This piece was originally published in the Orbis December 2014 Annual Manager's Report.

In 2014, Orbis identified several new opportunities, including selected shares in the energy sector, as well as a number of shares in Korea and Russia. All of these areas were out of favour when Orbis initially invested - and all have since continued to underperform. While this has been costly in terms of relative short-term performance, Orbis is now more excited about the Orbis Global Equity Fund's future return potential. Graeme Forster explains.

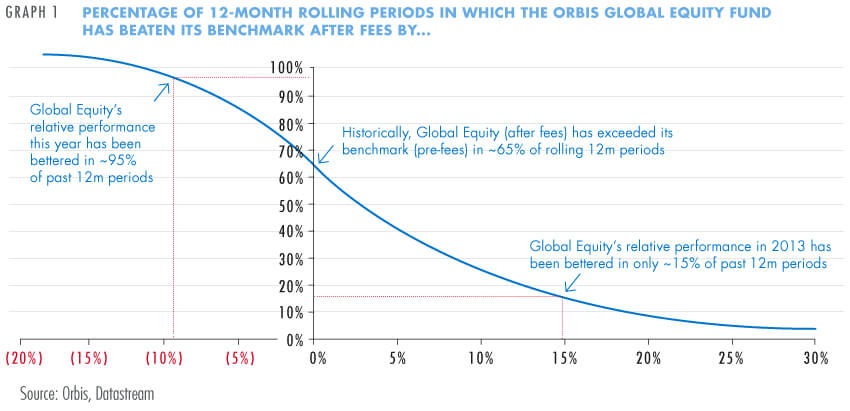

The past year was a painful reminder that investment returns don't come in a straight line. After particularly strong relative and absolute performance in 2013, the Orbis Global Equity Fund lost 5% while world stock markets gained 5%. While this was one of the worst calendar years in the Fund's history, its relative performance in any given 12-month period has been highly variable, as shown in Graph 1. Using our flagship Global Equity Fund as an example, it has underperformed its benchmark on a rolling 12-month basis about 35% of the time since its inception 25 years ago.

For that reason, we caution clients against reading too much into a single year, but accept it would also be wrong to dismiss it as merely short-term noise. In investing there are some things you can control and others you can't - and some of both were to blame for Orbis Global's weak performance in 2014. Bad luck arguably played a role in a few cases, but we also made an above-average number of mistakes of our own.

INVESTMENT RETURNS DON'T COME IN A STRAIGHT LINE

What could have been done differently?

Our key mistake in 2014 was in allocating too much weight to shares of companies that are highly sensitive to the price of oil. This includes both those shares directly involved in the energy sector as well as other shares where oil prices exert a significant influence over the rest of the country's economy (e.g. in Russia). Taken together, these oil-sensitive shares contributed roughly two-thirds of Orbis Global's underperformance in 2014. Approximately half of that was attributable to Russian holdings and the remainder to other shares outside of Russia, such as Weatherford International, Apache and INPEX.

While we could not have predicted with sufficient confidence the near-50% collapse in oil prices during the second half of the year, our positions were established at a time when oil was trading above what we considered to be 'normal' levels. On a bottom-up basis, the shares we selected were trading at a significant discount to our assessment of intrinsic value, but we should have been more measured in building the positions, knowing that we may have had a better opportunity to increase the weighting if the oil price fell to more appropriate levels. As it turned out, the oil price fell a lot more than that, and our oil-linked investments fell accordingly.

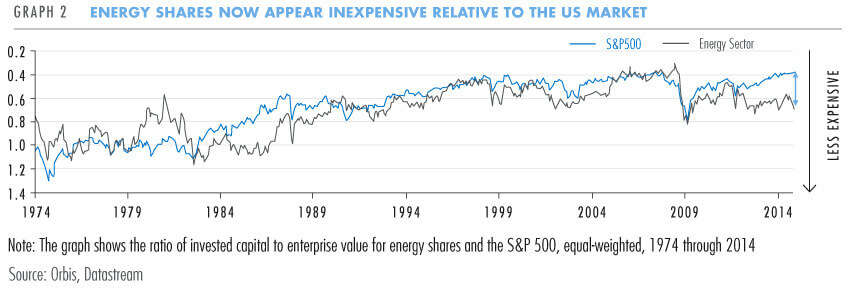

We are no better positioned to predict the yearly swings in the price of oil today than we were heading into 2014, but our assessment of the industry's long-term fundamentals and the intrinsic value of the Fund's holdings have not changed meaningfully. What has changed is the price at which the market is valuing these energy shares, and we have taken the opportunity to add to some existing positions at wider discounts to our assessment of intrinsic value. In addition, we are finding good reason to research a number of new opportunities in the sector. As shown in Graph 2, energy shares look more attractive today on a headline valuation basis versus the wider market than they have for quite some time, and it is clear that the market has severely punished our energy-related holdings.

Standing our ground

The situation in Russia is more complex. To get straight to the punchline, we continue to be enthusiastic holders - Russia accounts for about 3% of the Orbis Global Equity Fund today - but we did not add substantially to these positions into share price weakness. When we initially invested in two attractive Russian shares (Sberbank of Russia and Gazprom) following the Crimea referendum in March, we made a risk management decision to limit the combined position to no more than 6% of the Fund. Over time we bought that full amount, believing that it was a temporary political flare-up and it would be the best opportunity available.

Obviously, we underestimated the severity and duration of the Ukraine crisis as well as the lengths the West, and especially Europe, would go to in sanctioning Russia. The lion's share of the underperformance however has been a direct result of the sharp oil price decline and its impact on the economy and currency. In this sense, we concede that we should have been far more conscious of the risk we were carrying by holding our full appetite in Russia in combination with our favoured energy shares.

As it stands today, we consider our Russian holdings to be meaningfully undervalued and, as contrarian investors, we believe there is a lot to be excited about. Though the situation is constantly evolving, Russia remains one of the most depressed markets in the world and the fear surrounding both equities and the currency is palpable. One can now buy Sberbank, a dominant bank with attractive long-term growth prospects, for less than five times what we consider to be normalised earnings - making it one of the cheapest banks globally in our view. The currency also looks undervalued, having fallen further than we believe is economically justified by the oil price alone.

That said, while these Russian shares continue to trade at a wide discount to our assessment of intrinsic value, the range of outcomes has also widened. This is especially true of Sberbank, where the risks of permanent capital impairment have risen. We are likely to see a deeper recession in Russia than we originally envisaged as a result of lower oil prices and higher interest rates. While Sberbank's earnings power should allow it to withstand significant macroeconomic stress, in the event of a deep and protracted recession one cannot rule out the risk of the need to raise more capital, which would be dilutive to existing shareholders.

Reason for optimism in contrarian positioning

Beyond the Global Equity Fund's energy sensitive investments, another source of weakness in 2014 was its underweight position in US shares and meaningful overweight position in Korea. The US bull market that began in 2009 has continued to run and we have generally shifted weight away from the US, especially mid-cap shares, in favour of more depressed markets such as Korea, where we continue to find significant discounts. Both sides of this decision hurt performance in 2014: US shares kept rising and Korean share prices continued to sink well below what we believe they are worth. Only time will tell if this positioning proves to be a mistake, but we maintain conviction in these decisions and, in fact, have continued to add to our Korean holdings over the past year.

OUR UNDERPERFORMERS THIS YEAR MAY NOW SIT AT EVEN DEEPER DISCOUNTS TO INTRINSIC VALUE AND THE POTENTIAL FOR FUTURE OUTSIZED RETURNS IN THOSE AREAS OF THE PORTFOLIO HAS IMPROVED

Of course, it can be notoriously difficult to draw the line between mistakes and bad luck - and between being wrong and being 'early'. As a simple example, consider a coin that is weighted to land on heads 60% of the time. A player who risks a dollar can win two dollars if they are able to correctly guess the outcome of each flip. If you know that the coin is weighted in favour of heads, you should always bet heads. But 40% of the time it will look like you have made a 'mistake', when in fact you are following a rational strategy. Over shorter spans, you will be forced to weather inevitable periods in which you suffer far more losing than winning flips. Like the player in the coin game, at Allan Gray and Orbis, we don't define a 'mistake' as a decision that loses money. Instead, we define a mistake as incorrect analysis that leads us to buy something for more than it is worth, which is loosely akin to paying a dollar to bet tails for the 60/40 coin. To risk taking the analogy too far, perhaps our biggest mistake in 2014 wasn't the fact that we bet tails, but that we bet too aggressively on heads when we were more likely than not to get better odds at a later date. If we are correct in this assessment, then many of our underperformers this year may now sit at even deeper discounts to intrinsic value and the potential for future outsized returns in those areas of the portfolio has improved.

Looking across the portfolio as a whole, we see a more attractive opportunity set than we did at the start of 2014, albeit not as extreme as we have seen at other times throughout our 25-year history. Heading into the New Year, we are optimistic about the potential for relative returns, but not pounding the table.

Of course, as investors, we can't control the opportunities that are available to us. All we can do is take advantage of favourable situations as they arise. Ultimately, we remain confident that if we continue to adhere to our shared philosophy and execute in a disciplined manner then the odds will be skewed in our favour. If we are patient and forthright about our errors - and we continue to learn from them - perhaps we can even improve our odds over the long term.