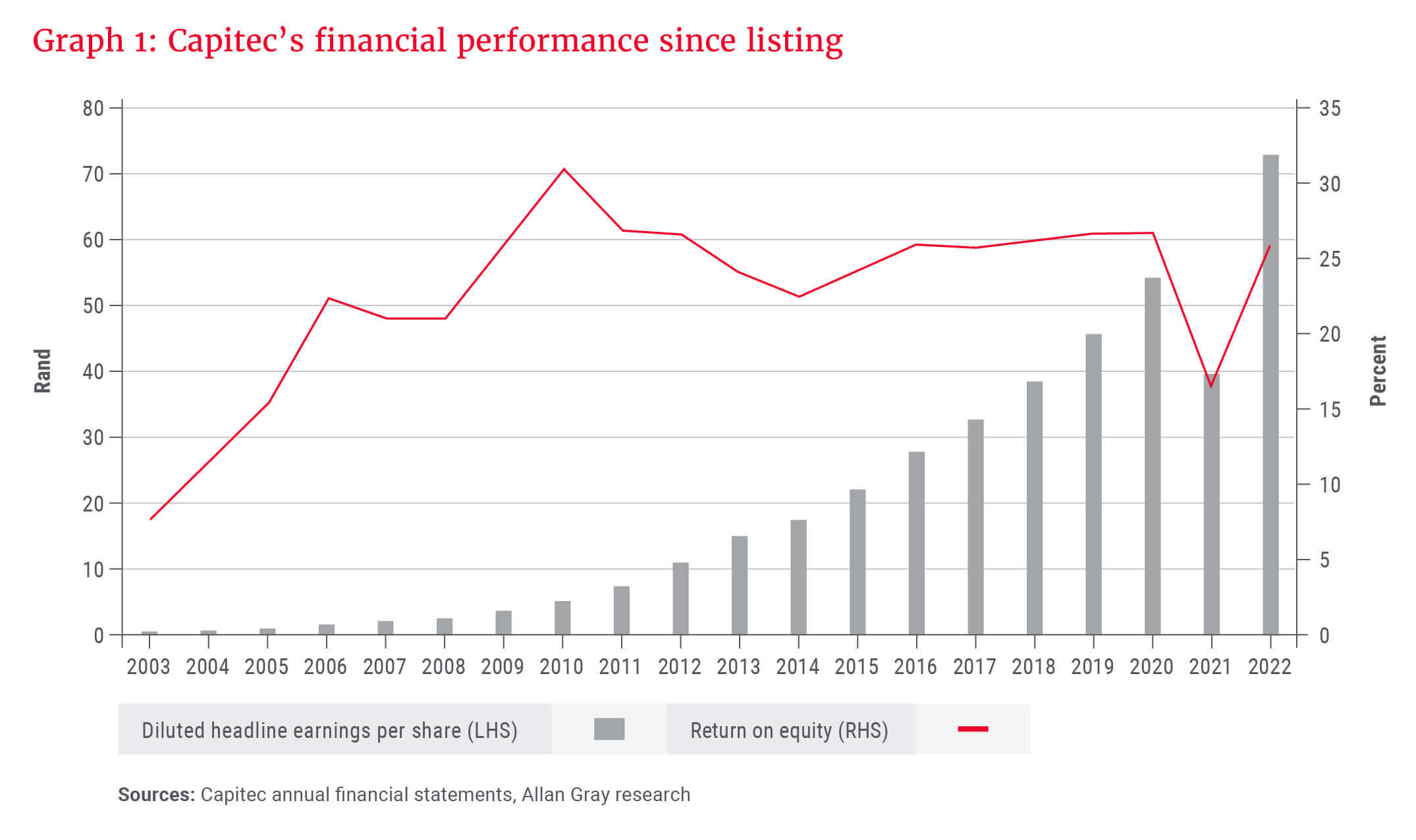

Capitec’s share price performance reflects its fast and furious growth, which it has sustained for a remarkably long period. Graph 1 shows that the bank has grown its earnings over the last 20 years at a compound annual growth rate of 25% (at this rate of growth, its earnings double every three years), while maintaining an average return on equity (ROE) of 23% and paying out 41% of earnings as dividends. Unsurprisingly, given this long-term track record, Capitec trades at a premium multiple of 28 times historic earnings, compared to the ALSI’s average price-to-earnings multiple of 11 times.

Lessons from Capitec’s success

There are important lessons to be learnt from analysing the key drivers of Capitec’s spectacular growth.

Find a gap in the market

Capitec’s founders intentionally targeted the banking industry due to its high barriers to entry and large market size. Banking has onerous regulatory, technological and capital requirements, which reduce the likelihood of new competitors entering the market and competing away profitability. The banking profit pool in South Africa is also very large at over R90bn p.a., and millions of individuals and businesses use banking services every day. This afforded Capitec ample runway for growth. At the time, the other South African banks were earning high ROEs compared to their cost of capital and to the ROEs of international peers. The industry was also not doing a great job for clients, with opaque and high fees compared to other countries.

Follow a client-centric approach

“Culture eats strategy for breakfast.” – Peter Drucker

From the beginning, Capitec aimed to disrupt the industry. At the heart of the business was (and still is) its strong client-centric and innovative culture. The company aims to provide simple and accessible financial services. This includes high-quality client service and fees that are simple, transparent and affordable, often priced much cheaper than competitors’. It has also been innovative in finding ways to better serve clients, including keeping branches open on weekends, running a 24-hour call centre, and paying interest at high rates on savings accounts.

Capitec started off primarily as a lending business focused on unsecured loans to lower-income clients. It adroitly consolidated this fragmented part of the market and used its greater economies of scale to offer clients lower rates than competitors, which in turn spurred further growth. The lending business was highly profitable, and Capitec reinvested these profits to grow other lines of business, including a retail transactional bank, which today accounts for most of its profits. Over the years, it has branched out into adjacent products and services, including credit cards and funeral policies.

Maintain focus and discipline

Despite this growing range of products, its management team has been disciplined and discerning in pursuing new areas of growth. They eschewed big acquisitions and following fads, like growing into Africa, which often proved to be the undoing of other South African companies. Instead, they stuck to their circle of competence, namely retail financial services, and kept their product range small. For example, they only offer one type of bank account, and there are no complicated point systems or tiers that determine service quality. This reduces operational complexity and costs, while simplifying the client experience.

A key part of Capitec’s advantage is its ability to offer competitive products at low prices. This is made possible by its very low cost base. One way of measuring a bank’s cost-effectiveness is its cost-to-income ratio, which is calculated as total operating costs (excluding bad debt charges) divided by total income. Over the last decade, the cost-to-income ratios of the other South African banks averaged 56%, while Capitec’s averaged 38%. This means that for each rand in revenue, Capitec incurs one-third less costs. This is even more impressive considering that Capitec charges considerably lower fees than competitors for comparable products and services.

Adopt an agile structure that reduces complexity and allows for iterative improvement

This low cost base is attributable to several factors, including Capitec’s small product range, and large scale in each of those products. For example, Capitec’s management team deliberately focused on retail lending and banking as these entail millions of similar transactions. Because of this characteristic, Capitec could automate and optimise its processes and systems for handling such transactions and, as their volumes grew, it became extremely cost-efficient at processing them.

In addition, Capitec’s management refrained from going into secured lending and investment banking. Even though these are highly profitable segments for the other banks, they are not a good fit for Capitec’s business model: Despite having higher transaction values, the transactions are more differentiated and have lower volumes, thereby limiting the potential to extract economies of scale in processing. By not offering a wide range of complicated products, Capitec avoided adding complexity (and the resultant costs) to its operations and IT systems.

This business model built on large volumes of small and relatively short-duration transactions had a second-order benefit: Capitec could quickly receive feedback and learn from what was working and what was not, and no individual mistake was big enough to put the company at risk. Over time, this allowed it to follow an iterative approach to incrementally improve its products and processes, and made it nimble. It could quickly change course by adjusting its credit pricing and risk appetite. Contrast this with building a new mine, where you have to make the decision to invest billions of rands upfront, and it takes a decade before it becomes clear whether the call was right or not. Given the large size of the investment, a wrong call could potentially bankrupt the company and the long lag also means circumstances can change materially in the meantime.

Think outside the box

The low cost base is also a product of Capitec’s innovative culture and approach to problem-solving. As a practical example, it was the norm at the other banks that each branch would include its own back office (i.e., a team of non-client-facing staff doing settlements, compliance, accounting, etc.). Capitec adopted a revolutionary strategy by opening branches with no back offices, and instead performed these functions centrally. This allowed it to have smaller branches and thereby save on rental costs, while also avoiding the usual duplication of costs from employing (highly paid) back-office staff at each branch. Centralising the back-office function had the additional benefit of giving them a real-time, holistic view of what was happening across all branches, enabling them to adjust their risk appetite and pricing accordingly as conditions changed.

On the technology front, Capitec initially had an advantage over its competitors as it could use off-the-shelf, modern IT systems, while its competitors were stuck with heavily customised legacy systems that offered limited functionality and were difficult and costly to maintain. The significance of this initial edge waned over time as Capitec’s original IT systems also became dated and had to be replaced or modernised. However, Capitec’s management teams have over the years proven adept at managing IT in a cost-effective yet progressive manner as clients migrated from branches to mobile, online and app-based banking. Key to this was Capitec’s prioritisation of keeping the client experience very simple and intuitive. Management recognised early on that IT was not just a necessary cost of doing business, but could be a potent competitive advantage. For example, they were early to capitalise on digital banking as a new distribution channel for products and services.

Luck plays a role

Lastly, it is important to note that luck has also played a role in Capitec’s success. For example, the business was founded when South Africa’s economy was growing strongly and social grants were expanding. These provided tailwinds for the high initial growth and returns that laid the foundation for Capitec’s later success. It would be more difficult to get off to such a good start in today’s anaemic economy.

When should you pay up for growth?

Capitec’s story, and similar ones from other fast-growing companies, can make investing in such businesses seem like a sound investment strategy, and it certainly is possible to achieve high returns this way; however, this is easier said than done. Part of the difficulty is that when a company has a couple of years of rapid growth, the market often values the share as if such growth will continue for decades. While companies can sometimes achieve this feat – Capitec is an important example of one that did so – it does not typically turn out that way. Indeed, history is littered with fast-growing companies that overreached in pursuit of growth and subsequently blew up, or delivered poor shareholder returns when they failed to live up to the market’s lofty expectations of them.

… we invest in companies that trade at a discount to our assessment of their intrinsic value, regardless of whether they are categorised as “value” or “growth”.

When, if ever, is it prudent to pay a high multiple for a fast-growing company? At Allan Gray, we are not “value” or “growth” investors. Instead, we follow a valuation-based investment approach, which means that we invest in companies that trade at a discount to our assessment of their intrinsic value, regardless of whether they are categorised as “value” or “growth”.

When analysing a fast-growing company that trades on a high multiple, we consider the following:

- Buying a fast-growing company on a high multiple means that the company must continue to grow its earnings at a high rate for it to be a good investment over the long term.

- The higher the multiple one pays, the smaller the margin of safety for avoiding permanent loss of capital if the company’s performance falls short of expectations. In a similar vein, the higher the multiple one pays, the faster and longer the company has to grow at a high rate in order to justify its starting valuation. The duration and rate of growth implied by the valuation multiple can be calculated with fairly simple maths, allowing one to assess the likelihood of this materialising.

- Paying a high multiple does not necessarily mean a company is expensive, just as paying a low multiple does not necessarily mean a company is cheap. The key consideration is how the intrinsic value of the company (which incorporates its fundamental quality and growth prospects) compares to its share price. As Benjamin Graham taught: “Price is what you pay; value is what you get.”

- As one looks further into the future, the uncertainty increases exponentially as the range of possible outcomes broadens. A myriad of events can affect the company: Macroeconomic conditions may deteriorate, regulations could change to its detriment, an excellent CEO could leave, its strategy may be replicated by competitors and lose its potency, technological disruption could render it less competitive or obsolete, it can run out of growth opportunities as its market share increases, etc. While competent management teams may adapt to such changes in circumstances, it remains hard to predict beforehand how this will play out.

Doing in-depth fundamental research to analyse the key drivers of a company’s competitive advantage can inform one’s conviction …

All these considerations make it difficult to determine whether a company can sustain a very high growth rate for a long period of time. Doing in-depth fundamental research to analyse the key drivers of a company’s competitive advantage can inform one’s conviction in this regard. Even then, it remains a tall order to do this with the necessary accuracy to make it a successful investment strategy.

Discovery is a useful example of why this is tricky. Discovery has built the biggest and most profitable health insurance business in South Africa. It has also achieved further profit growth by cross-selling additional types of insurance and investment products to its captive customer base. In 2018, it entered banking with the launch of Discovery Bank. Given Discovery’s track record and loyal customer base, many analysts believed that it would make a similar success of its banking effort. Discovery took a very different approach to Capitec by offering a complicated product range with various pricing tiers and complex point systems that determine the level of service and rewards. This is similar to its winning strategy in health insurance. It has made considerable progress by growing to 510 000 clients and R11bn in deposits. However, Discovery Bank remains loss-making despite several billion rand of investment, it has had multiple cost overruns, and its expected breakeven date has been pushed out multiple times.

In light of the above, it is only on rare occasions that we would assess it prudent to pay a high multiple for a fast-growing company. As such, we currently have limited positions in a small number of high-growth companies, including Capitec, Transaction Capital and PSG Konsult.