After the worst five-week crash ever, global stock markets have recovered all of their losses in just five months, with the MSCI World Index setting a new all-time high in late August. As the world continues to struggle with the pandemic, how is the market up?

Sources of returns

There are just three sources of equity returns: fundamental growth, changes in valuations, and dividends. By splitting out each one individually, we can see what is driving markets. For fundamental growth, we can look at changes in expected earnings, and for valuations, we can look at the change in the price-earnings multiple for the index. To “look through” the extraordinary conditions of 2020, we will focus on earnings estimates for 2021. This gives us the breakdown shown in the table.

Dividends have chipped in 1.2% towards returns. Earnings expectations have collapsed by 15.5%, but this has been more than offset by rising valuations, leaving the market’s price-earnings multiple 23.2% higher than at the start of the year. After the recovery, the market now trades at 19 times estimated next-year earnings. This is an unusually rich level, and one that has not been surpassed since the tech bubble burst in 2001.

Why are the markets up?

The above explains how markets are up. Despite falling earnings expectations, markets are up because valuations have become much more expensive. But why markets are up is a different question.

One explanation is that not all companies are suffering. To quote Microsoft’s CEO, “We have seen two years’ worth of digital transformation in two months.” Two years’ worth in two months might also be an apt description of software firms’ stock returns.

The other explanation is that central banks have flooded the market with money, pushing down bond yields. If bonds offer lower returns, that makes equities look better in comparison, and often drives up demand for stocks, which in turn pushes up stock prices.

What will happen next?

But an explanation of what has happened is not a guide for what will happen. The unusual conditions of 2020 are unlikely to repeat, and today’s high starting valuations do not augur well for future long-term returns — at least, not for headline stock indices.

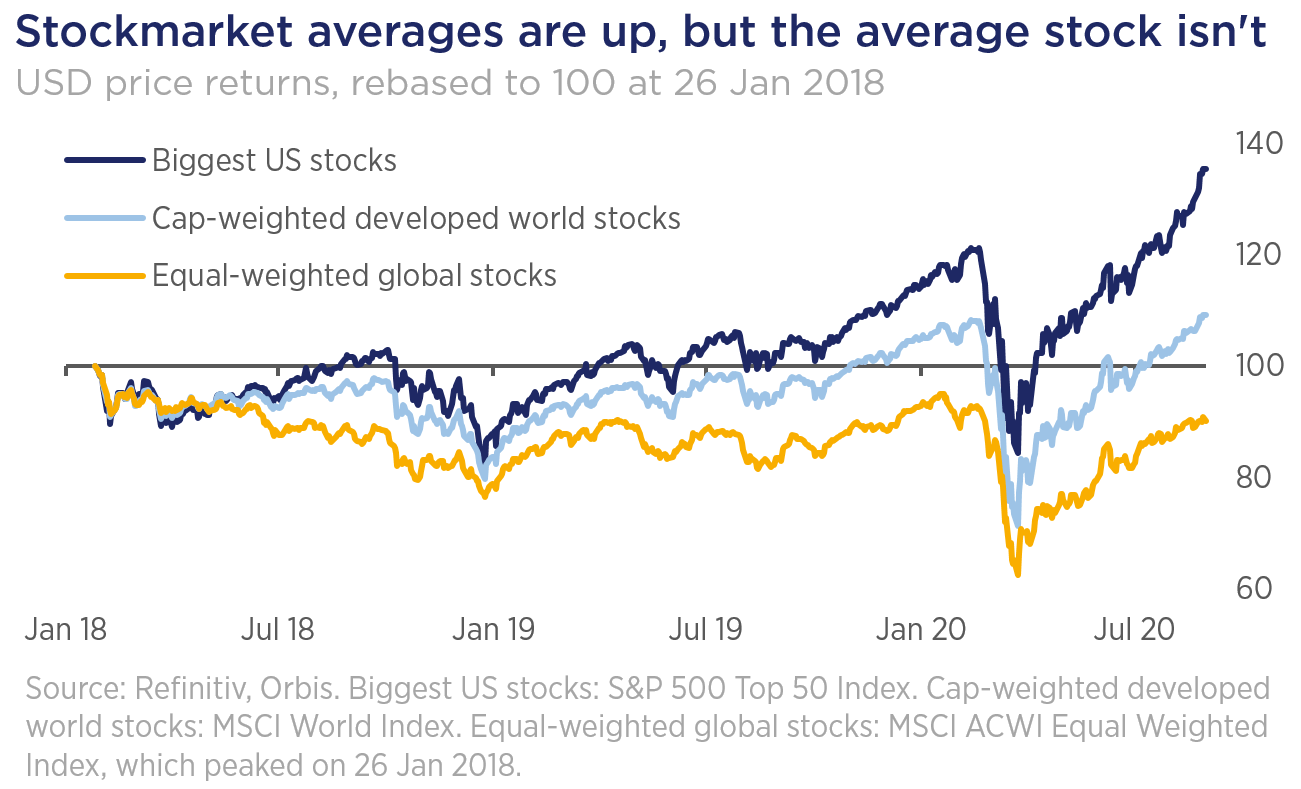

The good news is that those headline indices do a crude job of representing the opportunities available to bottom-up stock pickers. The graph shows the effect that the biggest 50 companies in the US have had on the performance of broad market indices.

As is evident from the dark blue line, these 50 stocks have done very well and now include some of the world’s largest companies by market capitalisation (the total value of the shares in issue). The middle (light blue) line is the performance of the market-capitalisation-weighted MSCI World Index. A market cap index weights the constituent companies by size, the performance of bigger companies has a greater bearing on the overall index than that of smaller companies. As you can see, the performance of the cap-weighted index is significantly better than if the performance of each stock is treated equally (yellow line).

If we look at the average stock globally on an equal-weighted basis, we see that the average stock remains stuck in a bear market that started all the way back in early 2018. That excites us, because it suggests that there are plenty of companies out there where valuations may be much more attractive. Such opportunities represent the bulk of the Orbis Funds.

In fact, the Orbis Global Equity Fund holds only six of the biggest 50 American companies, and while those giant firms represent over 35% of world stock markets, they account for just 14% of the Fund. The other 86% is in several dozen companies picked from the forgotten “rest”. In aggregate, our companies have similar or better fundamentals than the wider market, but trade at a steep discount. Being so different from the market isn’t always comfortable, but with market valuations where they are today, we wouldn’t have it any other way.