On 17 October 2019, angry demonstrators took to the streets of Lebanon to protest a US$6 per month WhatsApp communication tax. Little did they know that the financial collapse (which was inevitable) had just occurred. True, the tax proposal and the consequent protests were the straw that broke the camel’s back, but few realised that the loss that had just materialised would make an irony of the tax burden that was to be imposed. It took only a matter of weeks for the Lebanese to appreciate that value in the financial system was artificial, and that their hard-earned lifetime savings were no more.

Rami Hajjar sheds light on the processes that led to the collapse. The Lebanese crisis is a good case in point of how things can go wrong when mismanagement of public policy and corruption are the order of the day, and acts as a valuable lesson for our thinking when approaching investment opportunities in African and frontier markets. While South Africa is in a very different position to Lebanon, the events outlined act as a reminder of the importance of sound economic policy, fiscal discipline, and strong, independent institutions in maintaining a functioning economic and financial system.

All too often, the root of a crisis lies in a country consistently spending beyond its means. In budgetary accounting, this is manifested in the famous “twin deficit”, which denotes deficits in both the fiscal account and the current account.

The Lebanese crisis is a good case in point of how things can go wrong when mismanagement of public policy and corruption are the order of the day

The unsustainable twin deficit

The budget deficit

It would be useful to start with a brief background. Lebanon’s crisis was born out of the financial and economic policies it undertook during the period after the 1975-1990 civil war. Central to the model was the need to attract large foreign inflows to finance the reconstruction of the country. To do so, the currency was pegged (providing confidence in the monetary system), high interest rates were provided, and capital movements were fully liberalised.

As the economy was coming off low grounds, and the tax base was tiny, the budget was financed with a large amount of debt. Early on, the government relied on domestic borrowing, amassed in local currency, to meet its overall financing need. Most of that came with very high interest rates, given the risk premium demanded by investors to finance a broken country. With high costs of borrowing, the overall fiscal deficit expanded rapidly over the years. From 2001 onwards, Lebanon successfully tapped international capital markets, backed at first by successive Paris donor conferences and continuous support by local banks.

it takes just a few years of reckless spending to get stuck in a debt-overhang spiral

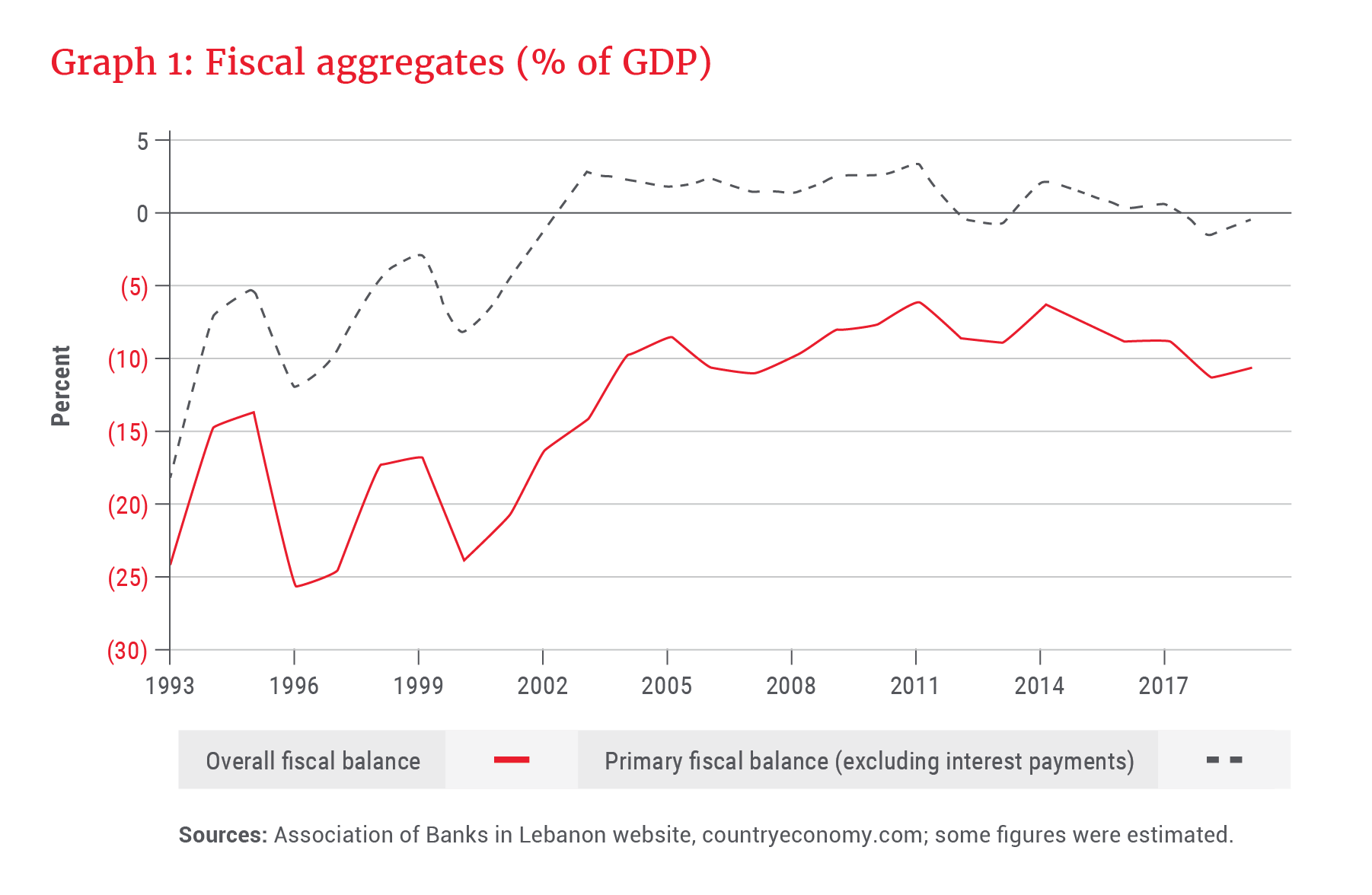

Interestingly, starting 2001, the budget registered primary surpluses (i.e. excluding interest payments), as shown in Graph 1. Between 1993 and 2019, and including estimated off-budget operations, the fiscal accounts showed that the government earned a cumulative revenue of around US$170bn and cumulatively spent around US$260bn, resulting in a deficit of US$90bn. This is compared to an estimated cumulative interest payment of US$87bn, which means that interest was responsible for the full cumulative deficit. Markedly, it takes just a few years of reckless spending (1993-1998) to get stuck in a debt-overhang spiral.

Important to note is that the reconstruction project involved massive embezzlement of public money through nepotism in the awarding of contracts, an overt shift of wealth from the public to private entities, and tenders greatly exceeding project costs. Some estimates put the amount of waste at more than 50% of the total cost of reconstruction. In another instance of transfer of wealth, it has been argued that the government engaged in overborrowing and offered interest rates more than warranted by market fundamentals, which resulted in enormous rent being derived by a concentrated group of private players.

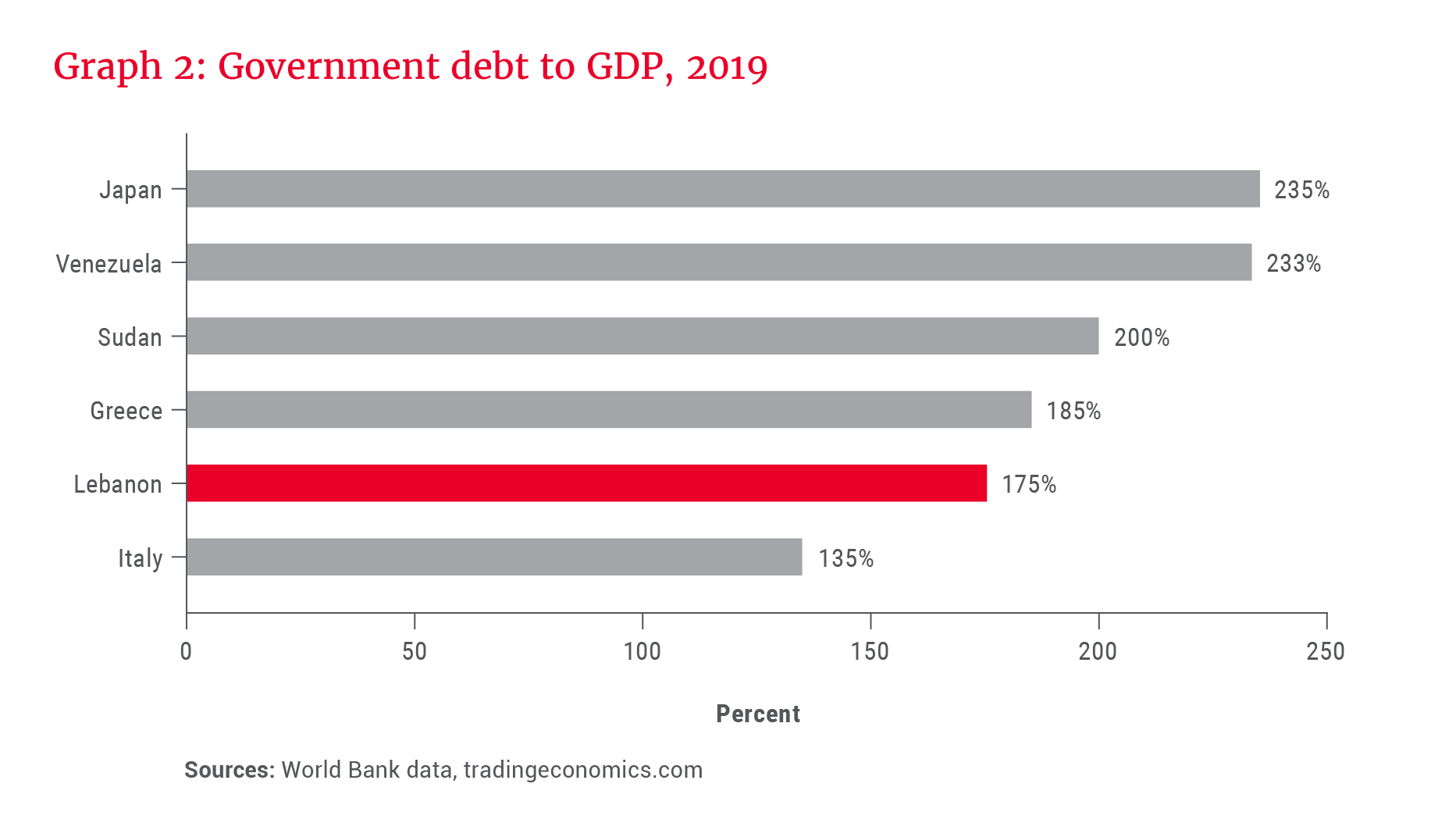

By 2019, Lebanon had one of the highest debt-to-GDP ratios in the world (Graph 2). As a consequence, interest payments consumed around 50% of government revenue by 2019.

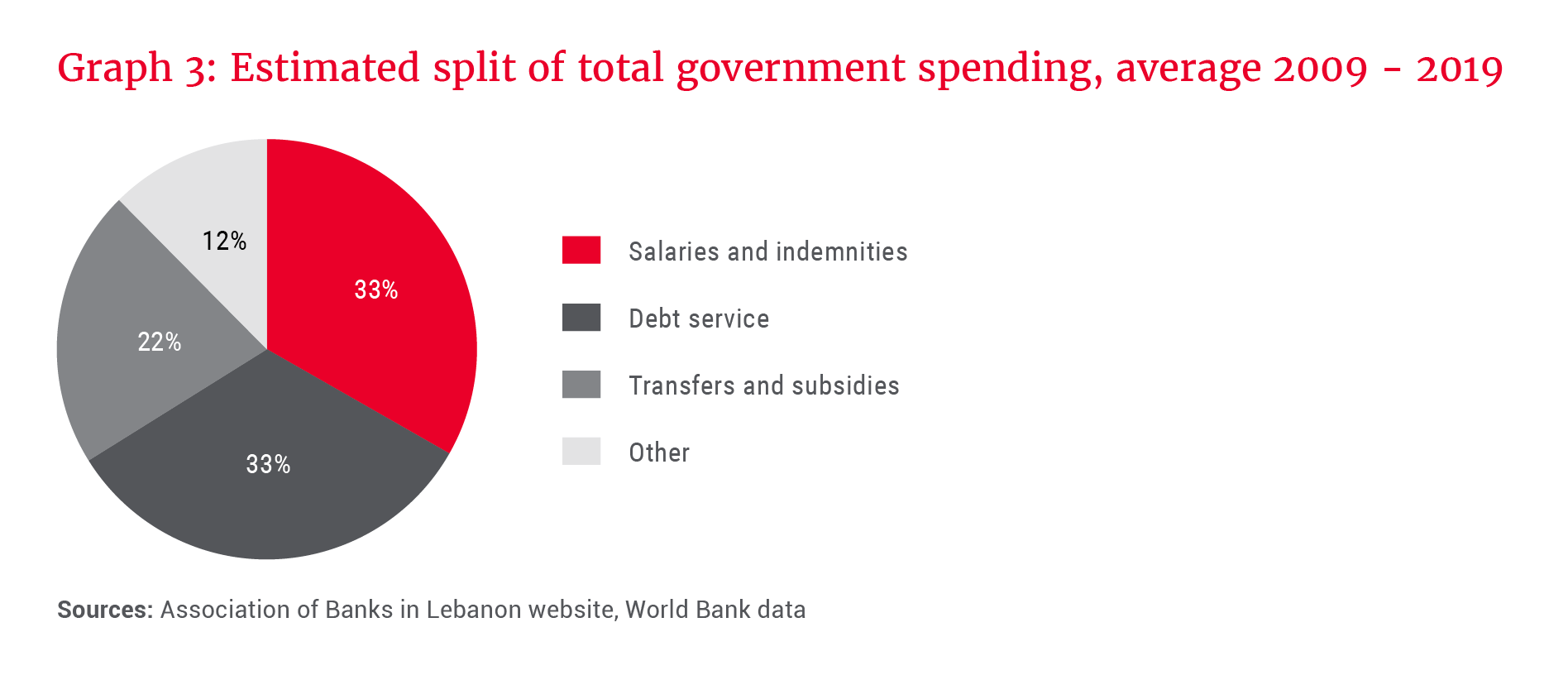

Another point to note is that most of public spending went into consumption expenditure, which means that spending was not generating economic value – compared to when a government invests with the intention to boost economic potential and future revenue generation potential. As reflected in Graph 3, the two main sources of primary spending were public sector wages (a highly bloated public sector that served sectarian patronage), and subsidies to the broken state-owned Électricité du Liban (EDL), where deeply entrenched vested interests blocked any reform.

The current account deficit

Lebanon consumes more than it produces and relies heavily on imports. The export base is tiny due to long-standing neglect of the productive sectors at the expense of the service sector, an overvalued exchange rate, and a commitment to open trade with no policies to protect domestic industries. For years, the country ran a huge current account deficit, equivalent to around 25% of GDP in some years.

It is important to note the link between the budget deficit and the current account deficit. As discussed above, budget spending comprised three main items: interest expense, wages, and subsidies to EDL. Nearly half of interest expense was in US dollars, and most of the EDL costs were in foreign currency. As for wages, even if they were paid in local currency, consumption spending would automatically lead to US dollar outflows as the country relied on imports to meet 85% of its daily needs.

The financing model of the country

Main source of foreign exchange inflows

Each dollar that leaves a country as a result of private or public consumption needs to be financed by an incoming dollar. A sustainable way that countries usually finance capital outflows is through exports. An exporter will sell goods in foreign markets, bring dollars into the country and exchange part of these dollars into local currency to buy local inputs. These usually end up as reserves at the central bank. If more dollars come in in a given year than leave, the country registers a balance of payments surplus, which is usually reflected in higher central bank reserves or higher banks’ foreign asset position. If less comes in, the country needs to bridge the gap either through external debt or by drawing down reserves, thereby reducing the net foreign asset position of the country.

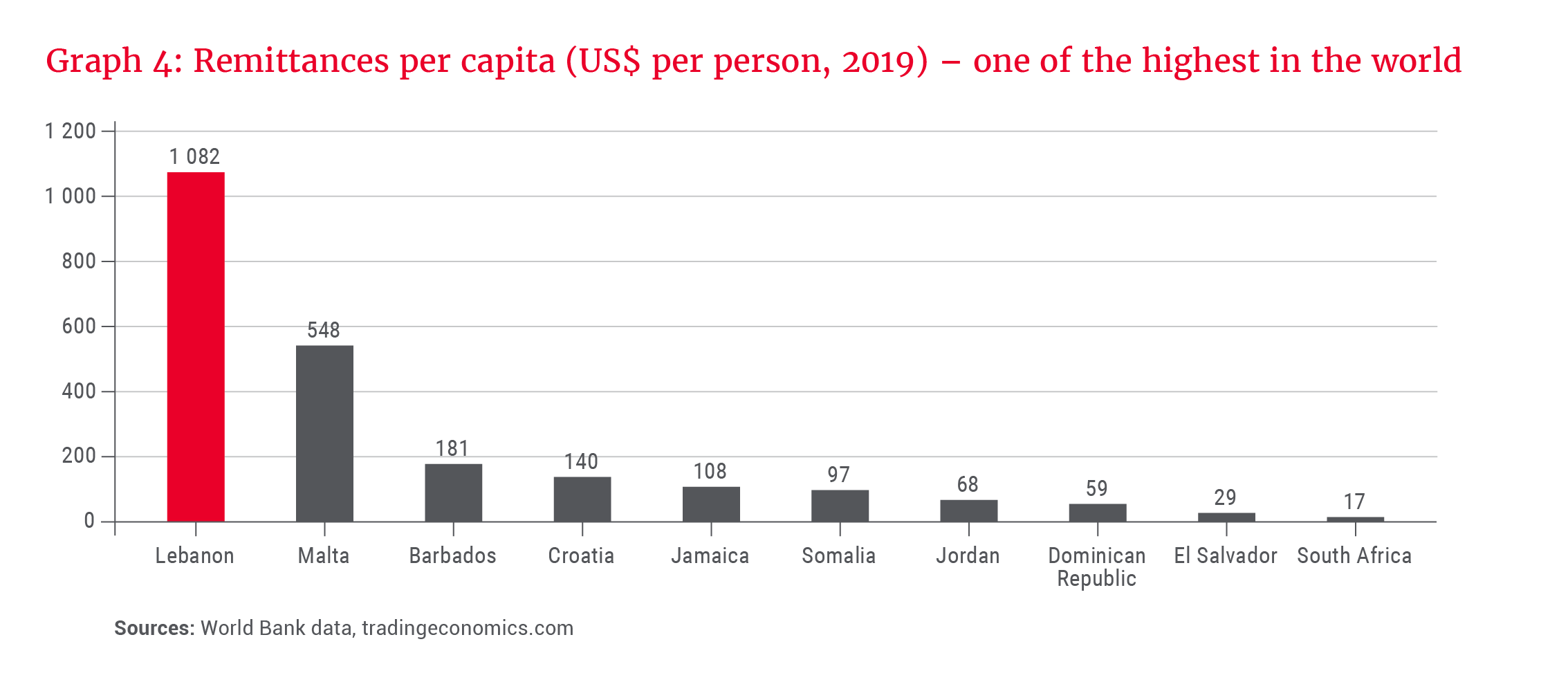

In Lebanon’s case, the main source of financing was unfortunately not exports. The country relied on the constant inflow of remittances from the Lebanese diaspora (there are an estimated 12 million Lebanese living abroad versus 6.5 million in Lebanon) that were channelled through a perceived strong banking sector – see Graph 4.

Remittances are not a sustainable way to finance a huge deficit. They are volatile in nature, as a large part accumulate as liabilities on the banking sector’s balance sheet, making them susceptible to sudden outflows.

The other source of financing, to a lesser extent, was foreign direct investments (FDIs), which mainly came from wealthy nationals of Gulf countries investing in real estate.

The banking sector’s role as intermediary

Trust in the Lebanese banking system dates from the inception of Lebanon. Free movement of capital and a banking secrecy law were key pillars of the sector, and these, alongside a more developed financial sector compared to those of the nascent oil countries, caused a lot of oil money to be channelled through Lebanon. The trust persisted in the post-war period due to the perception that the sector was tightly regulated. Confidence in the currency peg (bolstered by a decent amount of central bank reserves) and high interest rates on both the US dollar and Lebanese pound (LBP) were also pull factors for foreign capital.

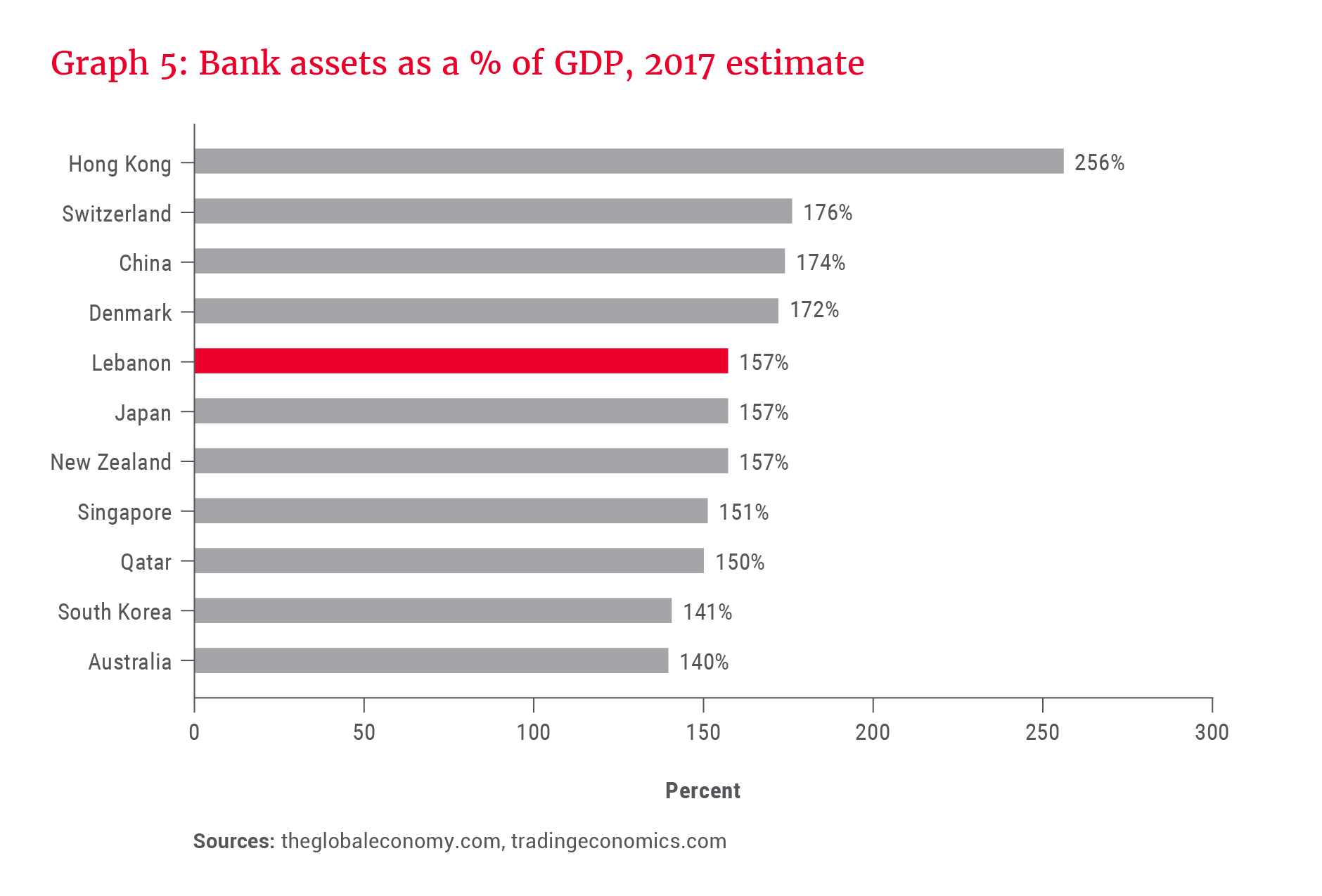

Large capital inflows from remittances and increased domestic borrowing supported the growth of the banking sector, making an anomaly of Lebanon in terms of banking asset penetration relative to the productive capacity of the country, as shown in Graph 5.

It is worth highlighting the significant interlinkage between the Lebanese financial system and Arab oil money. Most of the foreign exchange inflows were linked to the Gulf: diaspora money, FDI, Arab tourism, and foreign aid. This meant that even if Lebanon did not produce a drop of oil, financial flows were very much correlated to the oil price, making Lebanon a victim of the Dutch disease – large inflows of foreign currency that lead to an overvalued real exchange rate and a decline in the productive sectors of the economy.

The balance of payments

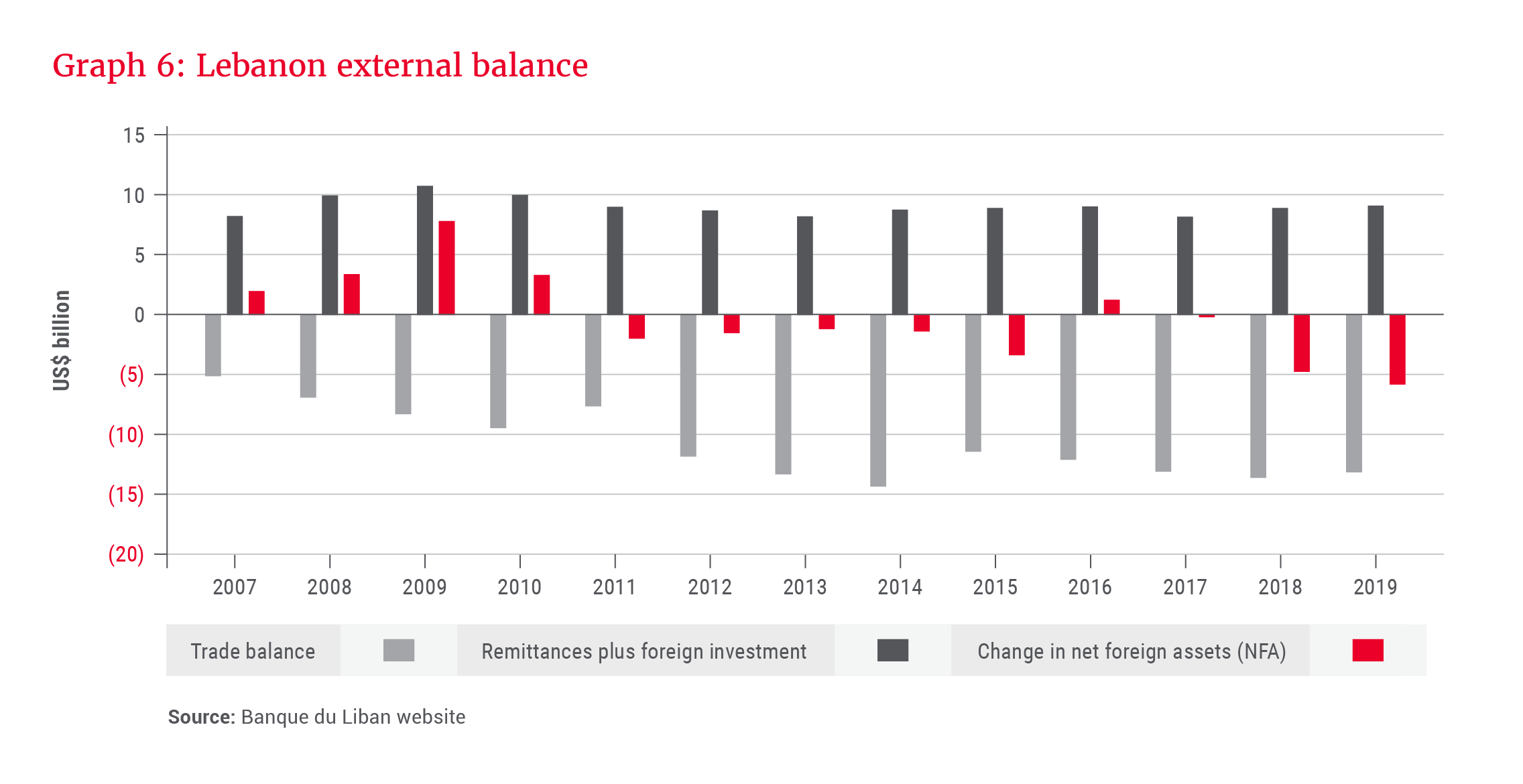

In the years leading to 2010, and despite a huge trade deficit, Lebanon was registering balance of payment (BOP) surpluses (net additions to foreign assets), meaning more dollars were coming into the country than leaving (see Graph 6). The large figures of 2008-2010 are related to diaspora money fleeing international banks to what was then perceived as a safe-haven Lebanese banking sector.

The period post 2010 coincided with lower oil prices compared to those of prior years. This, together with the repercussions of the Syrian civil war (outbreak 2011), had a major impact on the country’s external accounts through the oil link, and because of disruption from Syria (Syria is an export destination for Lebanese goods and an export route to the Arab interior). This is reflected in the “change in net foreign assets” figure turning negative starting 2011, as shown in Graph 6.

The (dubious) role of the central bank, Banque du Liban

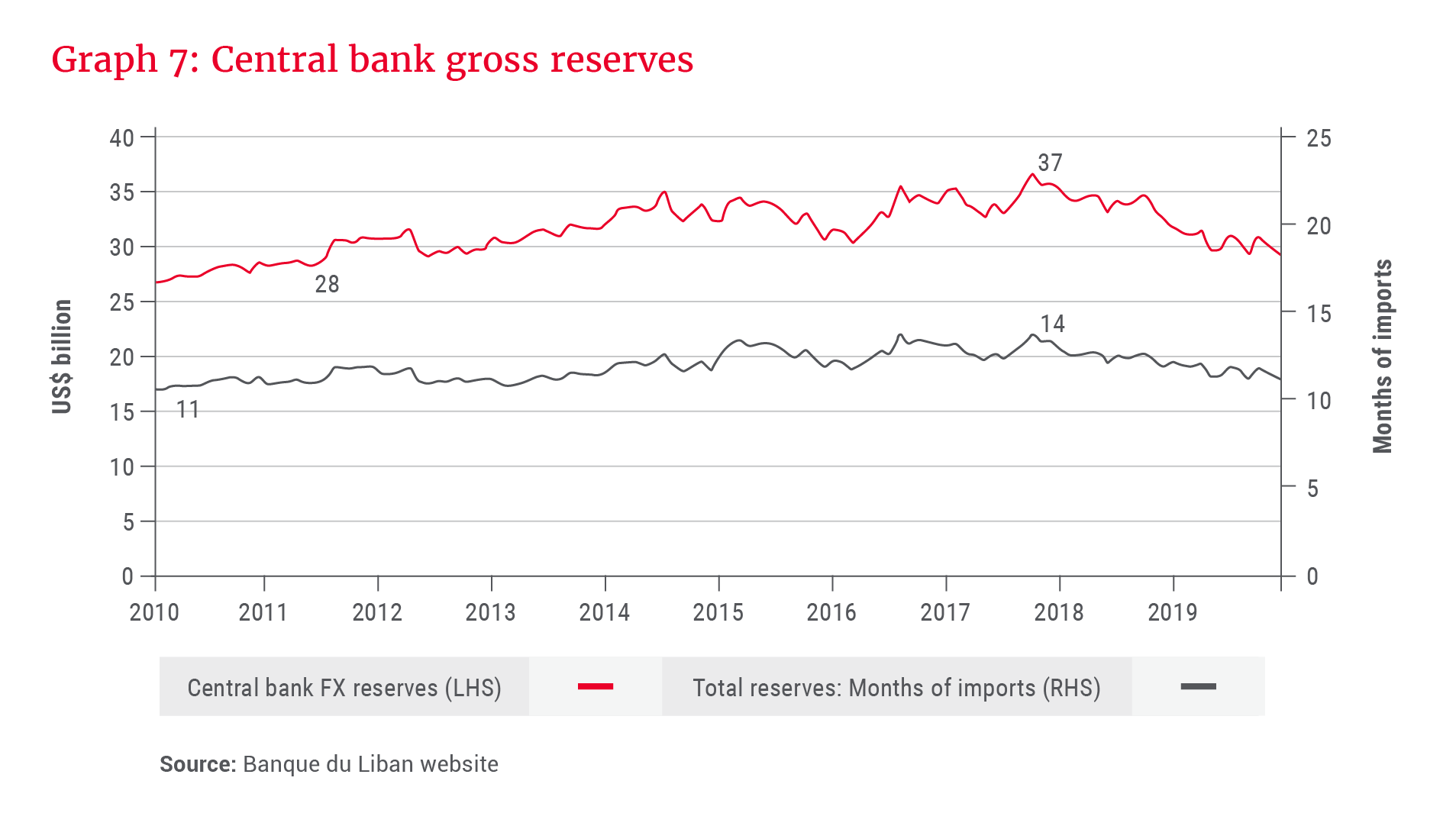

The value of foreign reserves appeared very comfortable throughout the years, as shown in Graph 7, reaching around 14 times months of imports (and more than 20 times if we account for gold). This was the main argument many used to justify their belief in the sustainability of the currency peg (which had been stable at LBP1 507.5/US$ since 1997).

What some failed to look at (deliberately or not) is the net reserve figure, which showed a totally different picture.

As Lebanon started to see diminishing inflows, which intensified in 2015, the central bank, Banque du Liban, underwent a series of transactions dubbed “financial engineering”. The scheme involved three steps among the central bank, ministry of finance and private banks that were meant to solve serious problems each had been facing: the central bank’s foreign exchange shortage, the funding needs of the treasury, and the insufficient capital and liquidity of private banks.

The details of the scheme will not be dwelled upon here but, in short, the central bank paid banks an exorbitant return on dollar deposits, effectively around 15%, to bolster its dollar reserves. This provided a windfall boost to bank earnings and capital (effectively a money-financed capital injection without any equity stake in return – i.e. a direct transfer of taxpayer money to a few wealthy bankers). To maximise the benefit from the scheme, banks were incentivised to attract new dollar inflows by offering high rates to expats (and as a concomitant significantly reduced lending to the real economy, exacerbating the problem).

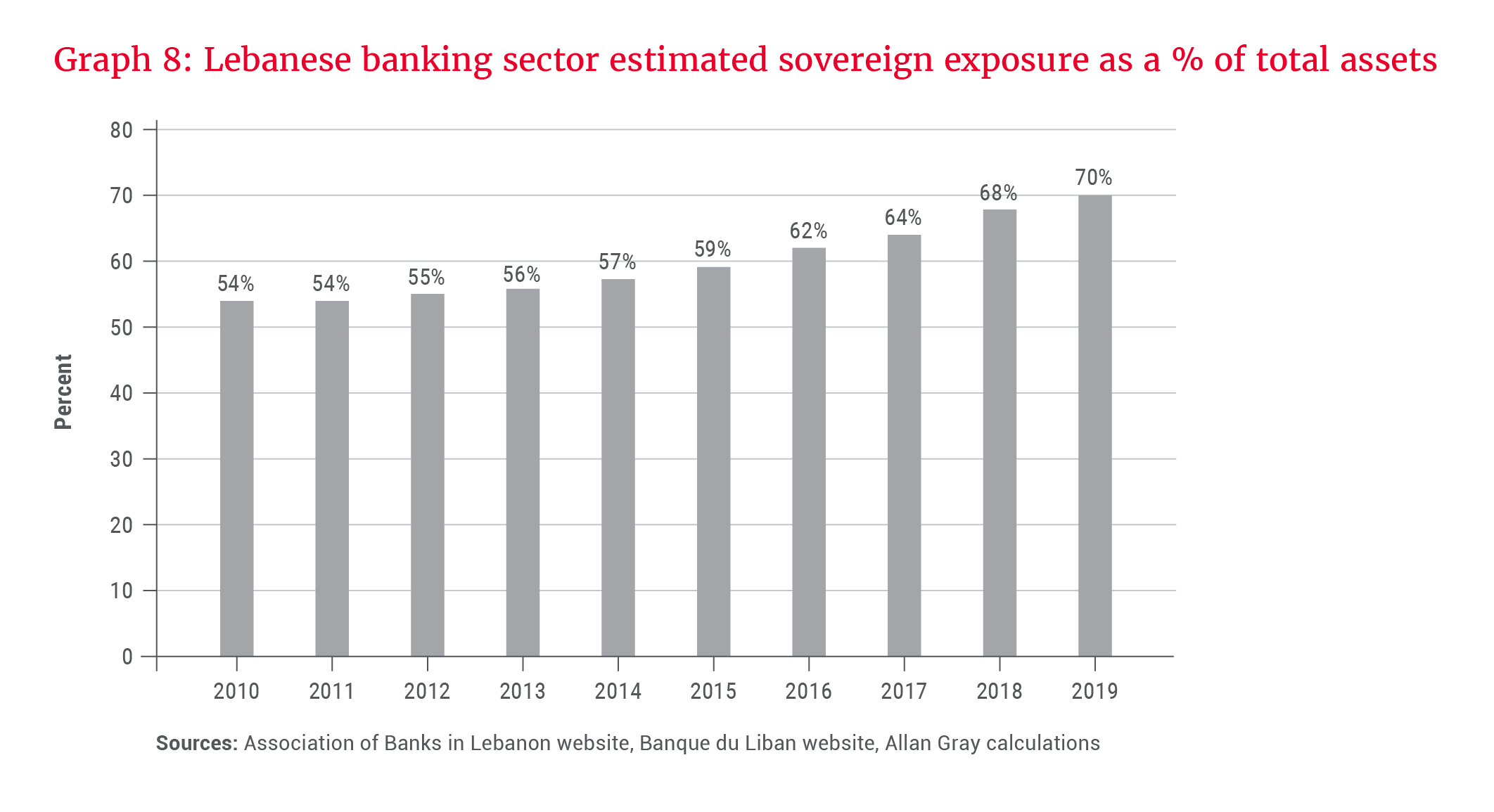

As of the end of June 2019, the banks’ exposure to the sovereign (central bank plus government) increased to around 70% of their total assets, estimated at more than 8 times Tier 1 capital. See Graph 8.

The effect of this was the strengthening of the central bank’s gross reserves in the short term. The central bank, in turn, was using that money to finance both the current account (i.e. continue supporting the currency peg) and the government (which at that point was struggling to raise foreign exchange debt on the market). The net reserve figure (which accounts for liabilities – and was never published) turned red at some point and continued widening.

The collapse

“‘How did you go bankrupt?’ Bill asked. ‘Two ways,’ Mike said. ‘Gradually and then suddenly.’” (From Ernest Hemingway’s novel The Sun Also Rises)

Things gradually worsened with continued net outflows, no reforms whatsoever (which would otherwise have set forth up to US$11bn in easy loans by CEDRE, an international conference hosted in Paris in 2018 in support of Lebanon development and reforms), and an unwillingness of traditional foreign backers to support the country.

On the ground, this was being reflected by ever-increasing interest rates, banks making it more complicated to transfer money out (although you technically still could) and offering all sorts of enticements to keep sceptical customers and to bring in new money. Interest of up to 10% on dollar deposits was offered, and more than that for large amounts coming from abroad. This is compared to global yields near 0% back then. Most of that money was ending up in the central bank, which used it to roll over the government’s dollar debt and continue supporting the peg.

Basically, a large Ponzi scheme was at play. The central bank was paying very high interest to banks and banks to customers by crediting accounts (computer entries) without generating the return on the cash. On the contrary, the central bank was spending the money and relying on new money to finance outflows.

At some point, just before the collapse, there was (very roughly) around US$150bn’s worth of deposits chasing around US$50bn’s worth of real dollars (i.e. around two-thirds of deposits in the system were not backed by real money). The role of the psychology of crowds in averting/precipitating crises is fascinating, and this is a very good case in point: As long as people did not know that a devious scheme was taking place and confidence existed, the scheme could continue. In theory, and assuming continued confidence, it could have continued up to the point where the country’s reserves were depleted.

As long as people did not know that a devious scheme was taking place and confidence existed, the scheme could continue

On 17 October 2019, the WhatsApp communication tax proposed by the government triggered large protests that carried on for weeks. The banks (which were partly a target of the protests, blamed for generating superprofits over the years, and not paying a fair share to the fiscus) closed their branches for a week. Confidence was lost. As they opened again, a run on the banks occurred, particularly from expat-holders of dollar accounts. The banks could not meet that demand. Unofficial capital controls were immediately put in place and the system collapsed.

There was a sudden stop in financial flows into the country. The traditional sources of inflows relied on confidence in the banking sector, and this suddenly crumbled. Lebanon was left with the central bank’s reserves and the small remaining amount private banks held with their correspondent banks to keep going.

As the maturity of the US$1.2bn March 2020 Eurobond came, the choice was between paying creditors or buying more time to keep subsidising basic goods. The country defaulted for the first time since its independence in 1943 and lost the reputation of a flawless track record in debt repayment. And a sovereign default meant a de facto banking sector default.

So, Lebanon ended up with a three-pronged crisis: a balance of payment/currency crisis, a sovereign debt crisis, and a banking crisis.

Could you have stayed until one minute to midnight?

In the months prior to the crisis, I would ask the average financially educated person in Lebanon whether they still held the majority of their savings in a deposit account in Lebanon, and most did. While they understood that the country’s metrics were worryingly grave, they were complacent about the situation, arguing that it had always been the case and that trust in the system would continue no matter what. Until it did not, and this happened overnight.

The study of when an unsustainable credit boom actually becomes unsustainable is relevant subject matter in behavioural finance, but as Gordon Pepper (one of Margaret Thatcher’s advisers) put it amusingly: “When you think you see something that is unsustainable, rationally work out the maximum period you think it can be sustained, then double it and take off a month.” His multiple needs to be adjusted after looking at Lebanon (it was much more than double), but the idea is clear.

I would summarise it as follows: The sustainability of an unsustainable credit situation is dependent on the willingness of a lender to continue to bankroll the borrower, and that, in turn, depends on the belief of the lender that other lenders will continue to do the same – i.e. a belief in others’ beliefs. The timing of the loss of this “aggregate belief”, if I may call it that, is something that is very difficult to foresee.

Looking forward

As bleak as the outcome of this has been on the real economy and therefore on social life, a comforting reality is that the crisis is financial and not real in nature, i.e. it does not involve a loss of physical capital or human lives. This means that the “cost to rebuild” lies in virtual measures that need to be taken to restore confidence and kick-start the economy – and these are not constrained by physical or time limits. But will those responsible release their hold of the state and its institutions?