South Africans who live and work abroad are not currently subject to income tax on the income they earn outside of South Africa, provided they spend more than 183 full days (including a continuous period of more than 60 full days) working outside of the country in any 12-month period. A proposed legislative amendment, set to come into effect on 1 March 2020, states that South African tax residents living and working abroad will be required to pay tax of up to 45% on their foreign employment income, if they earn more than R1 million during the year of assessment. But the government intends to offer tax relief in SA where the person’s income has already been taxed in a foreign jurisdiction.

There is a lot of confusion around tax residency and citizenship and how the proposed changes will affect different individuals. Sunèl Delport and Mlulami Nxele tackle some of the questions around these topics.

1. How do you determine your tax residency?

Tax residency is important because it determines where you have to pay tax and how much tax you need to pay. However, the concept of tax residency is complex and is often confused with terms like residence and citizenship. Countries use different rules or tests to determine when a person is considered a tax resident. As a result, you may qualify as a tax resident in more than one country and therefore be subject to tax in more than one country.

Let’s consider an example.

Maria, a qualified nurse who was born in Queenstown, decided to leave SA to pursue better salary prospects in Malta. She has signed a 10-year contract with a hospital in Valetta. She has her own apartment in Queenstown which she is renting out while she is away. The hospital where she works provides subsidised housing for staff. She eventually wants to retire in SA. After spending four years in Malta, she goes home for a long weekend and finds multiple letters from the South African Revenue Service (SARS), requesting that she complete her outstanding tax returns and pay an administrative penalty for the outstanding returns.

Maria decides to submit her returns via eFiling and one of the first questions she needs to complete asks whether or not she is a tax resident in SA. She decides to speak to a tax consultant and below are some of the questions and topics they discuss.

Am I a South African tax resident?

You are a tax resident in SA if either of the following applies to you:

- You are “ordinarily resident” in SA; or

- Provided you are not ordinarily resident in SA in a specific tax year, you have been inside SA for more than 91 days in that tax year, and each of the five preceding tax years, as well as for a total of more than 915 days in those preceding five years. This is referred to as the “physical presence” test.

What does it mean to be “ordinarily resident” in SA?

According to case law, you are ordinarily resident in SA if it is the country which you will, naturally and as a matter of course, return to after your wanderings. In other words, it is your real home. You could remain ordinarily resident for tax purposes in SA even if you leave the country for a substantial period, as long as you intend to eventually return to SA after your travels.

Your intention is a subjective matter and if you claim to be ordinarily resident in a country, all your surrounding actions and circumstances must support this claim. Factors that will be evaluated include:

- Your place of business and personal interests

- Your most fixed and settled place of residence

- Family and social relationships, schools, places of worship, social clubs

- Your habitual abode, i.e. the place where you stay most often, measured over time

How do I find out if I am a tax resident in a foreign country that I currently live in?

The Organisation for Economic Co-operation and Development (OECD) has a website where most countries have set out their own tests for tax residency relating to individuals and legal entities. You can access these here. Click on the country that you are living in to see the criteria for tax residency in that country.

Malta’s domestic legislation states that you are generally a tax resident if you spend more than 183 days in a tax year there, with an intention to establish residence. Maria is therefore a tax resident in Malta as well as SA.

I am a tax resident in more than one country – what now?

While it is possible for you to be a tax resident in more than one country, you can only be ordinarily resident for tax purposes in one country at a time.

A double taxation agreement (DTA) is an agreement or a contract entered into between two tax jurisdictions to avoid double taxation of the same amount earned by the same person. A DTA will help you determine in which (one) country you are ultimately a tax resident, and it sets out the rules about which country is allowed to tax particular income, and which country must provide tax relief for the tax already paid in the other country.

Since she is a tax resident in more than one country, Maria’s first step is to find out whether SA has a DTA with Malta. SARS maintains a list of all the DTAs that they have concluded with other countries. You can access these DTAs here. Click on “Double Taxation Agreements and Protocols” and then click on either “DTAs and Protocols (Africa)” or “DTAs and Protocols (Rest of the World)”.

Tax residency table tennis: going to a tie-breaker

Once you have determined that you are a tax resident in both countries and established that there is a DTA in place between the two, the DTA tie-breaker rules come into play. These rules will determine your “true” country of tax residence, i.e. the country in which you are ultimately a resident for tax purposes. The questions follow the sequence described below. You continue with the questions until only one country remains.

In the case of the Malta/SA DTA, the following tie-breaker rules apply:

- In which country is your permanent residence?

- In which country are your personal and economic relations closer?

- Where is your habitual abode?

- Of which country are you a national?

Based on the tie-breaker rules, Maria is a South African tax resident, which means that her salary income is taxable in SA and, if the current proposals come into operation, her South African tax liability could potentially be reduced by the tax that she has already paid in Malta.

When do you stop being a South African tax resident?

- You stop being a South African tax resident when you are no longer ordinarily resident in SA nor a resident according to the physical presence test.

- You are no longer ordinarily resident in SA when you state that you want to become ordinarily resident in another country and you take steps that confirm your stated intention.

- You cease being a resident by virtue of physical presence if you leave SA and stay physically outside of the country for a continuous period of at least 330 full days.

Consider the tax cost associated with becoming a non-tax resident

It is very important to note that when your South African tax residency ends, it does not necessarily mean that you no longer have South African tax obligations. You are still required to complete a South African tax return for any South African source income that you receive.

Since the 2018 tax year, there is a question in the personal income tax return that specifically asks whether you have “ceased to be a resident of SA during this year of assessment”. If you have, the Income Tax Act deems you to have sold all your assets (excluding South African fixed property and shares in South African companies that are property rich), resulting in a capital gains tax liability. This is sometimes called an “exit charge”.

From the point at which you become a non-tax resident in SA, you will only be subject to South African income tax on your South African source income, not on any income earned in another country.

2. Exchange control residency

Exchange control (Excon) regulations determine the flow of money in and out of SA. This means that these regulations govern how much money you may take out of the country and under what circumstances you may take it out.

The regulations apply to the following individuals:

- Resident: A person who has taken up permanent residence in SA.

- Resident temporarily abroad: A resident who has departed from SA to a country outside the Common Monetary Area (South Africa, Namibia, Lesotho, Eswatini), with no intention of taking up permanent residence in another country. This excludes residents who are abroad on holiday or business travel. In our example, Maria is a resident temporarily abroad while she lives and works in Valetta.

- Emigrant: A South African resident who is leaving or has left SA to take up permanent residence in a country outside the Common Monetary Area.

The South African Reserve Bank (SARB) grants all South African residents and emigrants an allowance of R1 million per calendar year, namely the single discretionary allowance, to use for any legal purpose offshore. If you want to take more than R1 million out of SA, you can apply for a tax clearance certificate from SARS to allow you to take up to an additional R10 million offshore. This is called the foreign investment allowance.

Emigrant vs. resident temporarily abroad

As a South African resident, you need approval from the SARB to emigrate from South Africa for Excon purposes (and become an emigrant). This process is often referred to as “formal emigration” and more recently as “financial emigration”. The two terms are used interchangeably to refer to the same Excon emigration process.

If you leave the country without SARB approval you are considered a “resident temporarily abroad”. This would be your status even if you consider yourself permanently resident in the new country. Maria is a resident temporarily abroad and would have to apply to the SARB if she wanted to formally emigrate.

The difference in terms of your investments is that you can only withdraw from your South African retirement annuity if you formally emigrate. From 1 March 2019, you can also withdraw from your South African preservation fund if you formally emigrate, even if you previously made a partial withdrawal from the investment. Maria, therefore, is not currently able to withdraw her retirement savings.

Formal/financial emigration vs. tax residency

There is a difference between emigrating from SA for Excon purposes (formal/financial emigration) and no longer being regarded a tax resident in SA. An emigrant may still be a South African tax resident according to the tax residency rules or tests. Formal/financial emigration could be one of the factors that support your claim for ceasing to be ordinarily resident in SA for tax purposes, because the declaration you make as an emigrant states that you permanently relinquish residency of SA to take up permanent residence elsewhere.

You can also be a resident temporarily abroad regardless of whether or not you are a South African tax resident. Your Excon status therefore has no direct bearing on your tax residency.

3. Citizenship

A citizen is a legally recognised national of a state or commonwealth. In SA, you can be afforded citizenship in three ways: By birth, through descent or naturalisation. A country grants certain rights and obligations to its citizens: Citizens can vote, access a country’s social services and live and work in the country without the need for a permit or visa.

You can be a citizen of SA with or without being a South African tax resident and/or South African resident for Excon purposes. This means that a South African citizen does not need to reside in the Republic in order to retain their citizenship status. Citizens of SA may also be citizens of other countries. This is referred to as dual citizenship.

Can a person lose their South African citizenship?

A South African citizen who fails to adhere to certain legal obligations may lose their citizenship. For example, citizens must apply to the Department of Home Affairs for permission to retain their South African citizenship prior to applying for citizenship of an additional country. Failure to do this may result in them losing their South African citizenship. South African citizens under the age of 18 years are exempt and do not need to apply for dual citizenship, as long as they acquire the foreign citizenship before they turn 18.

A South African citizen with dual citizenship may make a declaration renouncing their South African citizenship. This declaration, together with supporting documents, must be sent to the Department of Home Affairs. The applicant will cease to be a South African citizen from the moment the declaration is registered at the Department of Home Affairs. A certificate confirming the renunciation is issued and all valid South African IDs and passports are cancelled.

Can a person resume their South African citizenship?

Former South African citizens may only resume their citizenship by permanently residing in SA. South African citizens by birth, who lost their citizenship, never lose their right to permanent residence in SA and, should they permanently reside in SA, they will be able to apply from within SA to resume their South African citizenship.

Seek advice

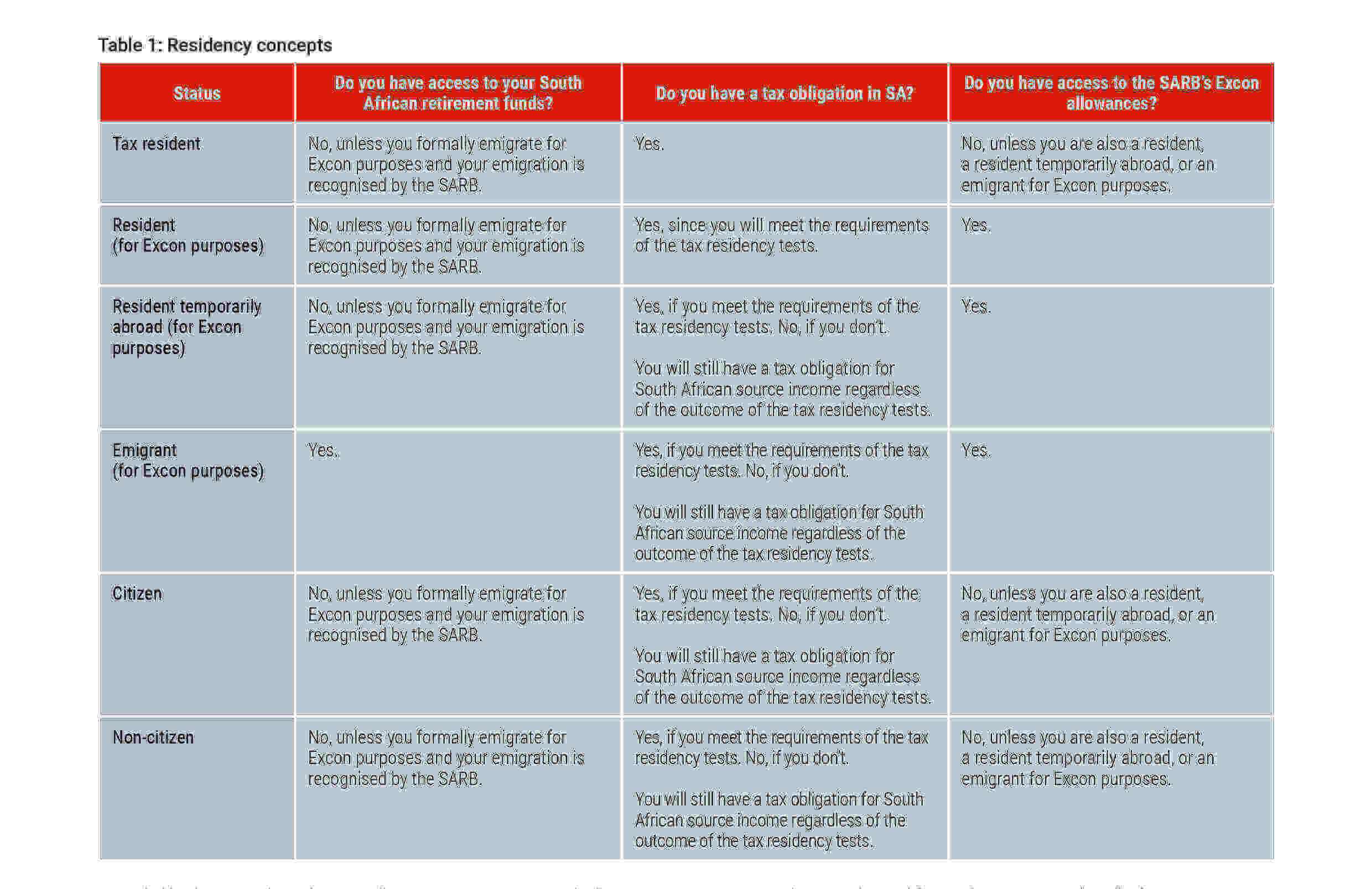

Determining your tax residence can become quite complicated and depends on your unique circumstances. We have summarised some of the key concepts in Table 1 below, but we recommend that you seek advice from a South African financial emigration specialist if you are contemplating emigrating for Excon purposes.