Over the last five years, the median global equity manager has underperformed the MSCI World Index and many value-oriented global equity managers have done even worse. Our offshore partner Orbis’s Global Equity Fund has fared better in the face of these headwinds, prompting the question of how Orbis has managed to do so. Matt Adams from Orbis explains that while many factors have contributed, our shared focus on intrinsic value and the independent nature of our research process have enabled Orbis to remain flexible and resilient at a time when the traditional rules of the game no longer seem to apply.

In his excellent book The Art of Learning, former junior chess prodigy and International Master Josh Waitzkin observed: “The stronger chess player is often the one who is less attached to a dogmatic interpretation of the principles.” While the Orbis investment philosophy is firmly rooted in a set of core principles – taking a long-term perspective, analysing individual companies, focusing on intrinsic value, and demanding a margin of safety – we have never been dogmatic in our interpretation of these principles.

For instance, we are not dogmatic about valuation methods (e.g. discounted cash flow, multiples, replacement value) or levels (e.g. maximum multiple of earnings, minimum dividend yield). Nor are we dogmatic about investment style or factors such as “value” or “growth”. Instead, we recognise that markets are dynamic and discounts to intrinsic value can arise in all types of businesses. While this may frustrate those who want to categorise our investment style, we believe it affords us the agility to uncover opportunities in a variety of market environments. Indeed, we have historically outperformed in both value and growth markets.

One thing we do insist on is a significant discount to our estimate of intrinsic value – defined as the value of a business to a long-term buyer who will own it in its entirety and hold it in perpetuity – but even then we allow our analysts flexibility to use their independent judgement and creativity.

Resilience in the face of change

An important consequence of this less dogmatic approach is greater resilience when the traditional rules of the game appear to break down. In chess, Waitzkin would seek to create chaos by radically deviating from convention. His opponents, who were often schooled strictly in the traditional principles, would struggle amid the chaos. Leveraging an exceptional foundation in the fundamentals, innate creativity, and a less dogmatic interpretation of the way the game was “supposed to be” played, Waitzkin was able to exploit the opportunities created in the disorder.

This reminds us of the current market environment, in which longstanding “rules” have been upended. For instance, there remain trillions of dollars of sovereign bonds with negative nominal yields – something that shouldn’t happen according to conventional economic models. Central banks have printed extraordinary amounts of money, yet inflation in the real economy has been absent until recently. Growth stocks have outperformed value stocks for the longest stretch on record. At the same time, the extraordinary growth of passive funds and the rise of algorithmic traders are impacting the market in ways that are still difficult to understand.

The result is a strange and confusing environment for those who rely exclusively on rigid or formulaic interpretations of what worked in the past. But amid the confusion, we believe compelling investment opportunities remain for those who think differently and aren’t afraid to look in less obvious places.

Finding compelling opportunities

The US market is a good example. By any traditional valuation measures, the US market looks expensive. Yet the Orbis Global Equity Fund (“the Fund”) has retained meaningful exposure to the US market in recent years, and our stock selections there have added significant value. We have done this by being highly selective, taking a longer-term view than most, and by focusing on company-specific circumstances that others have overlooked or misunderstood.

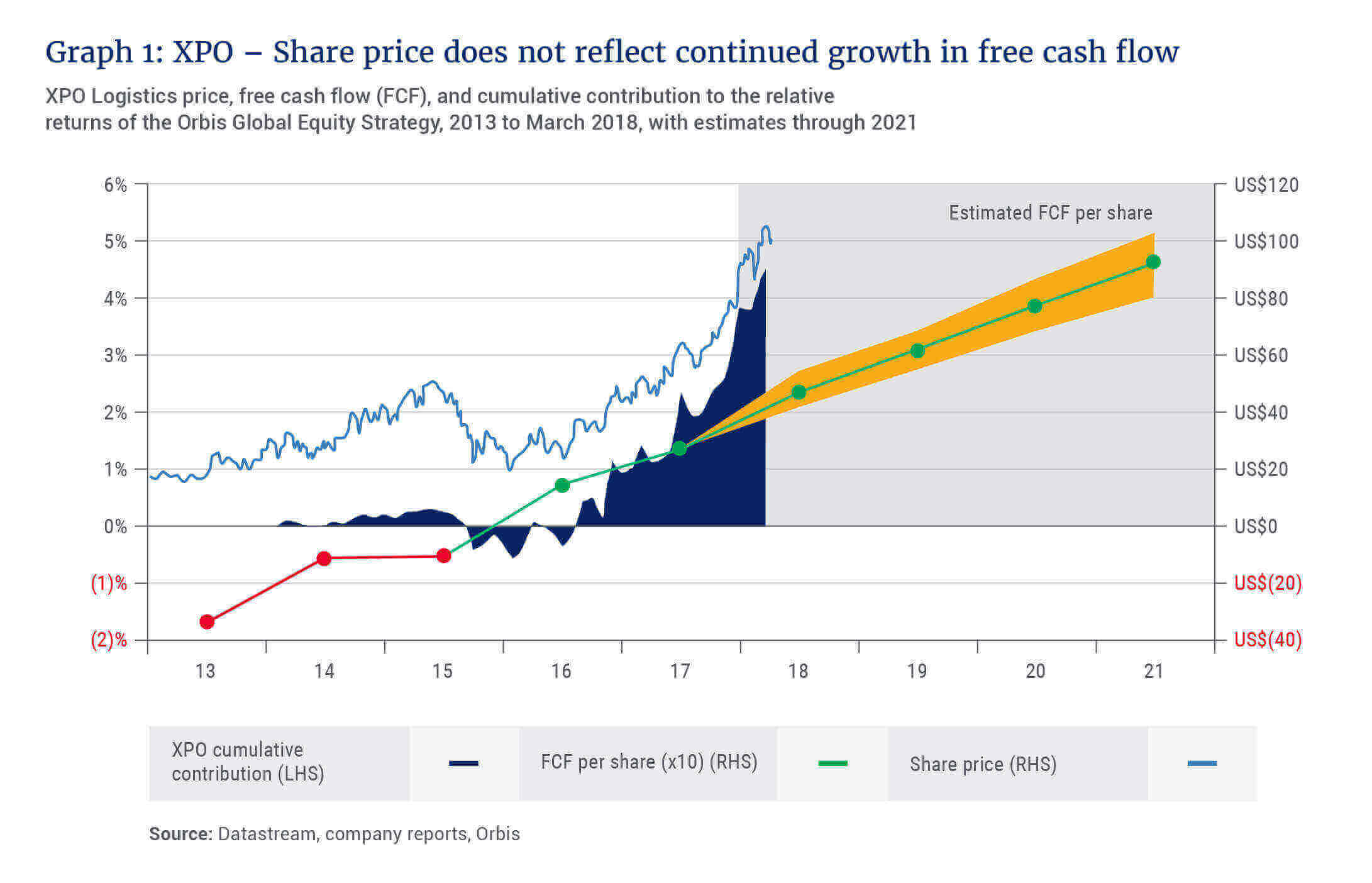

XPO Logistics, currently the largest holding, is a good illustration. It has been the largest contributor to the Fund’s performance over the past 12 months and is among its top ten contributors since inception in 1990. Today, at US$102 per share, XPO’s price has more than quadrupled since our initial purchase in 2013.

But it was hardly an obvious opportunity at the time. The company had negative tangible book value, negative earnings before interest, tax, depreciation, and amortisation (EBITDA), negative cash from operations, and negative free cash flow (FCF). Through our fundamental research, however, we developed deep conviction in management’s ability to create significant long-term value for shareholders through the company’s aggressive acquisition strategy in the transportation and logistics industry. And by taking a longer-term perspective than others, and developing insight into management’s skill, alignment and integrity, we were able to recognise the long-term potential of the investment.

In fact, the opportunity wasn’t even obvious to us at the time. Many of our analysts vocally challenged the thesis and argued that we should sell the position. It is probably fair to say that a firm with a consensus-based system would probably not have owned XPO. Similarly, those with more dogmatic approaches to valuation or style would also likely have avoided the stock. And it would have been hard for many to stick with the position during the uncomfortable period when it wasn’t adding value in the short term.

we believe compelling investment opportunities remain for those who think differently and aren’t afraid to look in less obvious places.

As Graph 1 shows, performance doesn’t come in a straight line, and that’s why a long-term perspective is so critical. Fortunately for clients, our process and culture embrace individual decision-making and accountability, and we empower stock-pickers to express unpopular views and to stick with them in the moments of greatest opportunity.

What is particularly exciting to us in this instance is that, despite such strong performance over the past several years, we believe that XPO continues to present an attractive long-term investment opportunity. Through strategic vision, savvy capital allocation, and strong execution, chief executive Brad Jacobs and his team have built XPO into a global logistics leader with highly differentiated technology and capabilities in the area of contract logistics.

In particular, the opportunity to provide logistics services to e-commerce customers, which now comprise nearly a third of XPO’s revenue, is driving approximately 10% per annum organic revenue growth for XPO. In turn, this is likely to fuel mid-teens growth in EBITDA and 20-30% growth in FCF as the company is able to leverage its fixed infrastructure and drive efficiencies. With the stock currently trading at about a 4% FCF yield on 2018 estimates, we see good potential for an annualised return of 25% or more over the next several years.

Importantly, this enthusiastic outlook for XPO’s prospects does not give any credit for management’s ability to create incremental value through additional acquisitions – something management is actively pursuing. With an exceptional track record in this regard, highly aligned interests, and a tiny 1.5% share of the trillion dollar global logistics market, XPO offers exciting long-term prospects for continued highly accretive capital deployment.

Some traditional “value” stocks warrant attention

This is not to suggest, however, that we haven’t found any traditional “value” stocks. An example here would be AbbVie, one of the world’s largest biopharmaceutical companies. AbbVie derives more than 60% of its revenue from its blockbuster drug Humira, which treats several autoimmune diseases. Despite robust growth, the market is sceptical that AbbVie’s earnings are sustainable given the perceived threat of biosimilars to Humira and doubts about the company’s drug pipeline. Consequently, the market is pricing AbbVie at a bargain 12 times our estimate of 2018 earnings and a 4% indicated dividend yield.

In contrast to the market’s cautious view, we’ve developed conviction through our fundamental research that not only are biosimilars less of a threat to Humira than is perceived, but AbbVie’s drug pipeline is also underappreciated. While not every pipeline drug will succeed, we see good potential for AbbVie’s collective portfolio of future drugs to drive sustained earnings and revenue growth over the long term. And due to the uncorrelated nature of these factors with the overall economy, we see an attractive return profile for AbbVie under a wide range of scenarios.

We don’t always get it right

Of course, we are not always right in our assessments. Consider Arconic, a leading manufacturer of highly engineered, lightweight metal products for the global aerospace industry. The company has struggled over the past year in the face of a distracting proxy contest, management turnover, and significant operational challenges as the company works to meet aggressive production schedules for an unprecedented number of new aircraft engines. Unsurprisingly, Arconic shares have underperformed the World Index by more than 20% over the past year, and the position was a top detractor for the Fund over that period. Despite these challenges, we remain positive on the company’s prospects and have added to the position substantially as the discount to our assessment of intrinsic value has widened.

We continue to believe that Arconic is a company with excellent assets, strong customer relationships, and great potential that has suffered primarily from poor governance and poor management. Fortunately, both have been dramatically improved in the past year, including a new chairman, a new CEO, and a substantially reconstituted board that we believe is much more aligned with shareholders. While the company’s shares are not an obvious bargain at 19 times 2017 earnings, we see substantial opportunity for idiosyncratic improvements over the next several years as past investments yield results and new management works to improve operations. Looking forward a few years, we believe Arconic can earn between US$2.50 and US$3.00 per share. If we are right, the current share price of US$23 will prove to be a bargain.

Well-positioned overall

These stocks – XPO, AbbVie and Arconic – are examples of how our investment approach, grounded in core principles but undogmatic in their interpretation, has enabled us to find compelling opportunities amid a challenging environment. Not all of these will perform equally well, but we are confident that your capital is well-positioned overall to avoid permanent loss – and our investment team stands ready for any new challenges that the market throws at us in the future.