Matthew Spencer, from our Offshore partner Orbis, explains what has driven Orbis’ recent performance, while also sharing some research about performance trends across global active managers. He discusses how Orbis has reacted, and why they are excited about the current positioning of their Global Equity Strategy.

Occasional periods of underperformance are an expected, but painful, aspect of long-term investing. That’s not just true of Orbis. Our research into the industry indicates that most skilled active managers experience extended periods of underperformance.

Good active managers underperform

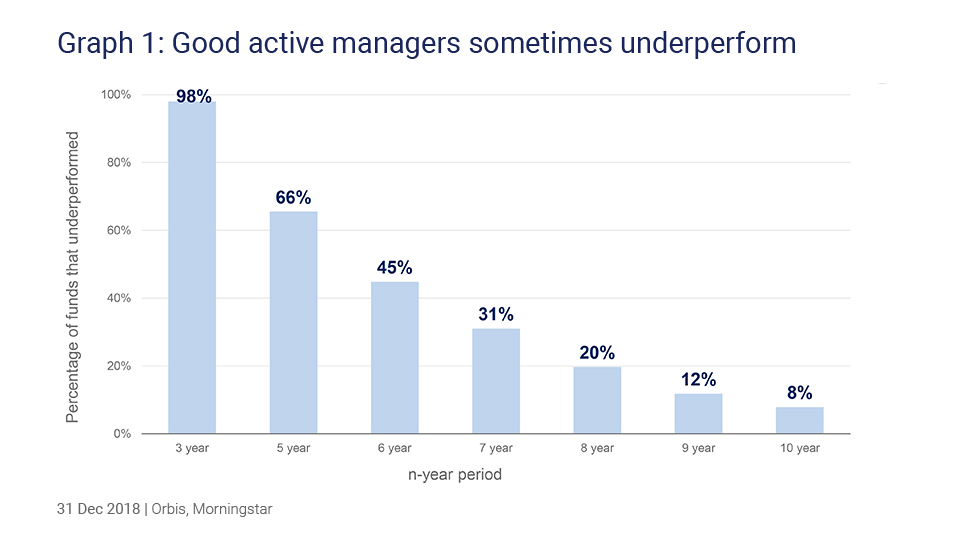

There are about 7 500 equity funds in the Morningstar database that have at least a 15-year + track record. Within that group there are about 200 “skilled” funds – which we define as funds that have delivered more than 3% net alpha over the 15-year period.

When you look at the experience investors have had with these skilled funds, what you find is quite surprising: 98% of them have a three-year period where they have underperformed, as shown in Graph 1. Meanwhile, two-thirds of them have a five-year period where they underperformed. This suggests that investors need a high level of skill to identify the small proportion of skilled managers, and a good degree of patience to weather the inevitable periods of underperformance.

Orbis is in one of those periods now. Over the past 12 months (to end April) the Orbis Global Equity Fund (the Fund) returned -7.9% compared to +5.7% for the FTSE World Index. This 12-month result has dragged down the three- and five-year track records. While this is disappointing, it might provide you a little comfort to know that Orbis has been through these scenarios many times before. The good news is that there is a silver lining to this underperformance cloud: History reveals that the Fund has outperformed quite handsomely after most down periods. Because past performance is not an indicator of the future, it’s important that we understand the current period of underperformance and assess whether this drawdown is in the ordinary course of business or something to be more concerned about.

Questions to get to the bottom of performance issues

There are two questions that come up frequently as clients want to understand performance:

- Have we been hurt by an anomaly like a big currency impairment or overexposure to a particular market?

- Have we sold the underperforming stocks?

Quite simply our underperformance has been overwhelmingly driven by our stock picking. Over the long term, about four of every ten stocks we pick are losers, and we have had our share of mistakes in this recent period. But for the most part, we still have conviction in the stocks that have underperformed – and in many instances we have added to these positions. The problem has been our lack of winners.

Our top-5 winners normally contribute 7.5% to our outperformance, while the top-5 losers normally detract 5%. In the last year, the big losers have detracted somewhat more than usual, while the contribution from the big winners is way below the normal level. A perfect storm.

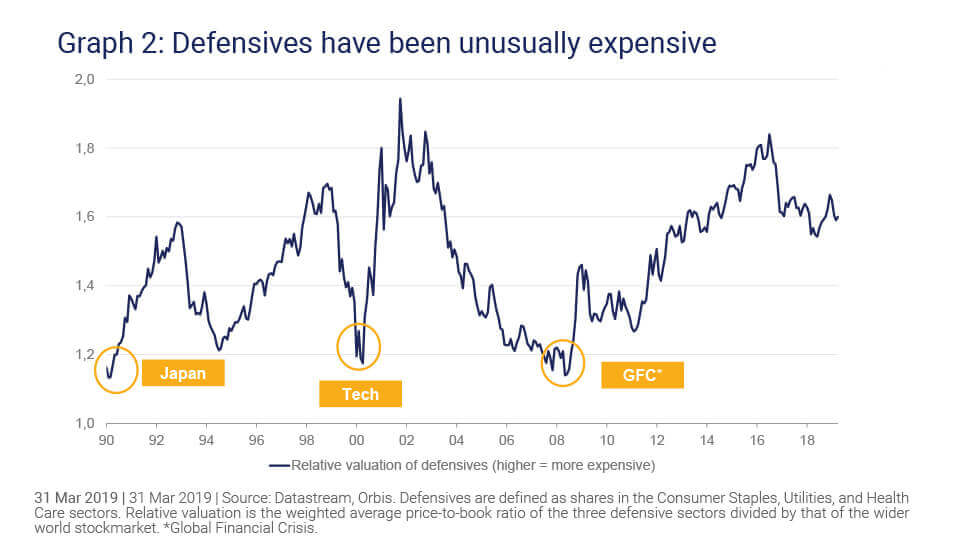

Blaming the winners for underperformance is the same as saying that there were parts of the market that we didn’t own that did really well: We do not hold much in the classically defensive parts of the market – things like consumer staples, utilities and REITS, and we have been very underweight the momentum shares that have led the market.

Defending our stance

Graph 2 looks at the valuation of defensives relative to the overall market on price-to-book ratio. You can see that the defensives were cheap at the three previous market peaks. You can also see the defensives have broken their historical pattern and become more expensive in the current bull market, probably driven by investors trying to improve on the low yields they get in bonds. While the defensives had started to underperform as the market started to anticipate higher interest rates, this reversed at the start of 2018, when volatility returned to markets after a serene 2017. Valuations have increased over the year taking the defensives back into expensive territory today.

As a contrarian value oriented investor we normally find that the high momentum shares become expensive as investors get ever more excited about their prospects. They are unusually expensive today, in our view, and history reflects that this is usually followed by a correction.

So while our underweight positions have hurt us over the past year, valuations of these stocks have reached levels where we believe these stocks are likely to help rather than harm our relative performance in the future.

Losers offer opportunity

On top of our deficiency of winners, we had losers too, which is fairly typical of any 12-month period. There were two stocks, software company Symantec and utility PG&E which we sold over the period, and impaired our clients' capital, and were discussed in the December 2018 commentaries.

While losers can be painful, they do provide us with the opportunity to buy even more stock at a much lower price. We have taken full advantage of this recently, adding around 6.5% of NAV into our big underperformers. We added about 5% of NAV into Chinese technology companies NetEase and Naspers as their prices fell. Together these stocks represent 12% of the Fund, a large position reflecting our confidence in the quality of these businesses and the exceptionally attractive prices that others are willing to sell them at. We also added about 0.5% of NAV to XPO Logistics (discussed in more detail below) and about 5% of NAV to AbbVie and Celgene – specialty pharmaceutical companies that were out of favour during 2018.

Portfolio scorecard

When assessing how we feel about the Fund’s positioning, we consider the price we are paying for the earnings, assets and growth of the companies in the portfolio and compare these to the benchmark. We also look at what we don’t own and question how we feel about this.

Next we drill down a little deeper into what we do own. Because we use a bottom-up approach, selecting each company on its own merits, from time to time we may get some areas of concentration. We need to asses if we are okay with this. This process also allows us to remind ourselves what we are excited about.

What follows is a brief summary of the investment case of two positions that we believe will add value to the Fund over time.

The investment case for XPO

XPO, one of the world’s largest transportation and logistics providers which we have owned for six years, was responsible for a large chunk of the underperformance over the period. But we have high regard for this company and feel the market is not recognising its potential.

We first stumbled across XPO in 2012 when we were researching one of its competitors. The man behind the company, Brad Jacobs, intrigued us. Mr Jacobs has a proven track record of unlocking value for shareholders, having consolidated the waste management industry in the late 90s, and the equipment rental industry in the 2000s. So when he spent ~US$400 million of his own money buying a defunct transport logistics business in XPO our interest was piqued.

We dipped our toe in towards the end of 2013 when XPO was trading at US$22/share, and by the middle of 2015 the stock had doubled. However, when XPO bought Conway trucking, one of the largest less-than-truck load transport providers in the US, and Norbert, one of the largest truck fleets in Europe, the share price collapsed. Investors were concerned that Mr Jacobs was moving from an asset-light business in contract logistics towards a capital-intensive business in owning the trucks where returns are historically lower. Secondly, investors felt XPO extending its sphere of influence beyond North America to Europe was dangerous.

However, our engagements with management assured us that if XPO were going to fulfill this vision of a logistics one-stop-shop, then owning trucks would be necessary and the cross-Atlantic opportunities were also very compelling, so we used the share price weakness to buy significantly more shares, quadrupling our position. By the end of 2016 the stock was back at about US$50/share. We trimmed on the margin and we kept the bulk of the position, but our thesis had evolved.

One area which excited us was the secular trend of growing e-commerce and the shift to outsourcing. These are two huge tailwinds which we believe will benefit XPO, which is offering to take care of logistics for manufacturers across industries.

However, a series of unfortunate events saw XPO’s shares fall from a high of about US$115/share all the way down to US$41/share. In October 2018 XPO reported an earnings miss largely due to the bankruptcy of a customer. A second downward tick came on 12 December, when XPO revised its free cash flow and profit guidance downwards for 2019. This bad news was made worse by the poor way they handled the disclosure. The stock fell by 10%.

This was the perfect time for the short sellers to press – and they did. One opportunistic short seller launched a sensational 70-page report essentially discrediting management, and accusing the company of using accounting practices which were not in line with Generally Accepted Accounting Principles (GAAP), and which significantly overstated earnings and cashflow. There was general panic and the stock tumbled another 26%.

We focused on working through the allegations in the report with XPO management and found the report to be largely without merit and riddled with arithmetic and calculation errors and stale criticisms. So considering that nothing had changed our view on management or the intrinsic value of the business, we used this as an opportunity to materially buy more shares. XPO also took advantage of the situation and has repurchased 29% of its shares since last November.

Looking at the stock today, it trades at an 8% free cash flow yield and just over 7 times 2018 EBITDA and 1.6 times book value. Putting this in perspective, we are getting XPO at about a 40% discount to the S&P 500, yet we get what we regard as a world-class business playing in a US$1 trillion industry which is growing. XPO is well positioned considering it owns scarce supply chain assets, earns high incremental returns on capital and is a prime beneficiary of the secular boom in e-commerce. Using conservative assumptions we see the intrinsic value of the business to be worth significantly more than the current share price.

In the words of our founder Mr Allan Gray, “A temporarily adverse environment for a good company can create a great long-term buying opportunity.”

The investment case for Autohome

One aspect of the portfolio we are excited about is our holdings in Chinese tech companies, specifically Autohome.

Autohome is like China’s version of Autotrader but instead of dealing with used cars it deals with new cars and it is almost certainly the first place you would go to if you were looking to buy a new car in China. Autohome is also a win for the dealerships, who, after paying a fixed subscription fee to list their inventory, generate many of their leads from this site, and for auto manufacturers, who have a captive audience to advertise to. About 30 million new cars were sold in China last year, of which one-third were generated from sales leads from Autohome.

Autohome and Autotrader make similar profits, but what is very different is their profit margins. Autotrader’s profit margin is almost double that of Autohome. Understanding why this is, hints at opportunity:

Autohome generates US$1 billion in revenue, and generates about 10 million successful leads per year. Car companies essentially pay Autohome US$100 per successful lead, which is strikingly good value considering the marginal profit for each car sold is about US$5 000. So why only US$100?

The game — as demonstrated by Google, Facebook and Amazon — is to establish dominance first, build the perfect mousetrap and once you have a captive audience, the upside is limitless. Considering the market size, the opportunity in China is, in our view, extraordinary.

Another long-term attraction is the immature second hand car market in China. Autohome has all the data and details of the individuals who are buying new cars today. They will be the second hand car sellers in a few years. Autohome is focusing on building a platform where they can leverage off this superior intelligence in the future. In addition, Autohome is 51% owned by Ping An insurance company and is currently exploring the best way to offer insurance and financing to these car buyers.

Of course, the future is unknowable. To assess the downside risk, we note that the company has US$1.5 billion of net cash and is forecast to earn another US$1.3 billion in free cash flows over the course of 2019 and 2020. That amounts to US$2.8 billion of hard value. Even if things subsequently go wrong for Autohome and its enterprise value slumps to just two times revenue, that would still imply US$5 billion of total value, capping the downside at 50-60%.

On the flip side, if Autohome can continue to generate the powerful combination of cash flow and growth that we expect over our investment horizon, the upside could be enormous.

With the Chinese auto market experiencing such tough times, the one thing that can be guaranteed is that Autohome will provide a bumpy ride. But without that near-term uncertainty, we wouldn’t have had an opportunity to build a position in such a promising long-term franchise at such attractive prices.