There are three ways to access the Allan Gray - Orbis Global Equity and Global Balanced feeder strategies. Julie Campbell explains the avenues for investment, reminding investors that the underlying investments, economic exposure and investment management fees remain the same across avenues.

We are pleased to announce that we have listed actively managed exchange-traded fund (AMETF) versions of the Allan Gray - Orbis Global Equity Feeder Fund and the Allan Gray - Orbis Global Balanced Feeder Fund on the Johannesburg Stock Exchange (JSE). These AMETF versions, namely the Allan Gray - Orbis Global Equity Feeder AMETF and the Allan Gray - Orbis Global Balanced Feeder AMETF, are now available to trade via the JSE and will also be available via Allan Gray in 2026. We will communicate these details closer to the time.

Why have we launched AMETFs?

Launching AMETFs gives clients an additional way to access the Allan Gray - Orbis feeder strategies and benefit from the investment expertise of our offshore partner, Orbis. Orbis has the same owner, investment philosophy and approach as Allan Gray and has demonstrated a long-term track record of superior performance relative to the benchmark with a consistent focus on preserving client capital.

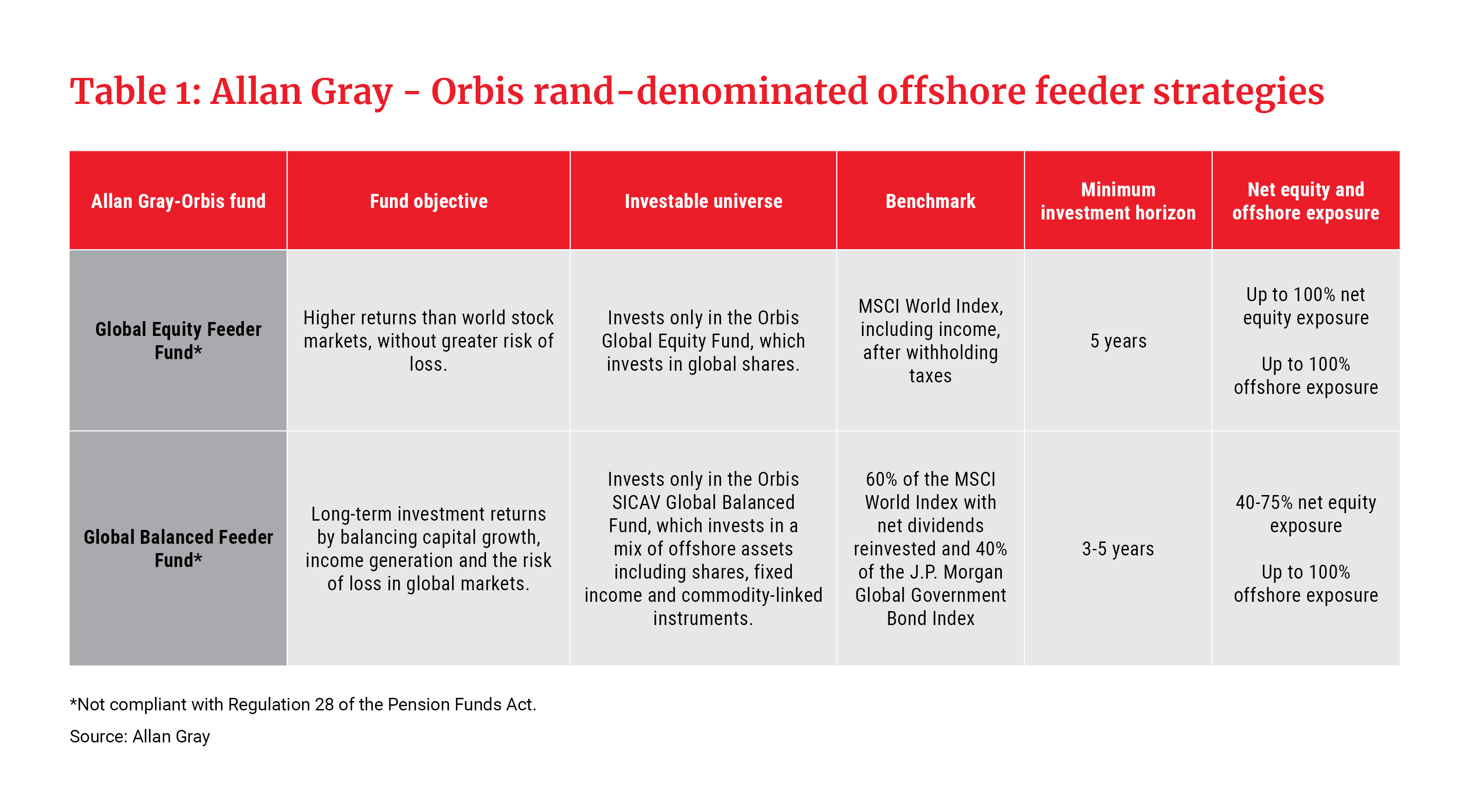

The Orbis Global Equity and Orbis SICAV Global Balanced funds are at the core of Orbis’ focused fund range. These funds offer differentiated global positioning that aims to deliver superior risk-adjusted returns over the long term. The feeder strategies invest only in the Orbis Global Equity Fund and the Orbis SICAV Global Balanced Fund respectively, apart from a small percentage of assets in liquid form. The objectives, investable universe and other details of the two feeder strategies are summarised in Table 1.

Rand-denominated offshore funds allow investors to invest offshore using rands. This is a simple way to diversify without needing to buy foreign currency or get tax clearance from the South African Revenue Service (SARS). Investors can also invest in Orbis funds using foreign currency via the Allan Gray Offshore Investment Platform or Offshore Endowment.

Unlike unlisted funds, listed exchange-traded funds (ETFs), which include AMETFs, with underlying foreign holdings (referred to as “inward listed”) are not restricted in terms of the amount they can invest offshore according to the South African Reserve Bank’s exchange control regulations. South African companies, trusts, partnerships, private individuals and non-residents may therefore invest in the Allan Gray - Orbis Global Equity Feeder AMETF and the Allan Gray - Orbis Global Balanced Feeder AMETF without restriction.

Accessing the Allan - Gray Orbis rand-denominated offshore feeder strategies

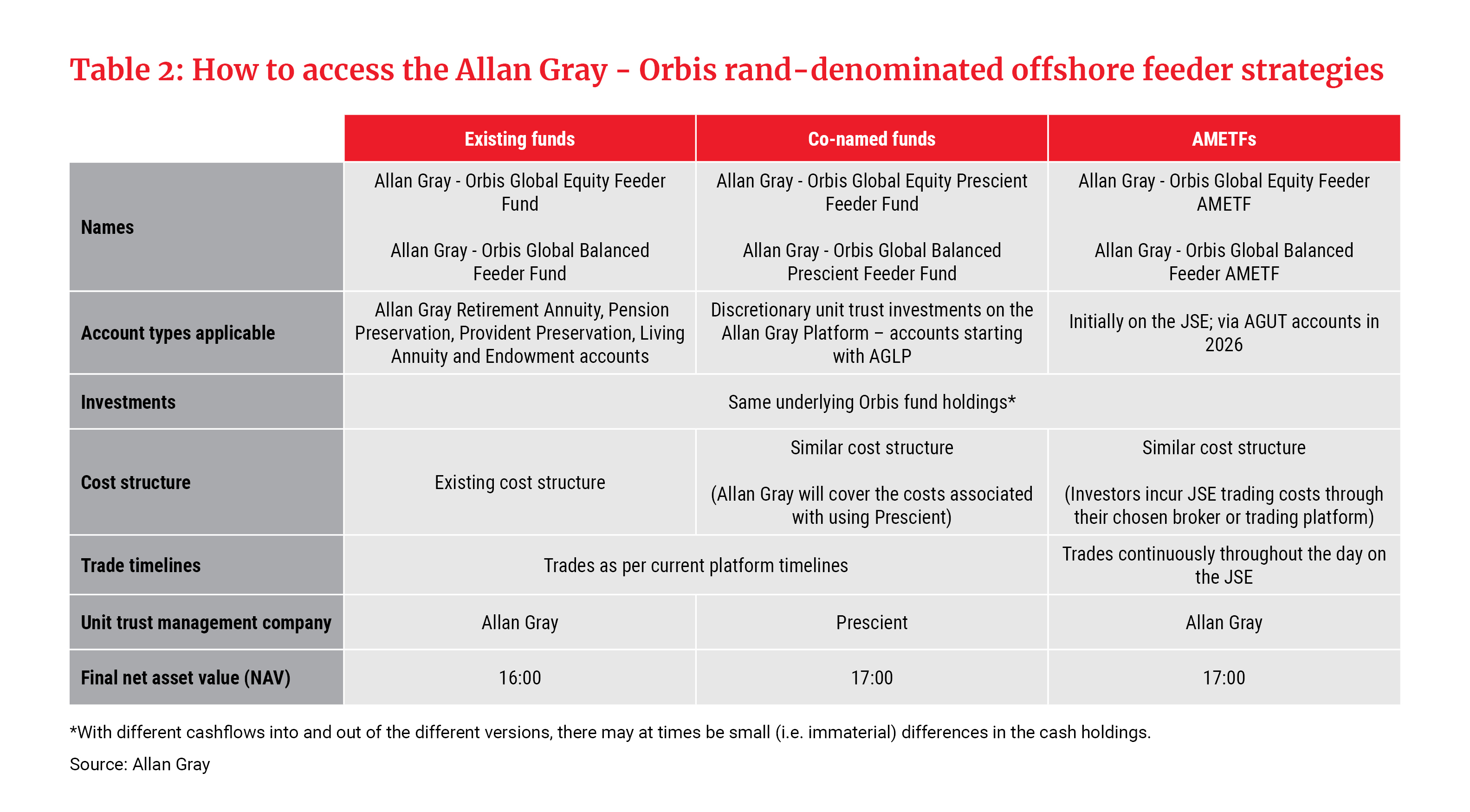

The addition of the AMETFs means there are now three avenues for clients to access these rand-denominated offshore feeder strategies, as summarised in Table 2. Until the AMETFs become available via Allan Gray, the co-named funds are open for new investments via the Allan Gray Local Investment Platform, and the existing unlisted feeder funds remain open via life and retirement fund investments.

For further information about the AMETF listing, please refer to the Allan Gray ETF Programme Memorandum and the Supplements for the respective AMETFs.

Frequently asked questions

What is the difference between a unit trust and an AMETF?

Unit trusts and AMETFs are, for all intents and purposes, the same thing. They are both funds that allow investors to pool their money with other investors to gain access to a basket of assets that are selected and managed in accordance with a specific mandate. The main difference is that the AMETFs are listed on and traded through a stock exchange, while unit trusts are not listed and are typically made available via investment platforms and/or directly from the unit trust management company.

In South Africa, both unit trusts and AMETFs are governed by the same legislation (i.e. the Collective Investment Schemes Control Act 45 of 2002), and both are offered by the same unit trust management companies. Therefore, it is possible to get the same fund, from the same manager, both as an unlisted unit trust (via an investment platform or directly from the unit trust management company) and as an AMETF (listed on the JSE).

How do AMETFs trade?

Units in AMETFs can be bought and sold intraday on the JSE, unlike unlisted unit trusts which can only be purchased at the final net asset value (NAV) price at the end of each trading day. This allows investors more flexibility to react to market events, should they wish to do so.

How do we ensure investors trade at fair prices on the JSE?

We will be publishing an intraday net asset value (iNAV) based on the previous day’s closing holdings at current prices on our public site at least three times a day, every trading day. This is in line with JSE regulations and will ensure that that investors on the JSE have a price at which they can trade. In addition, a final NAV will still be published every day on our website.

How are investment management fees charged?

Allan Gray does not charge annual management fees for its feeder strategies but is paid a marketing and distribution fee by Orbis. However, an investment management fee is charged by Orbis at the underlying Orbis-fund level. The Orbis funds have a highly unique and differentiated fee structure. They levy a base fee and a refundable performance fee component, which is calculated based on the fund’s performance relative to the benchmark. The performance fee component can be both positive and negative. If the fund outperforms the benchmark, it will not immediately be paid over to the manager. Rather, it is held in a reserve which is subsequently refunded to the fund’s net asset value if the fund subsequently underperforms. This ensures that performance fees are only paid if this performance is sustained and helps ensure that fees charged reflect the value added since inception.