2013 was a good year for global stock markets. The FTSE World Index returned 24.7% in US$ terms since the start of 2013 and is near an all-time high. The Orbis Global Equity Fund has had an even better year, delivering 43.2%. Adam Karr, from our offshore partner Orbis, discusses what this means for Orbis' ability to continue hunting down attractive stocks.

While Orbis and Allan Gray have a single-minded focus on picking stocks from the bottom up, one technique Orbis analysts use to advance their reasoning and to assess the broader opportunity set, is a proprietary quantitative measure that they call 're-rated total rate of return' or 'RTRR'. The calculation is based on the principle that valuation multiples, growth rates and the quality of a company's fundamentals tend to revert to long-term historical averages over time. If the future ends up being similar to the past, this number can be thought of as a crude estimate of the future annualised return that we expect from a given stock. The higher the RTRR percentage, the better. Of course, it is often a big 'if' to assume that the future will resemble the past, which is why we obsess over company-specific, fundamental analysis.

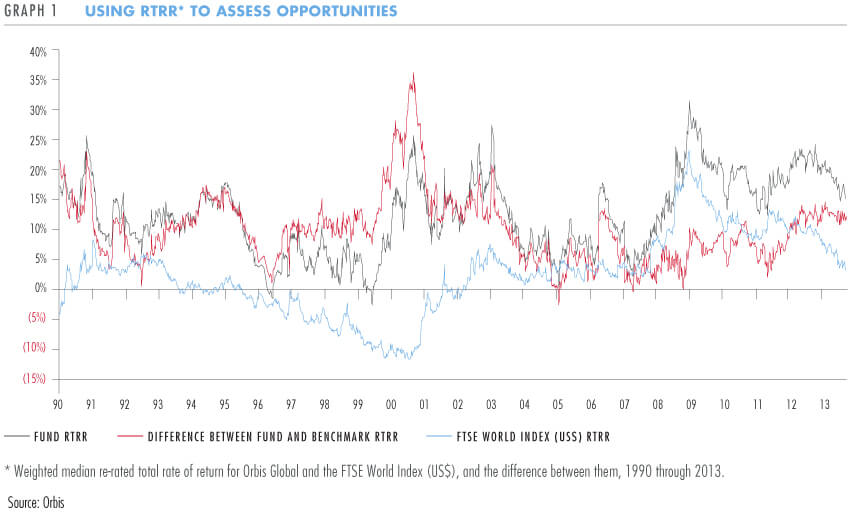

Likewise, the difference between the RTRR of a particular portfolio and the stock market benchmark can be a crude way to gauge the opportunities for stock picking that are available, particularly when there are sizable divergences between the stocks that Orbis has selected and the market's overall RTRR.

"IT IS OFTEN A BIG ‘IF’ TO ASSUME THAT THE FUTURE WILL RESEMBLE THE PAST, WHICH IS WHY WE OBSESS OVER COMPANY-SPECIFIC, FUNDAMENTAL ANALYSIS"

What does the data say about the current environment?

The dark grey line in Graph 1 shows the weighted median RTRR for the stocks in the Orbis Global Equity Fund since its inception, the light blue line shows the same for those in its benchmark, and the red line shows the difference between the two. The higher the red line, the greater the amount by which the Fund is expected to outperform the benchmark, again assuming that future fundamentals are similar to those of the past. Notably, the median RTRR of stocks in the benchmark has hovered near just 5% in recent months. This is the lowest since 2007-08 and suggests only modest stock market returns from today's levels. Of course, that does not mean stocks cannot or will not keep going up. It is not impossible to see negative RTRRs if share prices race far enough ahead of fundamentals, as was the case during the technology bubble of the late 1990s.

What intrigues us as stock pickers, is that the median RTRR of the stocks in Global is currently about 15%. It is a noisy estimate, but it implies that there is still real scope for the Fund to deliver satisfying returns, provided, of course, that our fundamental assessment of Global's stock selections and the broader opportunity set proves to be correct. The key message from the data is that, while lower absolute returns from the benchmark relative to the past few years can probably be expected, we continue to see some compelling opportunities in select stocks.

Investment case for Motorola Solutions

A good example, and one of the Fund's top 10 holdings, is Motorola Solutions (MSI). For most of its life, Motorola Solutions was the industrial division of Motorola Inc., alongside Motorola Mobility, which pioneered the flip phone and later the full-screen RAZR. In January 2011, Motorola Solutions was split from its more cyclical and lower-quality sibling to trade as a separately listed company. For the first time, this empowered MSI management to capitalise the company, structure incentives and run the business based on its unique and more durable industrial characteristics. We believe the spin-off has been, and will continue to be, a powerful catalyst to unlock value for MSI's shareholders.

MSI's crown jewel is its public safety business: it is the world's dominant supplier, with market share in excess of 60%, of mission-critical radio equipment for public safety networks used by police and emergency responders. This business accounts for about two-thirds of the company's revenue and almost 80% of current profits. The remaining third of revenue is from 'rugged' mobile computers and other highly durable devices used by large companies. In this area, which is known as its 'enterprise' business, MSI has a leading 40-45% market share. To measure the quality of a business, Orbis and Allan Gray most often look at the durability and magnitude of its return on capital. And in this respect, MSI shines. It generates an after-tax return on invested capital in excess of 30%, more than three times the average for companies in the S&P 500 Index. These returns are the combined result of MSI's long product cycles, significant intellectual property, high switching costs, sizable recurring revenue, massive installed base and return-focused management team.

A dose of fear is often a key ingredient in the most profitable investments. When MSI spooked investors in mid-2013 by trimming guidance due to product adoption delays in their enterprise business, these delays stoked fears that MSI's enterprise segment was under threat from consumer devices, like the iPhone, and the stock got punished. Where others see a threat, however, we see an enterprise business that is solidly positioned and poised to recover as information technology spending improves. Even if there were a threat, its potential impact is limited: only about 20% of MSI's profits come from enterprise sales and less than 5% from products that can realistically be replaced by consumer smartphones.

"A DOSE OF FEAR IS OFTEN A KEY INGREDIENT IN THE MOST PROFITABLE INVESTMENTS"

As always, we look to buy shares for less than they are worth

In MSI's case, intrinsic value is driven largely by its public safety franchise, which has been an impressive cash generator. The company currently generates adjusted annual free cash flow (FCF) of over US$5 per share, which implies a FCF yield to enterprise value of approximately 8%. This yield compares favourably to the FCF yield of the S&P 500 Index at less than 7% and the 10-year US Treasury yield at 3% per annum. Global is thus able to own an above-average franchise at a discount to the market at a time when shares of many other businesses in the US are more expensive and of lower quality.

At Orbis and Allan Gray we certainly cannot predict the direction of the stock market, but with US shares near all-time highs, we believe it is prudent to expect lower absolute market returns from current levels. Should that prove to be the case, we believe Orbis Global will be well served by owning companies such as MSI that are resilient and well positioned to control their own destiny.