The volatility of 2025 has underscored the importance of diversification. Global markets have swung from sharp declines to record highs, reminding us that a resilient portfolio requires thoughtful planning and the right tools to weather change. Offshore exposure remains a key lever for long-term growth and stability in an unpredictable world. Horacia Naidoo-McCarthy and Radhesen Naidoo explore the role of offshore investing in building portfolio resilience and outline the available routes to access the investment expertise of our offshore partner, Orbis.

Investors in the FTSE/JSE All Share Index (ALSI) have seen impressive year-to-date returns of 31%, driven largely by a strong rebound in commodity prices as gold and other metals have regained their lustre. However, it is worthwhile remembering that seasons change, and South Africa represents less than 0.5% of global equity markets. Offshore investing continues to offer access to a broader universe of currencies, regions and industries – including high-growth areas like technology, renewable energy and biotechnology. It also provides a buffer against rand volatility and local economic and political risks.

Orbis’ core fund range

Our offshore partner, Orbis – which has the same owner, investment philosophy and approach as Allan Gray – has been patiently cultivating wealth since 1989. With a long-term track record of performance superior to the benchmark, a focus on preserving client capital and a small range of funds suited to different risk profiles, Orbis may serve as an important diversifier in a broader portfolio. The Orbis Global Equity, Orbis SICAV Global Balanced and Orbis SICAV Global Cautious funds form Orbis’ core range and are good examples of offshore funds with differentiated positioning that aim to deliver superior risk-adjusted returns over the long term.

This long-term success reflects an enduring commitment to understanding the fundamentals of businesses and the ability to remain invested through cycles of volatility and change.

Orbis Global Equity Fund

The Orbis Global Equity Fund aims to outperform the MSCI World Index by being fully invested in global equities with growth potential that are overlooked or may have fallen out of favour. The Fund is well suited to investors with an investment horizon of more than five years. Through patience and discipline, it has built an almost 36-year track record by consistently applying a valuation-driven approach and resisting the temptation to chase trends. This long-term success reflects an enduring commitment to understanding the fundamentals of businesses and the ability to remain invested through cycles of volatility and change.

Over the past five years, the Orbis Global Equity Fund has outperformed the World Index, driven by its share selection, which is highly differentiated from the World Index and peers. While the world has been obsessed with artificial intelligence and US exceptionalism, the Fund has uncovered opportunities elsewhere, where the expectations were lower – and the opportunity to add value is therefore higher. It has found opportunities in Japanese and Brazilian stock markets – markets which can be ignored, yet offer rich opportunities for contrarian investors. The Orbis article unpacks the investment case for biotechnology shares, including Alnylam Pharmaceuticals, a company at the forefront of RNA-interference therapeutics.

For investors seeking exposure across a globally diversified range of asset classes, Orbis offers two funds tailored to different risk appetites: the Orbis SICAV Global Balanced Fund and Orbis SICAV Global Cautious Fund, both presenting compelling options – delivering strong absolute returns while actively managing risk.

Orbis SICAV Global Balanced Fund

The Orbis SICAV Global Balanced Fund aims to earn superior risk-adjusted returns to the 60/40 Index by blending global equities (typically 40-75% of the Fund), fixed income and commodities. It offers a well-balanced portfolio – ideal for moderate-risk investors with a medium-term horizon of three to five years. Since its inception in 2013, the Fund has outperformed its benchmark and managed to deliver strong returns while maintaining a lower risk profile.

The Orbis SICAV Global Balanced Fund’s recent performance has been buoyed by its contrarian stance. As a result of changing tides since 2020, the Fund has leaned into areas in which the world has underinvested, such as energy, defence and industrials, as discussed in the Q2 2025 factsheet commentary, available on this page.

As inflation fears linger, the Fund’s gold position has added value for clients, as gold’s role as a borderless, anti-dollar asset has re-emerged, offering both inflation protection and a store of value (covered in our Q2 2025 Quarterly Commentary and episode 28 of The Allan Gray Podcast). The Orbis SICAV Global Balanced Fund’s positioning reflects a deliberate shift away from consensus, rooted in valuation discipline and a global search for resilient, long-term opportunities.

Orbis SICAV Global Cautious Fund

The Orbis SICAV Global Cautious Fund has at its disposal the same tools as the Orbis SICAV Global Balanced Fund, but the key difference is that its exposure to riskier assets will be materially lower through the cycle; it is therefore better suited to more risk-averse investors. The Fund typically maintains a net equity exposure of 0-40%, with a core allocation to fixed income – reflecting its cautious stance and focus on capital preservation. It was launched to South African investors in 2024, but has a longer-term track record – since 2019 – and has delivered returns ahead of its benchmark over all periods.

What are the available channels for offshore investing?

Once you have aligned your goals, risk appetite and time horizon with fund strategy, an intentional step towards long-term growth starts with planting that first seed via the channel of your choice. Investors in our core local funds get access to some offshore exposure; those looking for additional exposure can select from multiple channels.

Offshore investing is essential in building and managing a resilient portfolio. Choosing the right manager – one who can skilfully navigate changing seasons – is key.

There are several factors to consider when making your selection, including whether you prefer to invest in rands or foreign currency. The South African Reserve Bank has rules regarding how much money individuals and companies are allowed to take offshore. These are known as the “offshore allowance” or “foreign exchange limits”. When you invest in foreign currency, you use your individual offshore allowance, and need to obtain a tax clearance certificate from the South African Revenue Service (SARS) for an amount greater than R1 million per year.

The offshore options available through Allan Gray are explained below. Further details and articles are available here.

1. Invest in offshore managers via the Allan Gray Offshore Investment Platform

The Allan Gray Offshore Investment Platform simplifies offshore investing by offering access to a curated list of offshore unit trusts, including those described earlier from Orbis, at lower minimum investments than going directly to the managers themselves. With this option, you will use your own offshore allowance.

The platform allows for investments in foreign currency as well as rands. Allan Gray can facilitate the conversion of your rands to foreign currency if you choose this route. You can monitor and manage your portfolios through our secure Allan Gray Online portal, with dedicated support available through our Client Service Centre.

Of course, you can also go to the individual managers, including Orbis, directly; however, it is worth keeping in mind that investing directly with an offshore manager can be administratively intensive as it introduces a range of operational and regulatory considerations – for example, each region would have its own anti-money-laundering requirements (similar to FICA in South Africa), and you would need to manage tax reporting obligations across borders. In addition, it would be more challenging to have a consolidated view of your global investment holdings compared to investing via a platform. Lastly, as mentioned earlier, offshore fund managers often have higher minimum investment requirements than offshore investment platforms, as platforms can aggregate multiple clients’ underlying assets to allow for lower minimums.

2. Invest offshore via the Allan Gray Offshore Endowment

The Allan Gray Offshore Endowment is a long-term, investment-linked product designed to grow wealth efficiently – especially for investors with a marginal tax rate above 30%. This product has been structured to provide greater flexibility than traditional endowment products and offers access to a range of offshore funds, including the Orbis funds. Other features include estate-planning benefits (continuity and transfer of wealth upon your death) and protection from creditors, depending on how your investment is structured.

With this option, you will use your own offshore allowance, and may make contributions and withdrawals in rands, US dollars, euros or British pounds. There are, however, some restrictions on withdrawals.

As with the Allan Gray Offshore Investment Platform, client servicing is through the local Allan Gray team, and you have access to your investment through our secure Allan Gray Online portal.

3. Invest offshore in rands via rand-denominated offshore funds

You can also access offshore markets through rand-denominated offshore unit trusts, which offer a convenient route to global exposure. Although your investment is priced in rands, your investment performance will be determined by the performance of the underlying offshore assets and the daily currency movements. You do not need to buy foreign currency or get tax clearance from SARS, as you do not use your own offshore allowance – you use the offshore allowance of the unit trust management company in whose funds you invest.

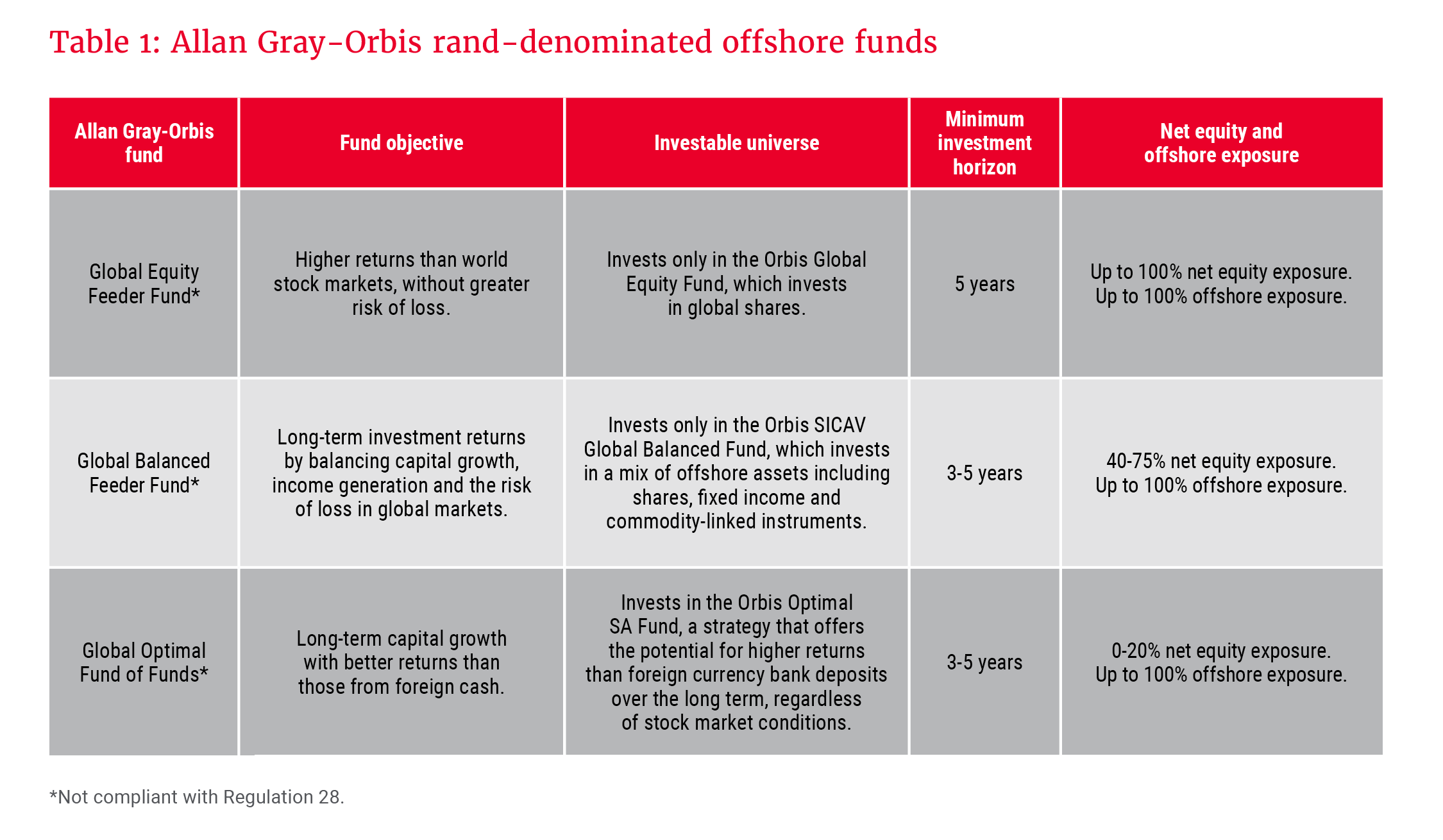

We offer three Allan Gray-Orbis rand-denominated offshore investment strategies, as shown in Table 1. There are different routes to access these strategies, determined by the product you choose: the Allan Gray-Orbis Global Equity Feeder Fund, Allan Gray-Orbis Global Balanced Feeder Fund or Allan Gray-Orbis Global Optimal Fund of Funds.

To broaden access to our rand-denominated offshore strategies, we have also recently launched two new co-named unit trusts in conjunction with another management company, Prescient, to enable investors to access the strategies for discretionary investments via our Local Investment Platform. Because exchange control regulations limit the amount unit trust management companies can invest offshore, rand-denominated unit trusts may need to restrict or close investments from time to time – as has been the case with our feeder funds. Our new co-named unit trusts allow us to use Prescient’s offshore capacity, which, in turn, allows you additional access to the strategies. It also gives us more flexibility to manage offshore capacity across our products.

You can access the Allan Gray-Orbis Global Equity Prescient Feeder Fund and the Allan Gray-Orbis Global Balanced Prescient Feeder Fund, as well as rand-denominated offshore funds from other managers, via our Local Investment Platform.

Focused investment outcomes

While access routes to offshore funds may vary, each with its own advantages and limitations, the overarching investment objective of growing long-term wealth on behalf of our clients remains unchanged. Offshore investing is essential in building and managing a resilient portfolio. Choosing the right manager – one who can skilfully navigate changing seasons – is key. Our diverse offshore solutions are designed to meet the needs of a broad spectrum of investors, and we are continually refining the experience with care and intention.

Explore more insights from our Q3 2025 Quarterly Commentary:

- 2025 Q3 Comments from the Chief Operating Officer by Mahesh Cooper

- How Booking.com changed the way we travel by Thalia Petousis

- Peeling back the layers in Remgro and Reinet by Jonty Fish and Malwande Nkonyane

- Orbis Global Equity: Biotech breakthroughs in a crowded market by Graeme Forster and Mo Zhao

- The ALSI's evolution in a changing economy by Matthew Patterson

- How to safeguard your investments by Twanji Kalula

To view our latest Quarterly Commentary or browse previous editions, click here.