Aside from our dedicated local fixed interest funds, being the Allan Gray Money Market Fund and the Allan Gray Bond Fund, we also invest in fixed interest across our multi-asset mandates. Notably, 32% of the Allan Gray Stable Fund and 12% of the Allan Gray Balanced Fund is currently invested in South African fixed interest. In total, across the business, our fixed interest portfolio managers, Thalia Petousis, Londa Nxumalo and Sandy McGregor, look after R87bn of SA fixed interest. Thalia Petousis discusses our approach to fixed interest and looks at our current positioning.

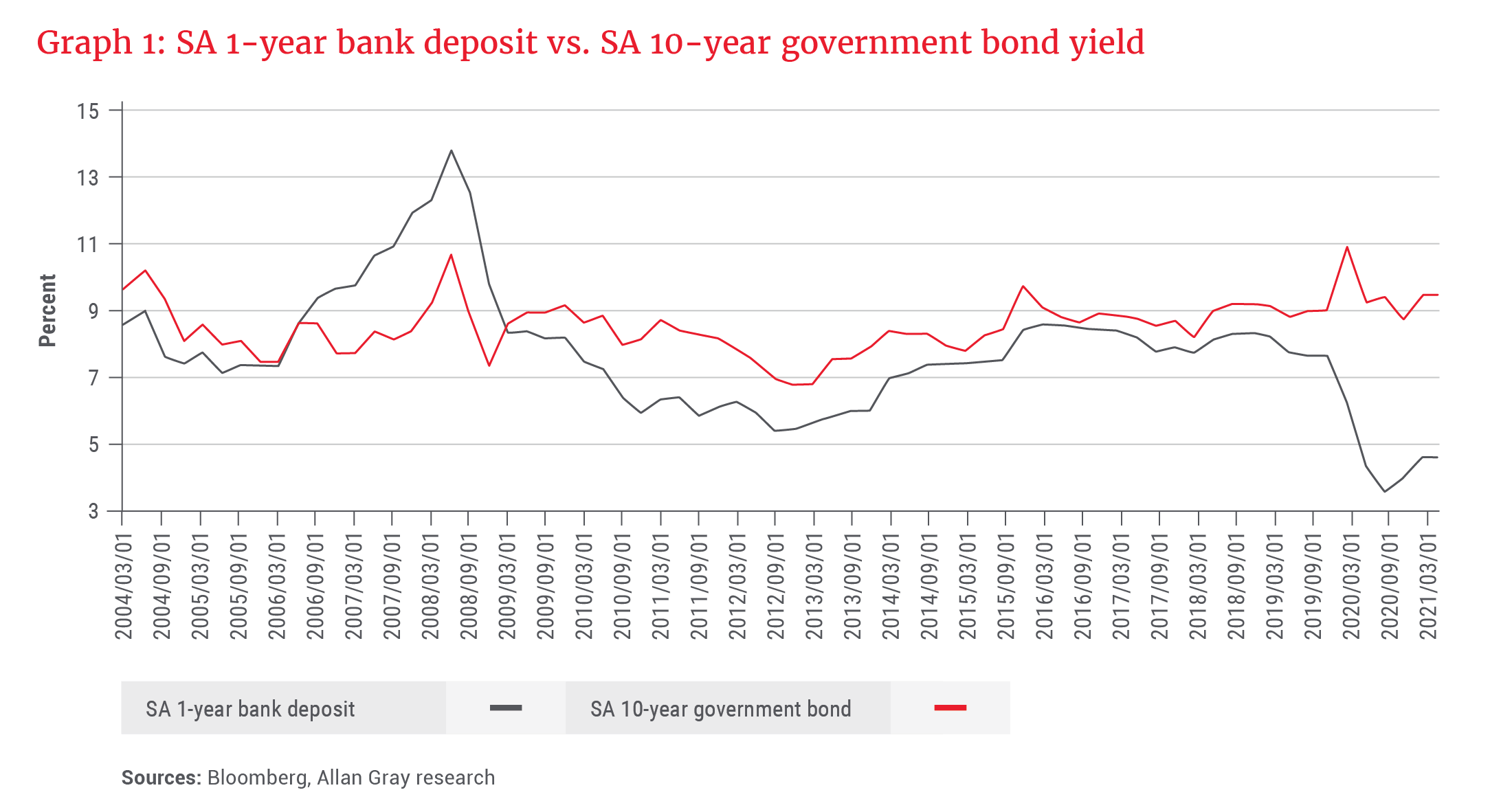

For the last 15 years, our fixed interest strategy could be forgivably oversimplified as the tactic of maintaining a higher yield1, but having lower duration1 risk, compared to the benchmark and our peers. This made enormous sense to us. Over this era, the rolling interest rate on short-term bank deposits at 8% was only a hair’s breadth away from the 10-year South African government bond at 8.4% yield. Short-term deposit rates were kept high in South Africa to do lethal combat with our ever-elevated inflation – which, incidentally, explains why our Money Market Fund was able to return inflation plus 2% for most of its life. There was simply no yield incentive for us as investors to cast our eyes further afield and take too much long-bond duration risk on board.

we invest in fixed interest in the same way we invest in all asset classes: with long-term wealth generation, value, and risk diversification always top of mind

In 2020, COVID-19 grasped that perennial SA market dynamic and turned it neatly on its head. Bank deposits took a spectacular swan dive to 3.5% yield, while the 10-year bond yield soared north of 12%, as illustrated in Graph 1. The South African Reserve Bank (SARB) likes to say that these interest rate cuts were their contribution to economic recovery in a post-pandemic world. For us as fixed interest investors, suddenly the adage “higher risk, higher return” had bearing.

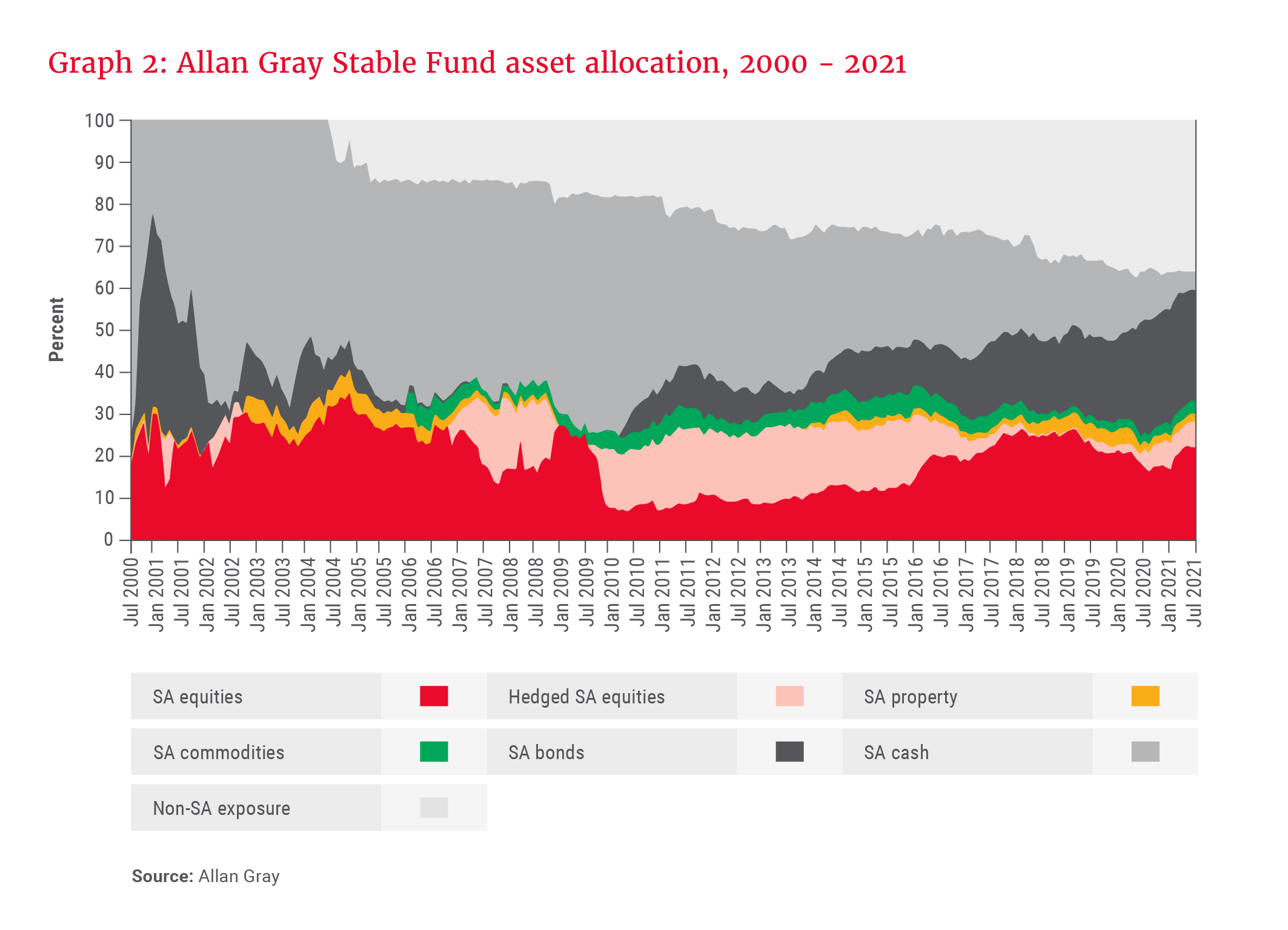

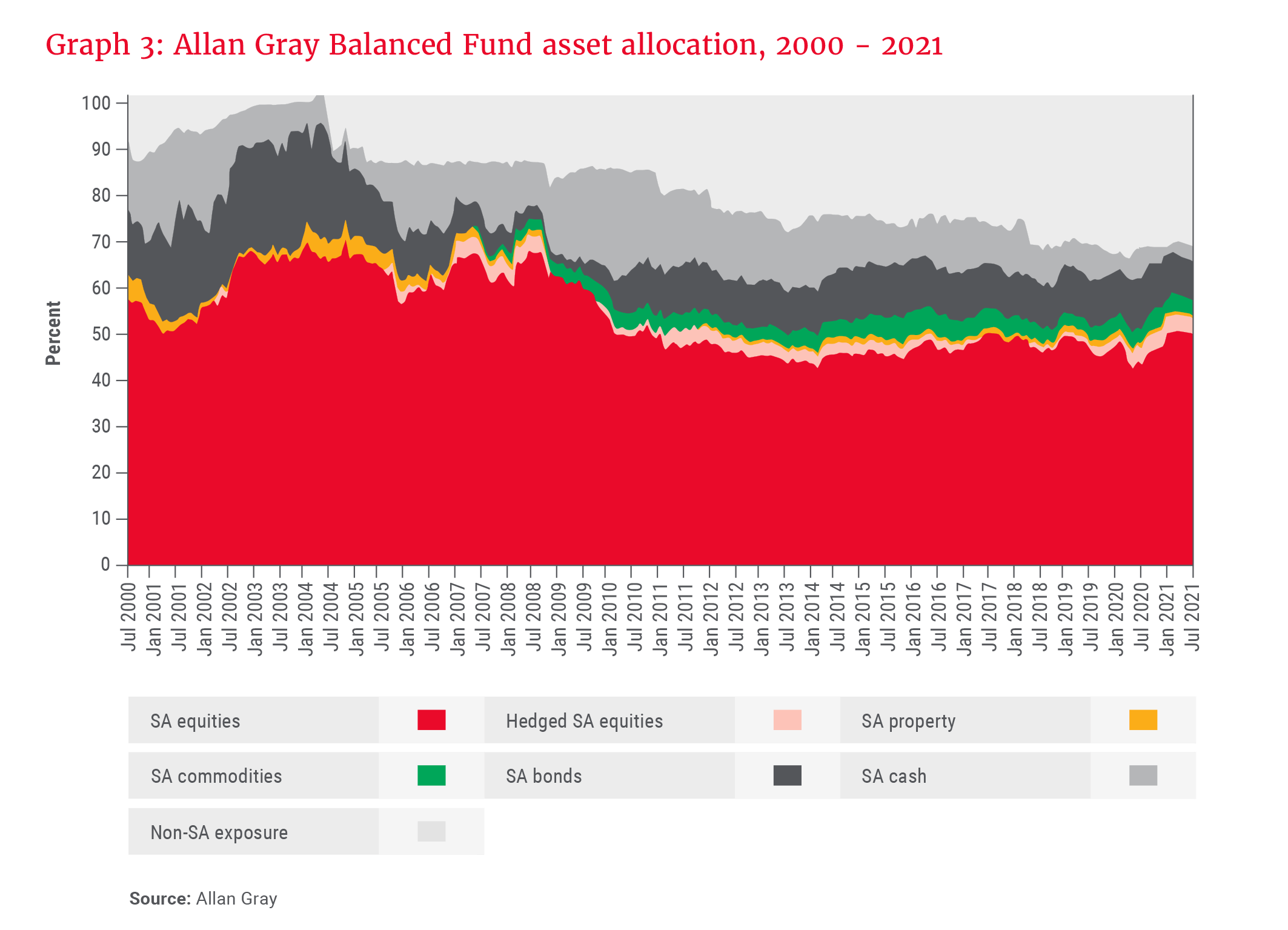

Herein lies the beauty of a multi-asset mandate: flexibility. The fixed interest positioning in our Stable and Balanced portfolios reflects our swift response to the unfolding post-pandemic phenomenon. In short, we ran down our healthy SA cash and money market holdings and invested them in part in bonds. Our positioning of the portfolios over time is reflected in Graphs 2 and 3.

What type of bonds do we buy?

Not all bonds are created equal; there are numerous varieties, and some carry vastly more risk than others. As discerning investors, we look to weigh, measure, dissect and decisively balance these risks.

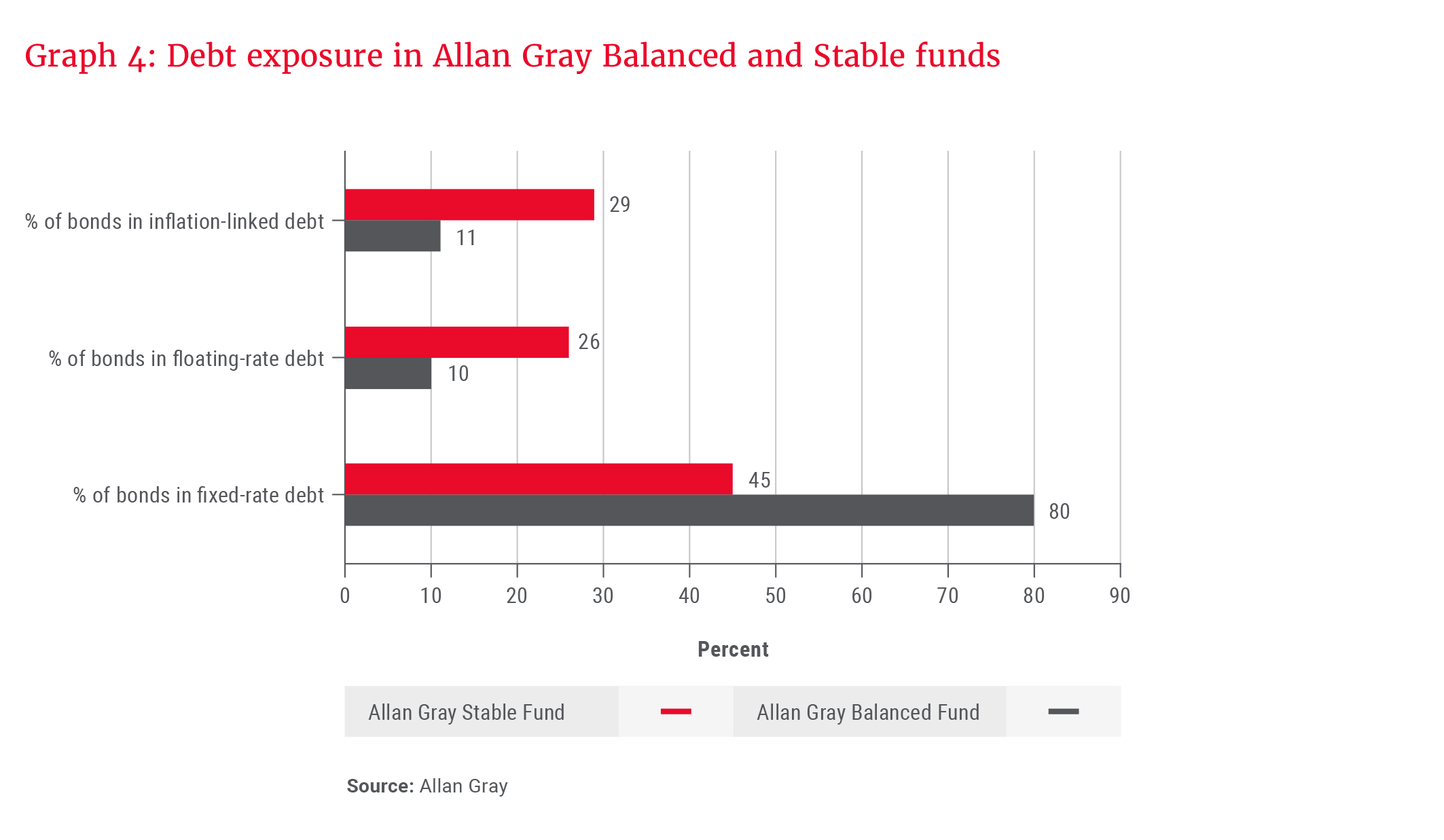

In the Stable Fund, caution predicates that we currently have 30% of our bonds invested in inflation-linked debt. These can be seen as a type of “insurance” should we see the developed world’s extraordinarily loose global monetary policy spill over into South Africa and wreak havoc on the prices of goods. These bonds have a coupon1 that pays a spread above inflation, and therefore one’s real income cannot be eroded. That is not to say that inflation-linked bonds are the holy grail of bond investing; if inflation disappoints, or the supply of bonds exceeds investor demand, these instruments can suffer price declines to the extent that they deliver negative returns.

We also have 25% of our stable fixed interest in floating-rate debt – which is not even “fixed” in interest at all. It pays a coupon that naturally rises with interest rates and carries virtually zero duration risk. This defensive bond offers a trade-off as the yield you earn at inception will likely be lower than that of the equivalent maturity1 fixed-rate bond. That said, it has the potential to outperform over its life should the SARB raise rates by more than what is priced into the market.

Graph 4 shows that our traditional fixed-rate bonds still make up the core of our Stable holdings and have an even higher representation in our Balanced Fund, which is a less cautious product. Bought at attractive yields of 10-12%, the valuations on these are compelling. Even if these long fixed-rate bonds sell off in the short term and underperform the 4.5% return on money market, it will be difficult for them to repeatedly underperform cash and money market.

A 15-year bond bought at 11% yield would break even with money market repeatedly over the ensuing five-year period if its yield rose closer to 17% (i.e. the bond’s price fell markedly from current levels, by more than 20%). Keep in mind that, by then, you would be left sitting with a 10-year bond in your portfolio that prices at a 17% yield. This is a yield we have not seen since the SARB started explicitly targeting inflation in February 2000. It took extreme risk spill-over from the 1997 East Asian crisis for our yields to get to 20%, a time also marked by the collapse of several emerging market currencies, such as those of Brazil and Russia, and their accompanying (primarily dollar) debt defaults. Therefore, while it is not an inconceivable yield to reach, there is substantial negativity already priced into the SA bond market at current levels. In the long run, investors can earn the long-run yield.

The input of the entire investment team … is … invaluable in the fixed interest investment process

At this point, some of our readers might be wondering: But what if South Africa defaults on its debt? Local currency debt defaults are quite rare, accounting for only 3.5% of all sovereign debt defaulted on since 1961. This is because sovereigns have access to the proverbial printing press when raising funding in their own local currency. Via this mechanism, they could simply print their way through their debt repayments. Such irresponsible behaviour should lead to rampant inflation, meaning that investors might suffer through a different and less direct mechanism than default. In some ways, it is this type of inflationary buffer that is already priced into our current bond market via the high yields on offer.

How long are the bonds that we buy?

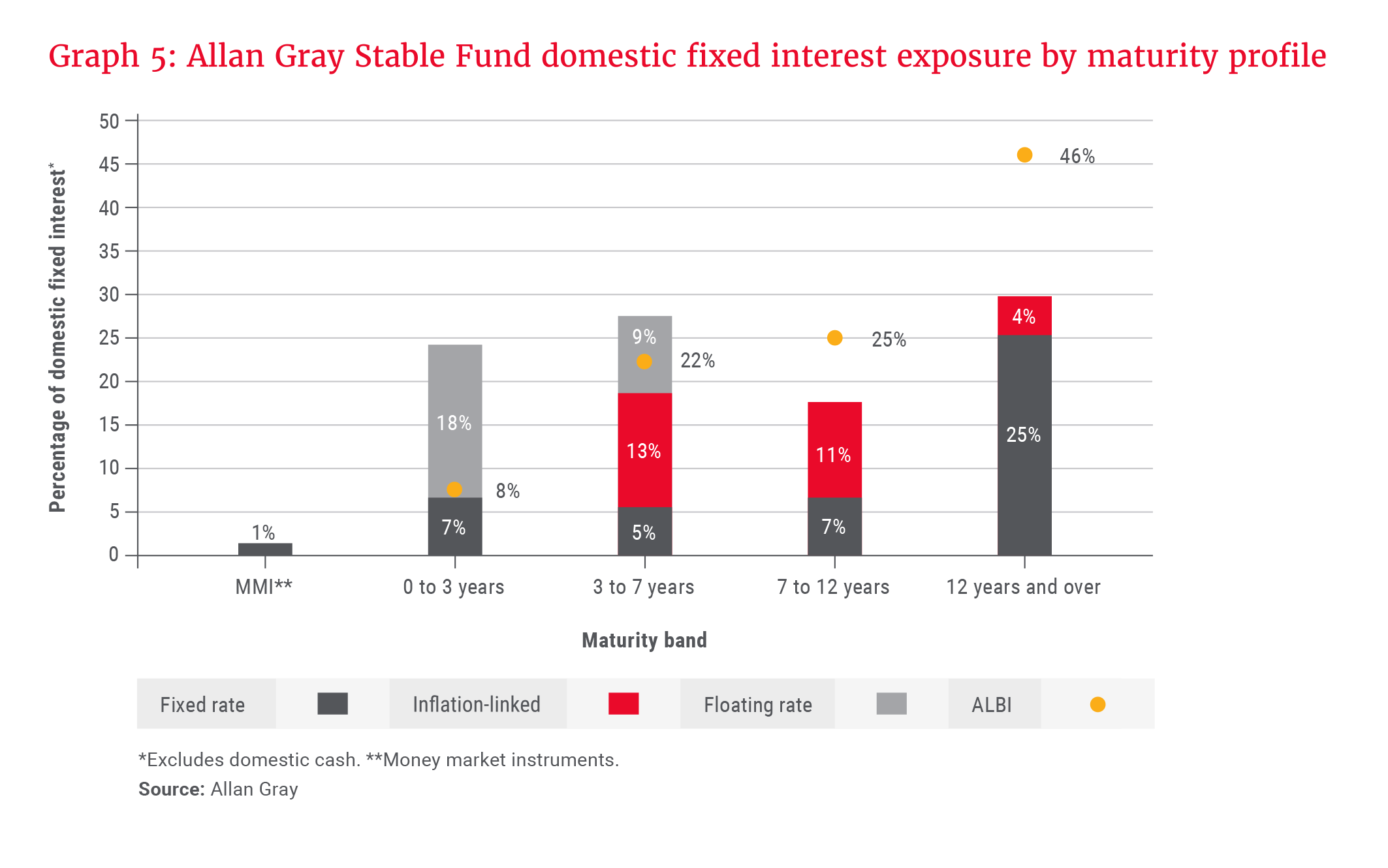

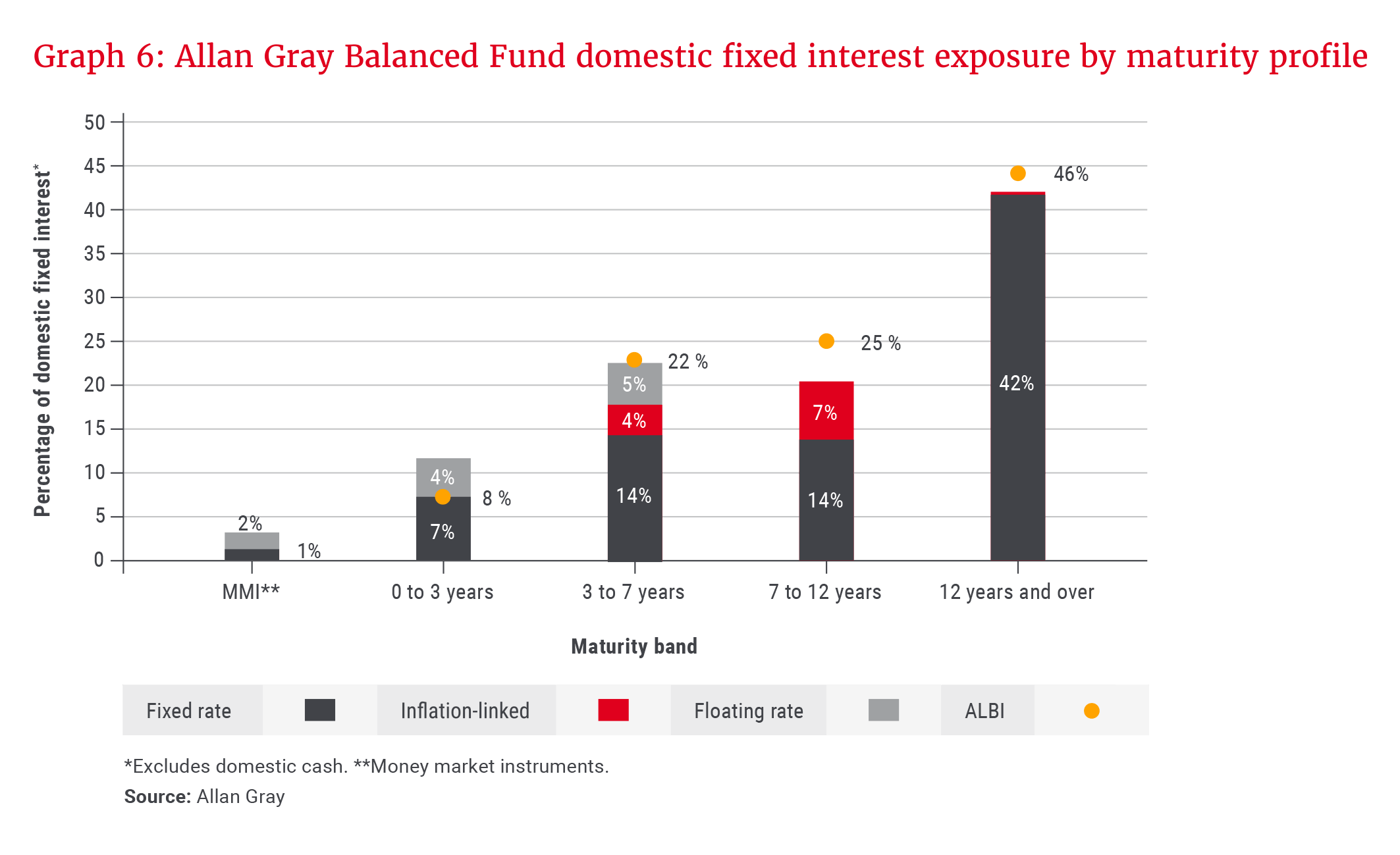

Our fixed interest maturity profile is more nuanced in its risk considerations compared to the FTSE/JSE All Bond Index (ALBI), which is 100% invested in fixed-rate bonds, with the majority allocated to long-term tenors. The case of the 15-year fixed-rate government bond at 11% yield is very compelling to us given the steepness of the fixed interest yield curve. However, that is not to say we would fill all the bonds in our basket with such long-dated tenors. Our portfolios are layered with what we feel are the most attractive bonds in each time-to-maturity bucket. Graphs 5 and 6 display our fixed interest exposure by maturity profile.

We have avoided too many short fixed-rate bonds, given that these are more anchored to near-term interest rate risks. These bonds have already underperformed in 2021 due to a rise in inflation and should continue to sell off with the commencement of interest rate hikes. We have instead focused our one- to seven-year bond buckets by skewing them towards inflation-linked and floating-rate debt at more attractive relative valuations.

The fixed interest team also manages the money market, or “cash”, component of our Balanced and Stable portfolios, which can be a valuable buffer for liquidity as it protects against price shocks associated with longer-duration risk.

Whose bonds do we buy?

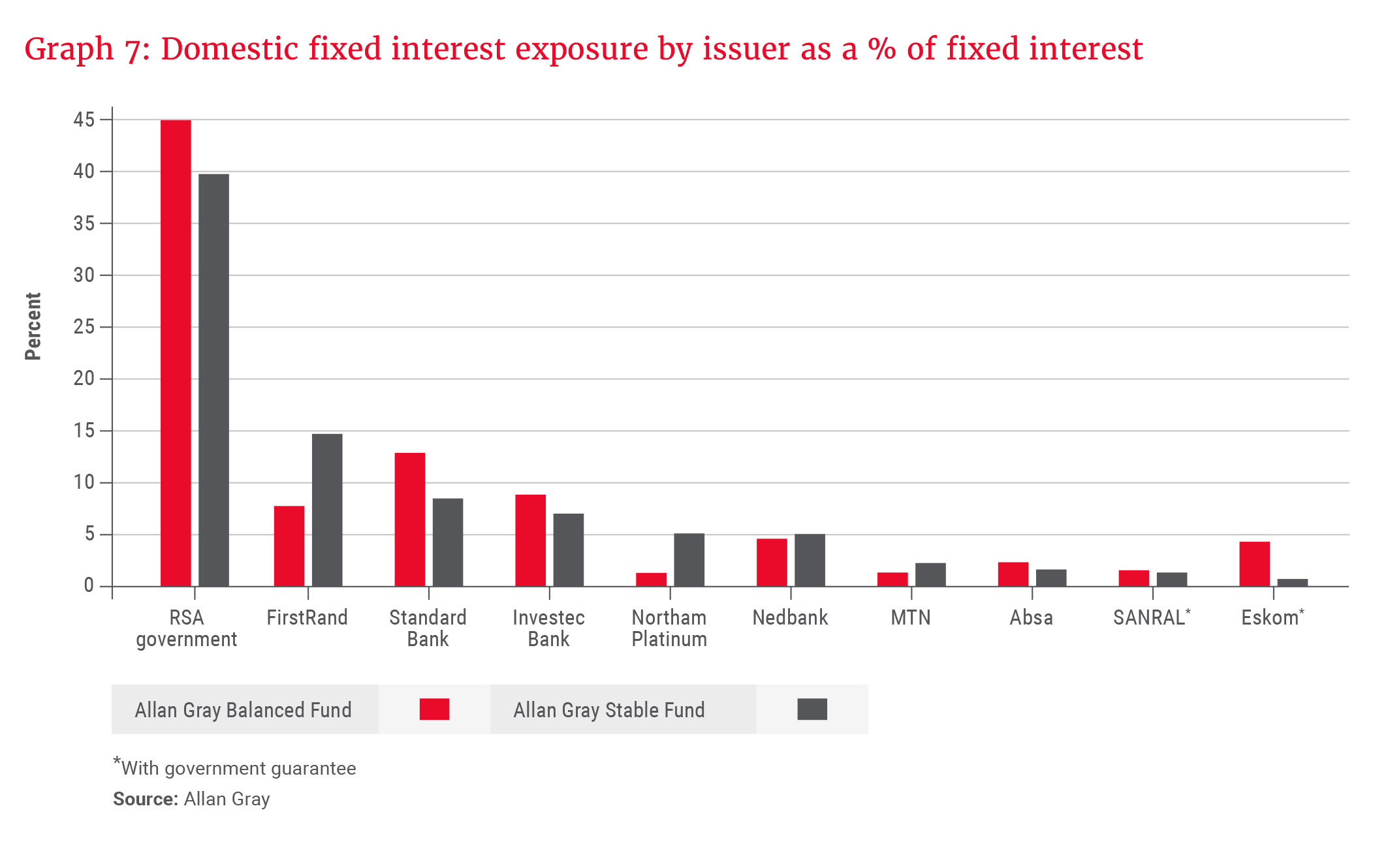

The ALBI is 95% weighted towards RSA government debt and 5% towards the state-owned entities Eskom and Transnet. Our weightings are far more diversified, as shown in Graph 7, with the notable addition of the debt of the large South African banks, which are well-capitalised financial institutions with mostly strong balance sheets.

We also buy the debt of corporates we like who have solid creditworthiness. One example is Northam Platinum, which has an excellent operational track record and good management. Its bonds offer sufficient credit spread to compensate for the cyclical nature of both platinum pricing and its cash flow generation capacity. This is one of many examples of a corporate that we are highly familiar with on both the equities and debt sides of the spectrum.

The input of the entire investment team, including the equity portfolio managers, is therefore invaluable in the fixed interest investment process. Aside from our ongoing discourse around key macroeconomic issues like inflation, group insights into SA corporate issuers of both equity and debt form the backbone of investment committee meetings.

If I can impart just one message, it is quite simply that we invest in fixed interest in the same way we invest in all asset classes: with long-term wealth generation, value, and risk diversification always top of mind.

1. Sources: Investopedia, Allan Gray