First published in May 2024

South Africa’s retirement savings system is changing, with the implementation date of the new system set for 1 September 2024. All current and future retirement fund members will be impacted by the change, so it is important to familiarise yourself with the new structure. Jaya Leibowitz aims to simplify and explain the intention and mechanics of the so-called two-pot system and quiet any confusion.

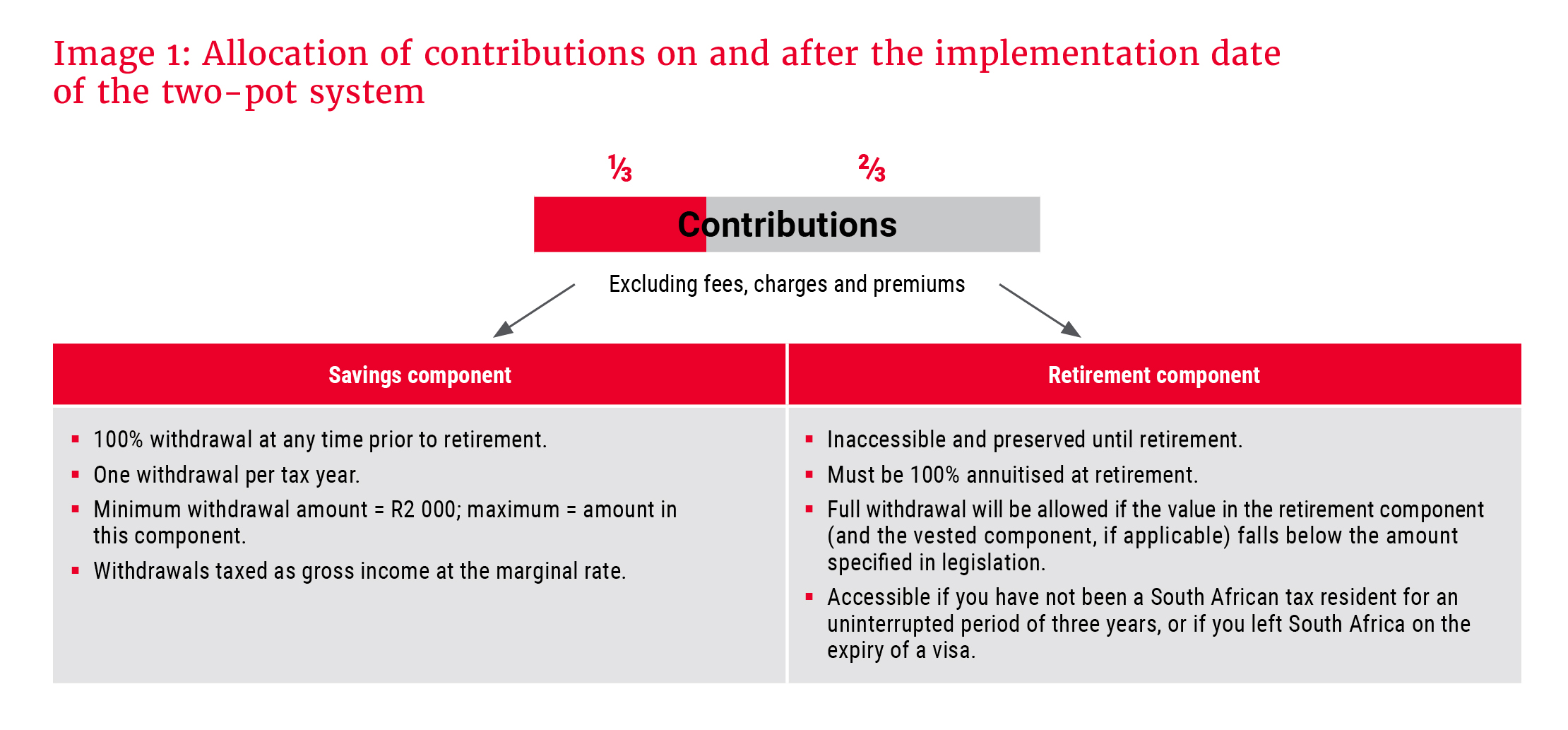

The intention of the new two-pot retirement savings system in South Africa is to promote the preservation of retirement fund investments until members retire, while also allowing them access to a portion of their accumulated savings during their working years. From the date of the implementation of this system, all contributions to provident, pension and retirement annuity funds, including the Allan Gray Retirement Annuity Fund and Allan Gray Umbrella Retirement Fund, will be split into two components: One-third of the contributions will be credited to a savings component, which members can access before retirement in the event of an emergency, and the remaining two-thirds will be credited to a retirement component, which will be inaccessible before a member retires, and at retirement must be used to purchase a pension-providing product. The features of each component are shown in Image 1.

What complicates matters is that government needs to cater to the rules that are currently in place and manage the transition to a world where the entire retirement fund system works in the way described.

The transition and vested rights

Vested rights refer to the rights that you already have in relation to your retirement investments, which the new legislation protects. All your retirement investments immediately prior to the two-pot system start date will form part of your vested component, and all the rules that currently apply to your retirement investments (including those relating to accessibility and tax) will continue to apply to this component.

If you are a member of a provident fund, and you were a member of that fund and were 55 or older on 1 March 2021, you will be excluded from the two-pot system, unless you decide that you want to participate. Exclusion means that nothing will change for you and all the rules currently in place for your retirement fund account will continue to apply. If you choose to participate in the two-pot system, from the month after you made your election, your contributions will be allocated to the savings and retirement components, while your existing benefit will be vested.

While the savings component allows you access, it is prudent to guard against thinking of it as a discretionary savings account.

Some access at implementation

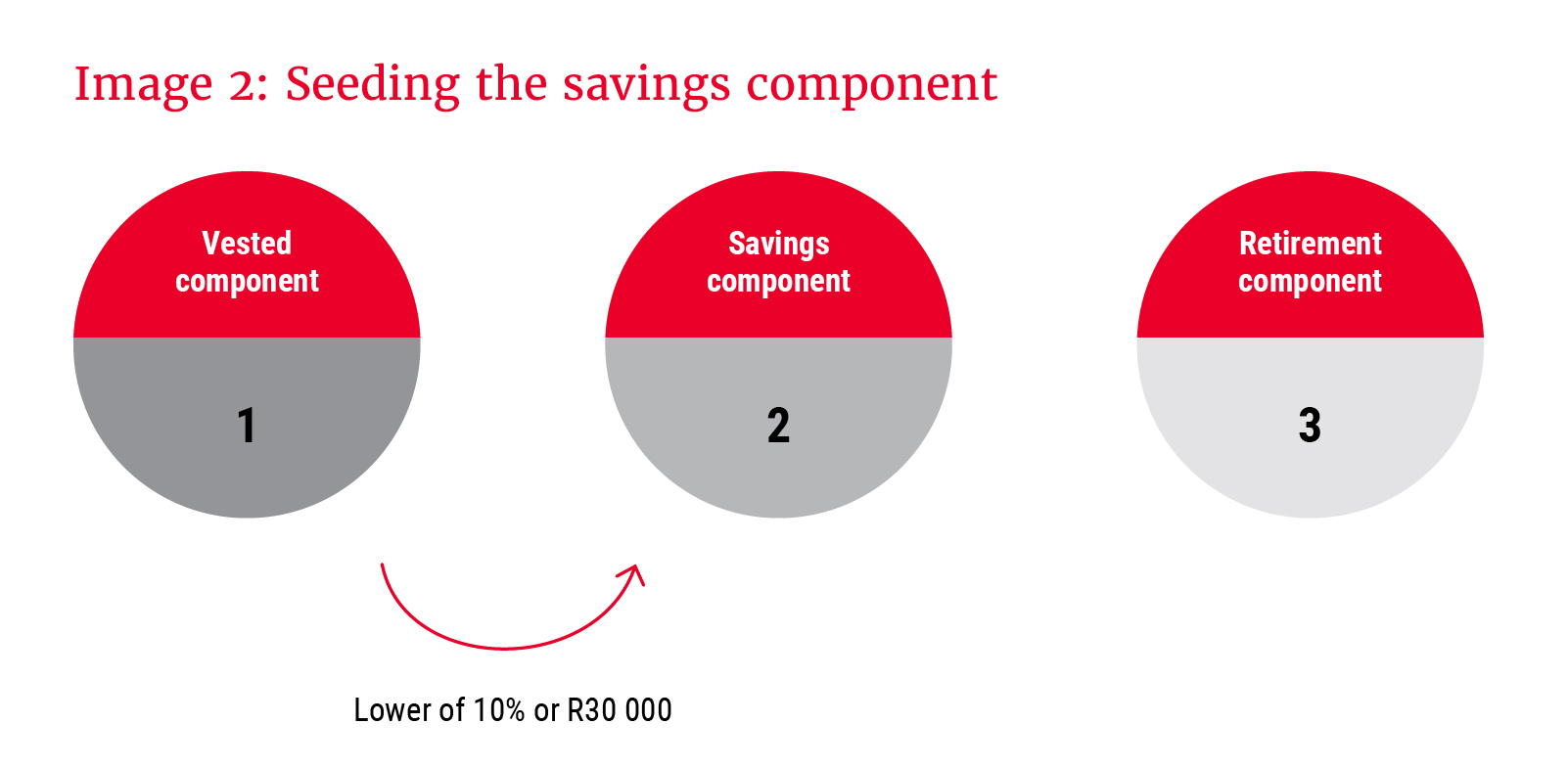

Members of retirement funds will be able to withdraw a small portion of their existing savings immediately once the two-pot system is implemented. This is commonly referred to as “seed capital” and is reflected in Image 2.

There are a few things about this withdrawal benefit that are important to bear in mind:

1. Value limit

The seed capital will be limited to 10% of the amount in your retirement fund account on 31 August 2024, subject to a maximum amount of R30 000. For you to have access to a withdrawal benefit of R30 000, the value of your retirement fund account on 31 August 2024 needs to be at least R300 000.

Below are some examples of how much cash will be accessible depending on the value of your retirement fund account:

R30 000 in your account: R3 000 will be accessible

R150 000 in your account: R15 000 will be accessible

R900 000 in your account: R30 000 will be accessible

2. Tax

Any amount accessed in cash as a savings withdrawal benefit will be taxed at your marginal income tax rate, which will depend on your taxable income for the tax year, including the withdrawal amount. The retirement fund or its administrator will apply for a tax directive from the South African Revenue Service (SARS) and deduct the tax before paying you your benefit.

3. Timing

The current version of the legislation permits retirement funds to allocate the seed capital to the savings component (to making it accessible as a withdrawal benefit) on or after 1 September 2024. If a retirement fund’s rules have not yet been approved by the Financial Sector Conduct Authority, or the fund’s systems cannot cater for the seed capital on 1 September 2024, withdrawals may be delayed.

The two-pot system has the potential to create good outcomes for retirement fund members …

SARS is in the process of designing its systems and processes so that it can issue directives setting out the amount of tax to be deducted from the savings withdrawal benefit. SARS will require your specific information to issue a directive. If certain information has not been provided to the retirement fund, the withdrawal will not be processed.

The good and the not-so-good

The two-pot system has the potential to create good outcomes for retirement fund members, helping those who desperately need some access, while ensuring greater levels of preservation due to the inaccessibility of the retirement component.

Having some access to your retirement investment without having to resign from employment may assist you in times of need. However, it is important to remember that the intended purpose of your retirement investment is to provide you with an income in retirement. While the savings component allows you access, it is prudent to guard against thinking of it as a discretionary savings account. Each time you access a savings withdrawal benefit, the amount available to provide you with an income in retirement will be reduced. In addition, that savings withdrawal benefit will be taxed and has the potential to push you into a higher tax bracket, depending on your income and the value of the withdrawal.

It is critical to understand that members’ ability to withdraw from their savings component hinges on many factors, including the Financial Sector Conduct Authority being able to timeously approve fund rule changes and SARS being able to issue tax directives.

For more information about the two-pot system, see The two-pot system – what we know for now, and The two-pot system and your savings withdrawal benefit to learn more about the accessibility of your retirement savings.

Visit this page to learn more about the two-pot retirement system.