With much of the world in lockdown, one wonders whether it is appropriate to draw on past analogies in thinking about what lies ahead. However, every prior drawdown had some sense of uncertainty, and the world persevered, with investors enjoying strong returns in the years that followed. Stephan Bernard draws on history as he tries to make sense of the current situation and potential outcomes.

We are facing a financial crisis on top of a health crisis as COVID-19 continues on its global path of disruption. An indiscriminate global asset sell-off is playing out, in light of an economic decline without modern precedent. The US market has not fallen this rapidly since the Great Depression. The local market is down by a similar extent, and investors are rightfully concerned as few investments offer refuge and asset class returns have converged.

What can we learn from the past?

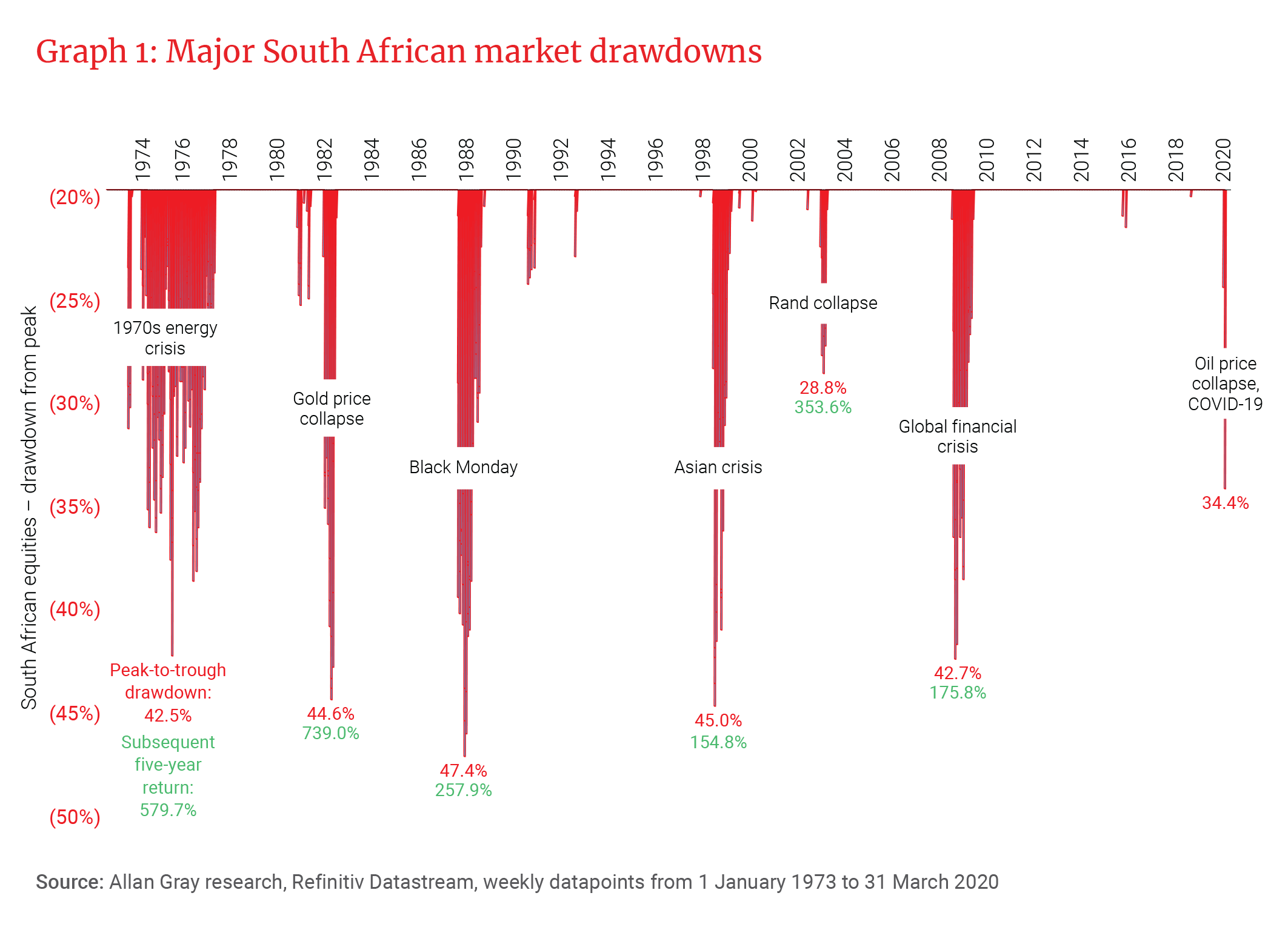

At Allan Gray and Orbis, our analysts are working tirelessly to understand the impact of recent developments on the fundamental value of businesses, cautiously investing where value is exceptional, and companies appear to have the potential to survive and thrive beyond the current pandemic. This approach has enabled us to successfully navigate past crises that have impacted markets. Graph 1 captures the most severe events since Allan Gray’s inception. Being in the current crisis is particularly painful, and uncertainty and risk abound. However, we continue to believe that our valuation-driven approach will guide us through to the other side.

Large drawdowns are often followed by high returns

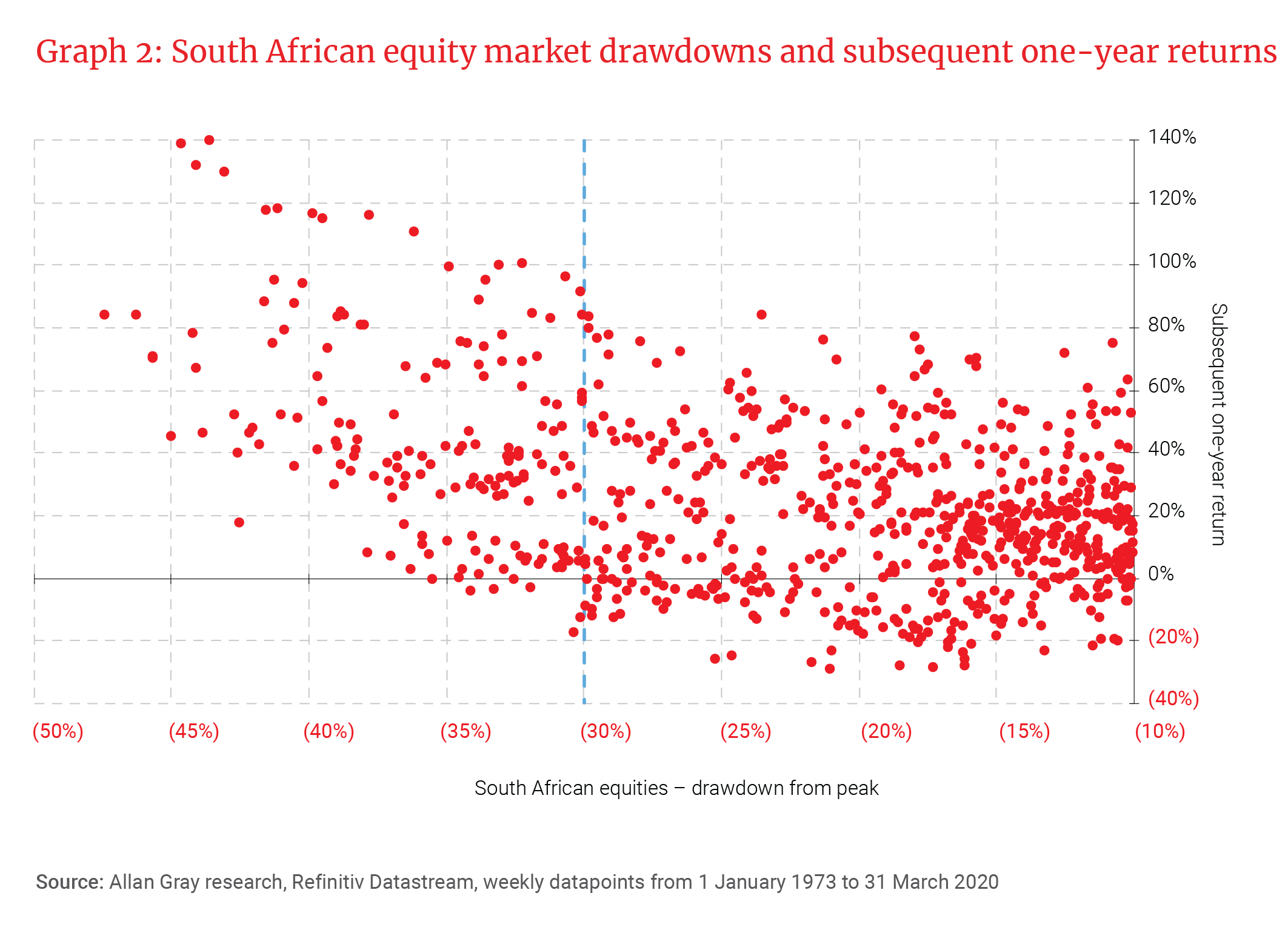

While mindful that past experience may not always be a reliable guide to the future, it is hard to ignore the rhyming in returns experienced after sharp declines in the past. Over one year, the range of possible outcomes after a dramatic sell-off in the local market is quite wide, as shown in Graph 2. But notably, deep drawdowns of the magnitude we have recently witnessed (over 30%) have typically been followed by high one-year returns.

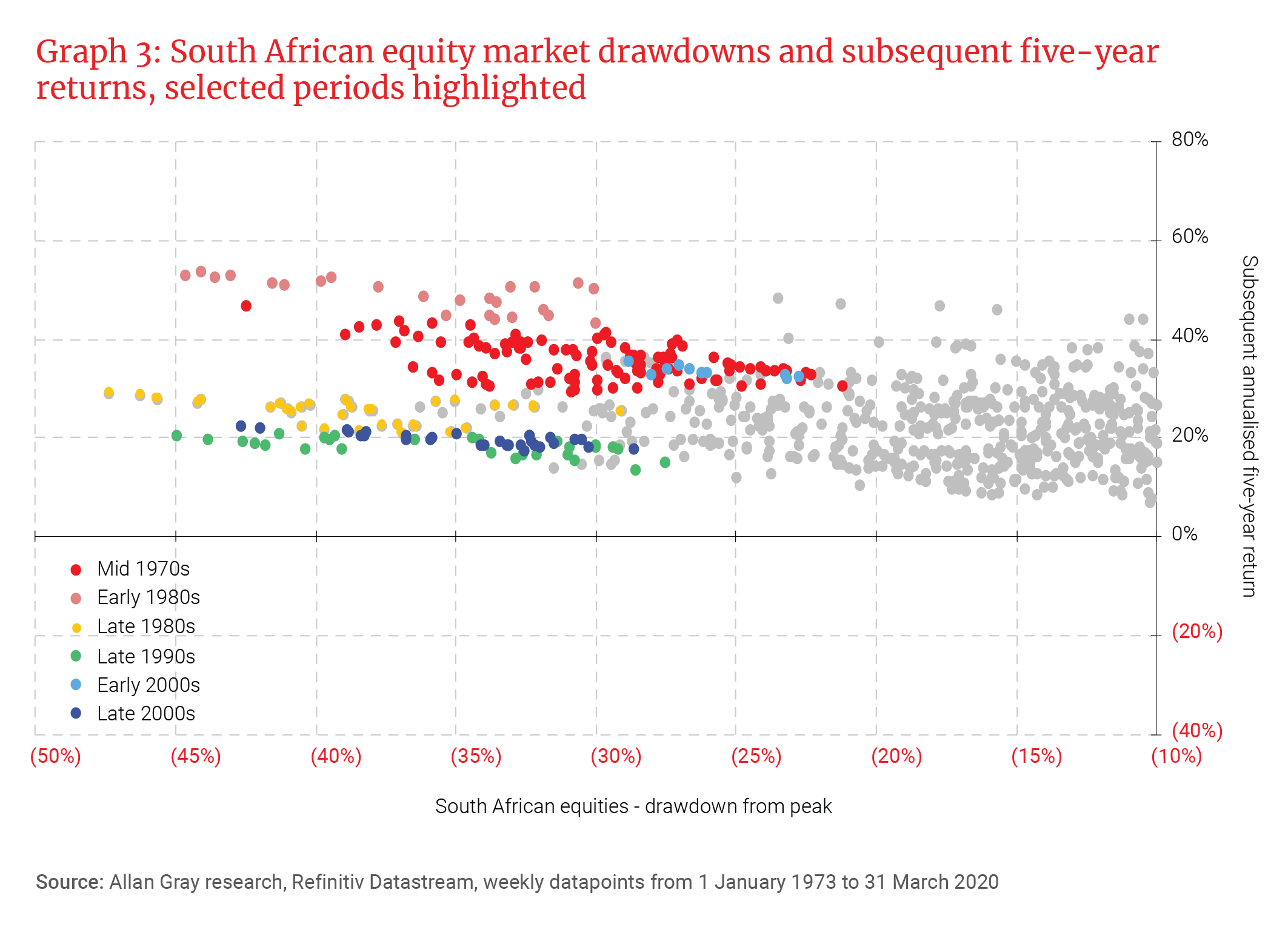

If one extends the time horizon to five years (see Graph 3), the range of outcomes narrows markedly. Things could get worse before they get better, but adopting a longer-term view at the most uncomfortable of times has historically resulted in attractive returns for investors who remain patient: The median five-year return following a drawdown greater than 30% is 27% per annum or 231% cumulatively, with the lowest five-year return after such a drawdown being 14% per annum (93% cumulatively) and the highest 54% (755% cumulatively). On previous occasions – and as today – the prevailing pessimism following significant market declines would have made attractive prospective returns feel highly unbelievable.

Looking at valuations, the median price-to-earnings ratio of the constituents of the FTSE/JSE All Share Index (ALSI) is currently at levels seen in the early 2000s. During that period, domestic equities, and consumer stocks in particular, experienced significant declines. The rand depreciated by over 60%, inflation soared, and interest rates spiked. Investors who bought South African equities at these depressed levels were rewarded with exceptional returns in the years that followed. The light blue dots in Graph 3 represent the market drawdowns over this period and the strong recovery that ensued. The situation today is markedly different, and it is likely that earnings are still to fall, but history suggests that as difficult as things are today, the tide will eventually turn.

Our long-term approach takes historical outcomes into account

As Duncan Artus reminded us last month, times of pessimism have historically set the basis for strong future returns. With moves of the magnitude seen of late, there are many forced sellers in the market – with investors desperate for liquidity. Some of the more liquid areas of the market, particularly South African bonds and equities, have been more severely impacted relative to other assets or regions. With enough cash in our portfolios, we are well positioned to take advantage of opportunities that may arise.

In our view, South African assets were not overvalued coming into this crisis and there were no significant valuation disparities like in 2002 or 2008. We considered the overall market quite attractive. Now, we are being offered the opportunity to buy South African assets at extremely low prices almost across the board.

That said, we are moving very cautiously, extremely tuned in to the risks. We believe many local companies are worth less today than they were at the start of the year, and we are mindful of stepping in one of the many value traps that have been set as an already-stagnant South African economy braces itself for what is to come. Government is constrained, debt levels are high, and global supply chains have been disrupted. We think about this when constructing our portfolios, focusing on those businesses best placed to survive, and retaining liquidity to take advantage of considerable price swings as uncertainty and market volatility persist.

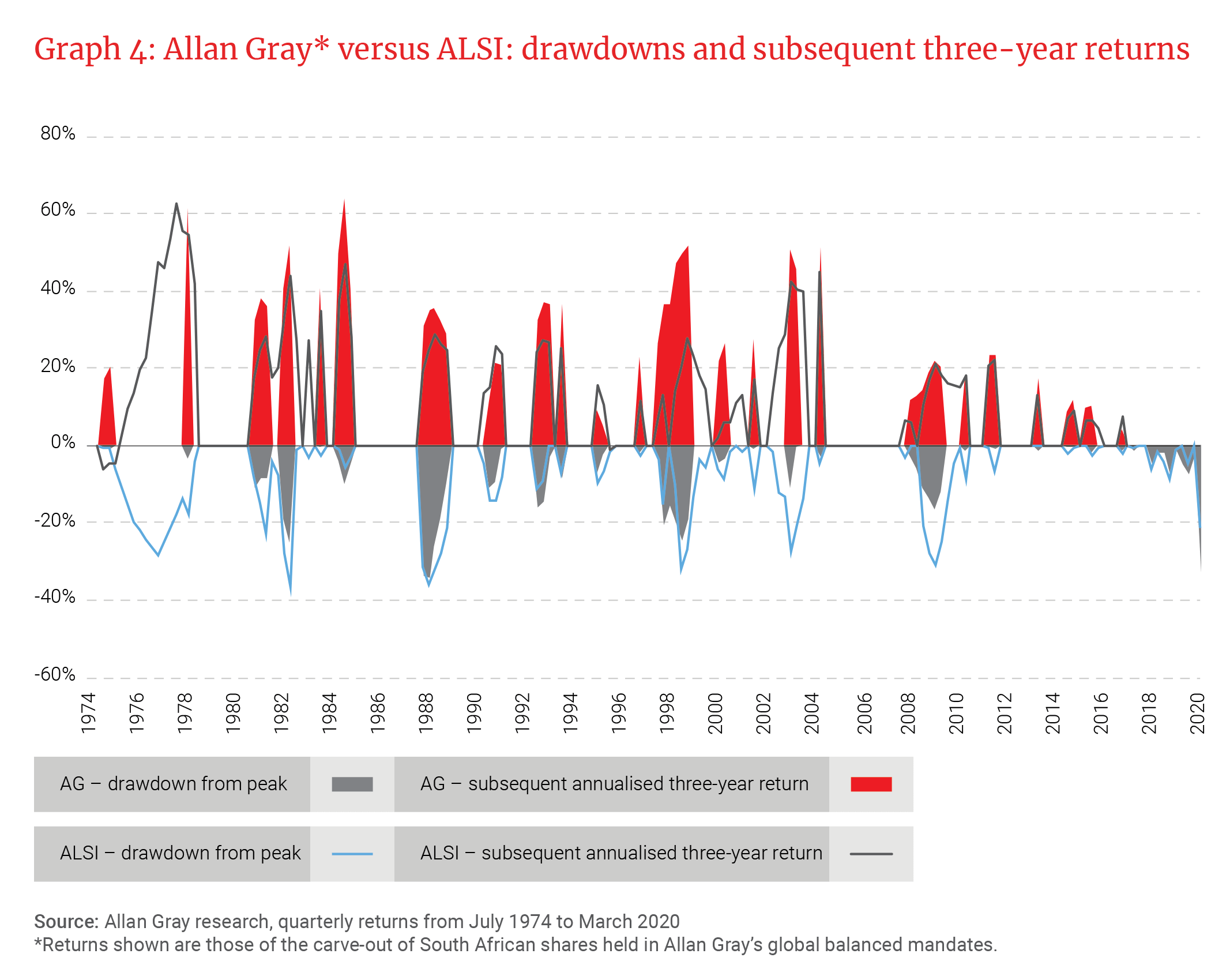

Historically, we have generally done better than the market both in terms of drawdown depth and the level of subsequent returns achieved for our clients, as illustrated by Graph 4. In recent months, our stock selection resulted in underperformance of the market portfolio. Sasol has been the standout disappointment as cost overruns at the Lake Charles project resulted in a significant net debt position leaving the business extremely vulnerable to a collapse in the oil price. An underweight position in Naspers and Prosus relative to the index was the second largest detractor. Of the top 40 JSE-listed shares, only Naspers and Prosus offered notable positive returns over the past quarter. Collectively they represent 23% of the ALSI. Even though Naspers is our largest holding, our portfolios are nonetheless underweight the share relative to an index weight that would be imprudent to match from a portfolio diversification point of view. We believe that our focused, level-headed approach has the potential to deliver market-beating long-term returns once more, as we hold securities that are cheap in any scenario that assumes eventual recovery.

Headlines are likely to get scarier in the coming months. Now more than ever, it is important to remain calm and focus on one’s long-term investment strategy, as hard as that may be. We are investing in a period characterised by market conditions that have rarely occurred in the last century – with possibly much pain still in store. Allan Gray and Orbis’ investment teams are committed to navigating this environment on your behalf.

This, too, shall pass.