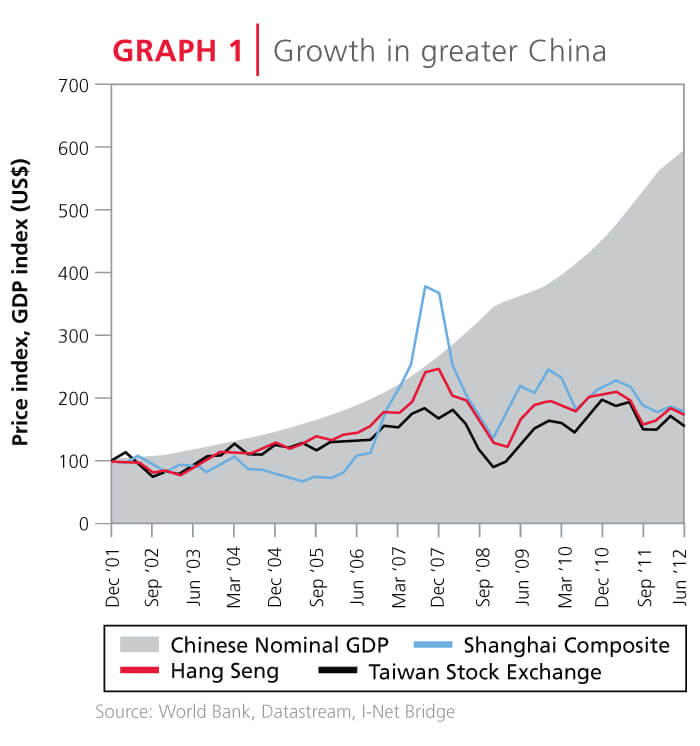

We have made the point many times in this magazine and on other platforms that the best investment opportunities are often not to be found in industries or countries that are growing fast or that are performing most strongly. For example, patient investors in the Shanghai Composite Index would have seen about a 5% p.a. nominal increase in the index over the last decade. Those investing at the peak in 2007 would have lost more than half of their money in the five years since then. Of course, an investor seeking index exposure to greater China could have taken positions in the Taiwan and Hong Kong indices, each at close to the same scale as the Shanghai exchange and similarly exposed to China's economic opportunities. But these have been no better, each going up between 4% and 5% p.a. in nominal terms since the beginning of 2002 (see Graph 1).

There are two reasons why the total return from listed shares may not match an increase in economic activity. Firstly, opportunity attracts competition and therefore each company makes less profit than would be expected, despite industry growth across all firms. Secondly, investors become over-excited about the future profits of companies in high growth industries or countries and pay more for these shares up front. If reality does not live up to these expectations prices fall, sometimes to reflect an overdose of pessimism about the same companies.

In the previous Quarterly Commentary Ian Liddle wrote about the prospects for the South African economy and in this issue Sandy McGregor explains how the world's obsession with Europe and America is distracting attention from what may prove to be the most important current investment issue: the slowdown in growth in the emerging markets. Both of these may be classed as economic commentary. Why do these things matter if market returns are so poorly correlated with economic performance?

In the previous Quarterly Commentary Ian Liddle wrote about the prospects for the South African economy and in this issue Sandy McGregor explains how the world's obsession with Europe and America is distracting attention from what may prove to be the most important current investment issue: the slowdown in growth in the emerging markets. Both of these may be classed as economic commentary. Why do these things matter if market returns are so poorly correlated with economic performance?

The answer is obvious, but it bears articulating: in any market, diligent analysis of individual shares reveals some opportunities to invest and some pitfalls to avoid. We make investment decisions about individual companies and not markets, but these companies benefit or suffer under different economic conditions. Stock analysis has to include an understanding of the drivers of each company's performance - a simple example would be that the demand for steel in emerging markets has an impact on the prices of coal and iron ore sold by JSE-listed resources companies.

Responsible investing

Since this firm's inception in 1974 we have steadfastly adhered to the same investment philosophy and guiding principles. While longstanding clients will have hopefully seen us putting these principles into practice over the years, in support of an industry-wide initiative, the introduction of the Code for Responsible Investing in South Africa ('CRISA'), we have now made public our responsible investing policies. I encourage you to read our Policy on Ownership Responsibilities, introduced by Ian Liddle and Mahesh Cooper in the first of our articles this quarter. This and our other responsible investing documents are available on the Responsible Investing page of our website, along with a record of our voting recommendations for shareholder meetings.

I hope you enjoy this quarter's pieces. Thank you for your continued support.