Each year we listen with bated breath to the Minister of Finance’s annual Budget speech to learn whether tax rates will increase and breathe a sigh of relief when no noticeable tax hikes are announced. But beyond the Budget headlines lurks a silent tax. Ahead of the 2026 Budget, Carla Rossouw brings bracket creep into focus, helping us to prepare for what may come.

In recent years, low economic growth has made spending cuts and legislated tax increases unfeasible. Instead, the Minister of Finance has opted to raise additional revenue by making little to no adjustments to the personal income tax brackets, leading to what is termed “bracket creep”. Bracket creep is a deliberate yet simple measure for National Treasury to collect more revenue in a way that is uncontested and largely unnoticed by most taxpayers.

Stagnant tax tables may appear to be a reason to celebrate, but in fact have an impact on the average South African taxpayer’s take-home pay – especially when this persists over several years. While bracket creep is not new, the compounding effect over several years is significant.

Understanding bracket creep

Salaried taxpayers expect to move into a higher tax bracket when they are promoted and, as a result, receive a notable salary increase and/or performance bonus. However, for many, the shift into a higher tax bracket may be incidental.

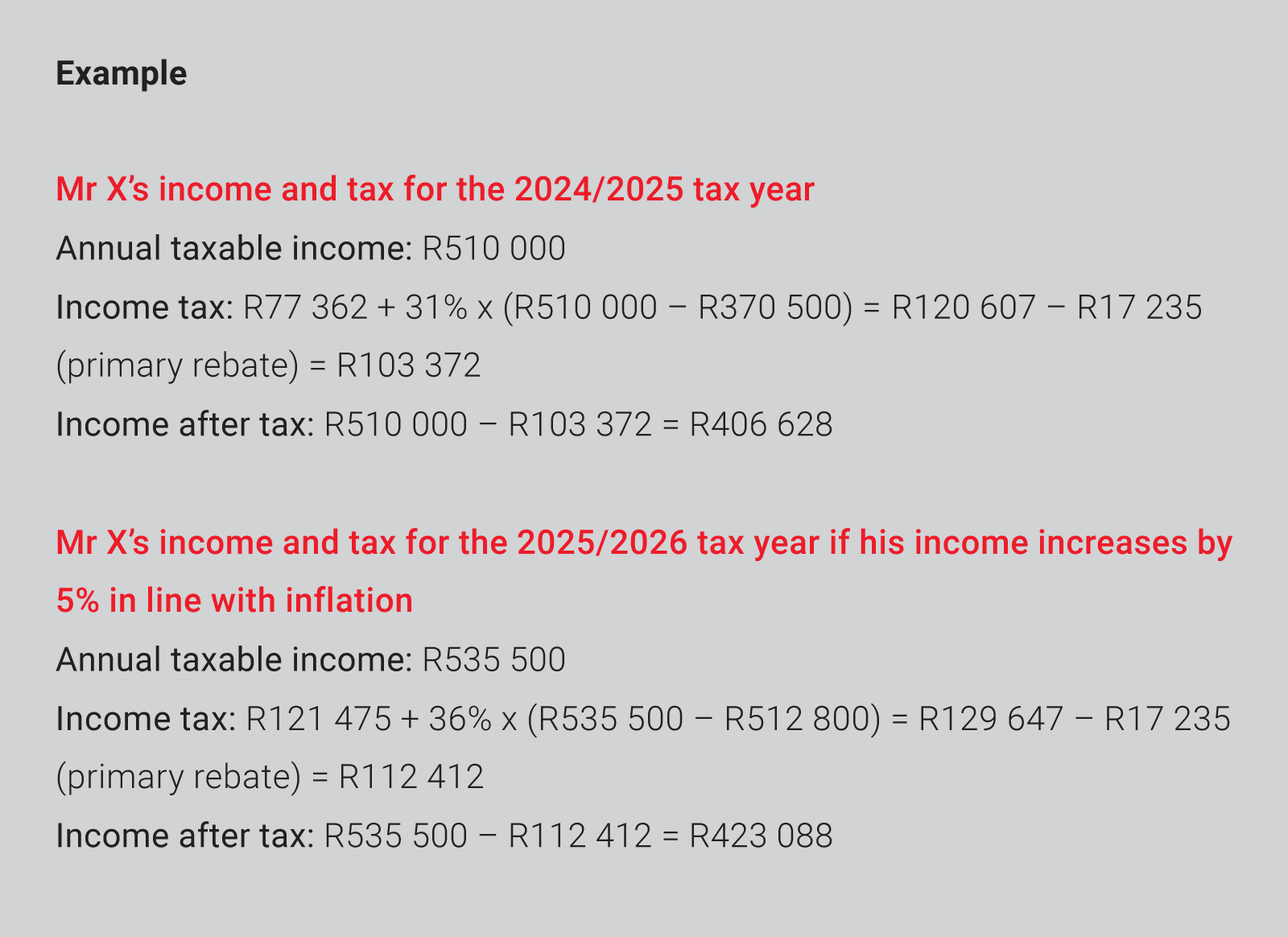

Salaries are often designed to keep up with inflation so that purchasing power (the goods and services you can afford with a given amount of income) remains the same over time. But if your salary increases as a result of an annual inflationary adjustment and there is no change in the tax brackets, you may be pushed into the next tax bracket and come out poorer. This is because a greater portion of your increase will be swallowed by tax. The end result is that your salary increase does not translate into a genuine uplift in your purchasing power, as shown in the example below.

Although Mr X’s income increased by 5%, his after-tax income only increased by 4.05%. This equates to a monthly reduction in purchasing power of around R335 compared to what he could have received had the tax brackets been adjusted. When tax rebates (amounts that reduce the overall tax liability for individual taxpayers) are also not adjusted to account for inflation, this could result in a double whammy.

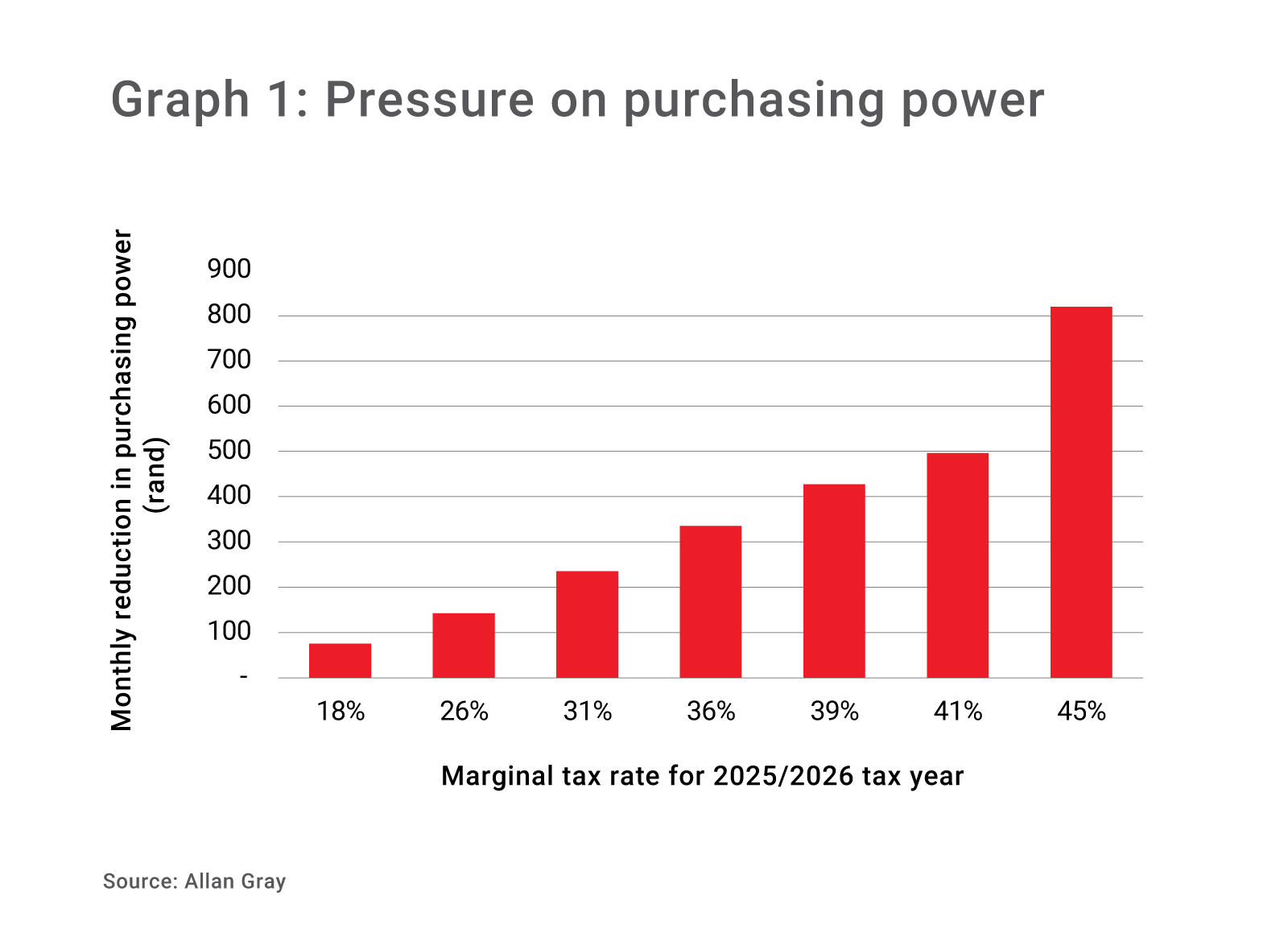

Graph 1 illustrates the monthly reduction in purchasing power (y-axis) as determined by your tax bracket (x-axis).

Impact on the vulnerable

South Africa has a progressive tax system, meaning that your tax rate increases as your taxable income or wealth increases. The system is premised on the “ability-to-pay” principle, i.e. those with greater resources should contribute more to public services and infrastructure. However, the unfortunate reality is that the most profound impact of bracket creep is experienced by 1) low- to middle-income taxpayers given that they are more likely to be pushed into a higher tax bracket, and 2) those who previously earned just under the tax threshold (the amount above which you become liable to pay income tax) and have never paid Pay As You Earn (PAYE).

Bracket creep not only raises revenue from existing taxpayers but also widens the tax net, with more people shifted over the monetary threshold when PAYE becomes due and payable.

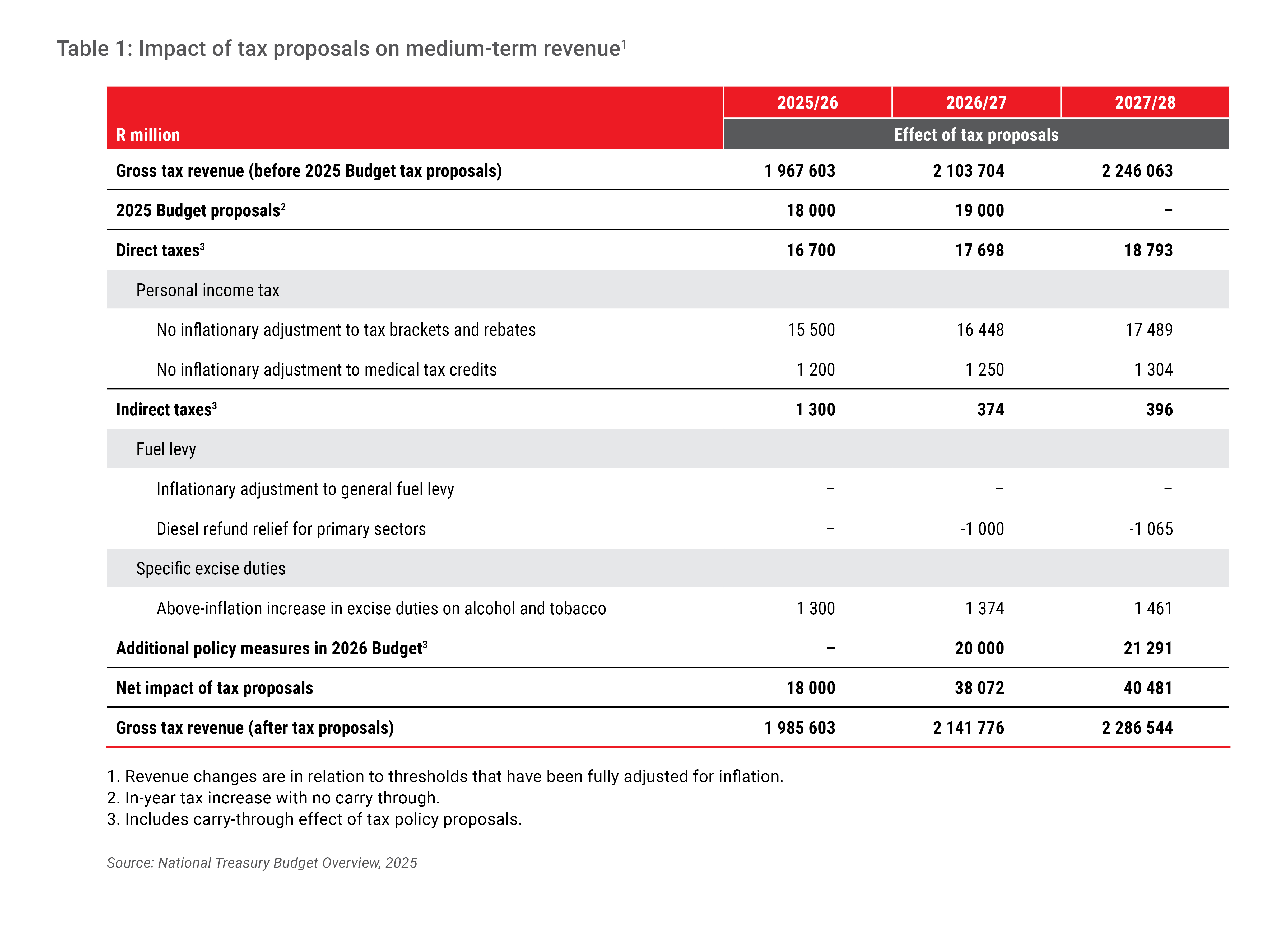

While the 2025 Medium-Term Budget Policy Statement presented a better fiscal outlook (due to higher tax revenue, reduced spending in certain areas and lower debt-servicing costs), gross revenue is projected to fall short of 2025 Budget estimates by R15.7bn in 2026/2027 and 2027/2028. To make up for this shortfall, for the third consecutive year, it is projected that individual income tax tables may not be adjusted, placing greater pressure on households.

The projected additional revenue collection from bracket creep is significant: R16.4bn for the 2026/2027 tax year and R17.5bn for 2027/2028, as shown in Table 1.

How to ease the impact of bracket creep

In the absence of a systemic solution, such as annual indexation – a process of automatically adjusting tax brackets to account for the annual rise in the cost of living – there are practical steps that one can take to lessen the impact of bracket creep:

- Don’t be caught off-guard. Understanding the impact of bracket creep and how it affects your after-tax income is the first step towards finding an appropriate solution.

- Adjust your financial plans. You can reduce your taxable income (while growing your wealth) by maximising contributions to tax-efficient investment vehicles, such as retirement funds. Contributions to tax-free investment accounts – while made with your after-tax income – allow you to benefit from tax savings on your investment return.

- Be mindful when negotiating salary increases. Annual adjustments that beat both inflation and the effects of bracket creep assist in retaining real purchasing power.

It is important not to let unexpected tax increases impact your financial goals. Consider consulting an independent financial adviser (IFA). An IFA can assist you in adapting your personal budget to accommodate the changes and devise tailored tax and investment strategies to help mitigate bracket creep’s impact over time.