Bonds are typically included in an investment portfolio to provide diversification and deliver yield. Developed market bonds are currently offering much lower yields than their emerging market counterparts, yet are perceived as less risky and are therefore more popular. But is the safe option the best one? Mark Dunley-Owen from our offshore partner, Orbis, offers a view on developed market bonds, whereas Londa Nxumalo provides us with a different perspective on the bond market in Africa in her article.

At Orbis, our investment principles include limiting the assumptions we make about the future and ignoring the short term. This is unusual in fixed income, where many investors rely on macroeconomic predictions over the coming months. Our investment philosophy, across all asset classes, including bonds, is the opposite of this thinking.

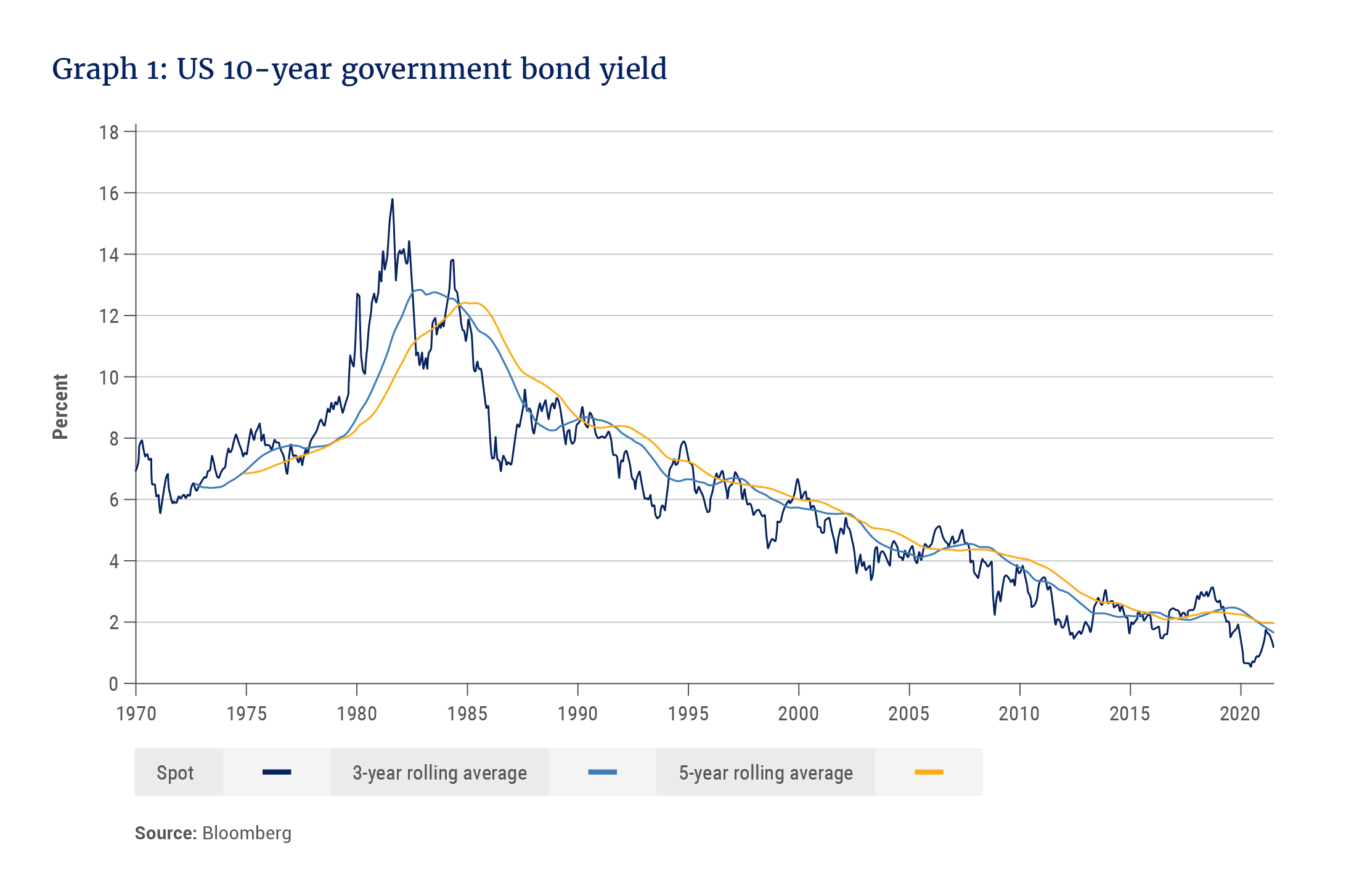

Graph 1 is a remarkable reminder why getting the big things right matters. It shows the yield on the US government 10-year bond since 1970. Bond prices move in the opposite direction to bond yields, hence consistently lower yields have resulted in consistently higher prices. A US bond investor in the 1980s needed to get one thing right, namely that inflation and therefore yields would fall, and stick to this conviction for the following 40 years.

This downward yield trend has not been restricted to US government bonds; most developed market government bond yields have fallen towards zero, and negative for safe havens such as Germany and Switzerland. Even Greece, which appeared likely to default on its debt obligations following the global financial crisis, now pays less than 1% for its government debt.

Corporate bonds have experienced similar yield compression, often irrespective of underlying fundamentals. The Bank of America US High Yield Index tracks US corporate debt rated below investment grade, more commonly known as junk bonds. Junk bonds offered around 10% yield for much of the 1990s and 2000s. Investors were rewarded for taking on the “junk” credit risk. Today, in many ways a more challenging period than the 2000s, these bonds offer a historically low 4% nominal yield, and negative real yield.

we own assets that … offer higher long-term returns than developed market bonds, as well as better yield and diversification benefits

Low yields mean fewer opportunities

Undiscriminating low yields pose a problem for long-term fixed income investors such as us. Most importantly, in contrast to opportunities in Africa, as discussed by Londa Nxumalo, low yields mean there are fewer opportunities with attractive probable return. They also nullify two of the reasons we hold bonds in a balanced portfolio, namely to earn the carry (“the carry” is the return accruing to an investor from holding the bond) and diversification.

The S&P dividend yield and long-duration US government bond yields are similar, making it difficult to justify holding bonds for the carry. As for diversification, we believe the zero lower bound on yields skews the upside/downside potential from bonds. Simplistically, bond prices may fall more than equity prices rise in risk-on scenarios and rise less than equity prices fall in risk-off scenarios.

Limited value, low carry and questionable diversification leave us with few reasons to own bonds. We are fortunate that we are not forced to fill a bond bucket or mimic a benchmark and are able to have low fixed income exposure in our funds. Instead, we own assets that are underpriced relative to their cash flow and provide diversification by behaving differently to mainstream equities. These include cash, gold, energy exposure and a basket of cheap, idiosyncratic companies. We believe these offer higher long-term returns than developed market bonds, as well as better yield and diversification benefits.