William Gray, from our offshore partner, Orbis, reviews Orbis’s recent performance and discusses their investment approach in the current environment.

Our purpose at Orbis is to empower our clients by enhancing their savings and wealth, and yet we have done just the opposite this year. On an asset-weighted basis, blending net-of-fee returns across share classes, the Orbis funds returned -16.9% in 2018 versus -8.4% for their benchmarks. During the good times we try hard to remind clients that periods of underperformance are inevitable, but they are always painful when they arrive.

In a sense, underperformance is the market’s way of saying that it doesn’t agree with our assessments of the long-term intrinsic value of the businesses whose shares we’ve selected for your funds. In some instances the market will be right. In others, it may simply be excessively pessimistic or overreacting to recent events. Our focus is to separate the signal from the noise as best we can, and to ensure that your capital is positioned appropriately. It is a process of constant questioning, learning and decision-making under uncertainty.

Investing is ultimately about putting the power of compounding to work in your favour over the long term.

At times like this, our investment team’s efforts are focused intensely on the investments we hold on your behalf. The individuals directing your capital, working closely with their colleagues, have shown the ability to take advantage of challenging times over the past 15 years they have been with Orbis on average. But our conviction is based more on the opportunities currently held in the funds than anyone’s track record. While not as extreme as the technology, media and telecom (TMT) bubble in the late 1990s, current market dislocations seem highly unusual and we are more enthusiastic about the prospects for your portfolios relative to their benchmarks than we have been for some time.

The rush towards “safety”

A notable pattern in recent months has been the rush towards apparent “safety”. Companies with highly predictable future earnings have seen their share prices rise sharply while anything with increased uncertainty has dropped precipitously. Dislocations of that nature are often a reliable sign of opportunity for investors with an approach focused on the long-term fundamentals of the underlying businesses.

One wonders how much of the recent market environment is the result of how prevalent passive, “smart beta” and other similarly algorithmically based investing philosophies have become. Share prices globally have also been affected in ways that none of us can fully appreciate by low interest rates driven by aggressive monetary easing since the global financial crisis.

In the past, many fundamentally oriented investors like us would make individual assessments of value, causing share prices to adjust incrementally as perceptions changed. Today, prices move sharply as broadly adopted approaches buy or sell for reasons either independent from fundamental value or that few really understand. Investors who are transacting for reasons other than a fundamental view of a company’s prospects now account for around 85% of trading volume, according to a recent report from J.P. Morgan. That produces short-term variability but long-term opportunity for skilled investors who focus on the fundamentals.

Rewards for those left standing

While the current market environment makes our approach difficult to stomach, it bodes well for what we do. As it becomes harder to sustain a focus on fundamental value through the shifting tides, managers who seek to do so might either get themselves fired, capitulate or change their stripes – perhaps at the worst possible moment. As share prices ultimately reflect long-term business results, it will be all the more rewarding for those left standing.

While the current market environment makes our approach difficult to stomach, it bodes well for what we do

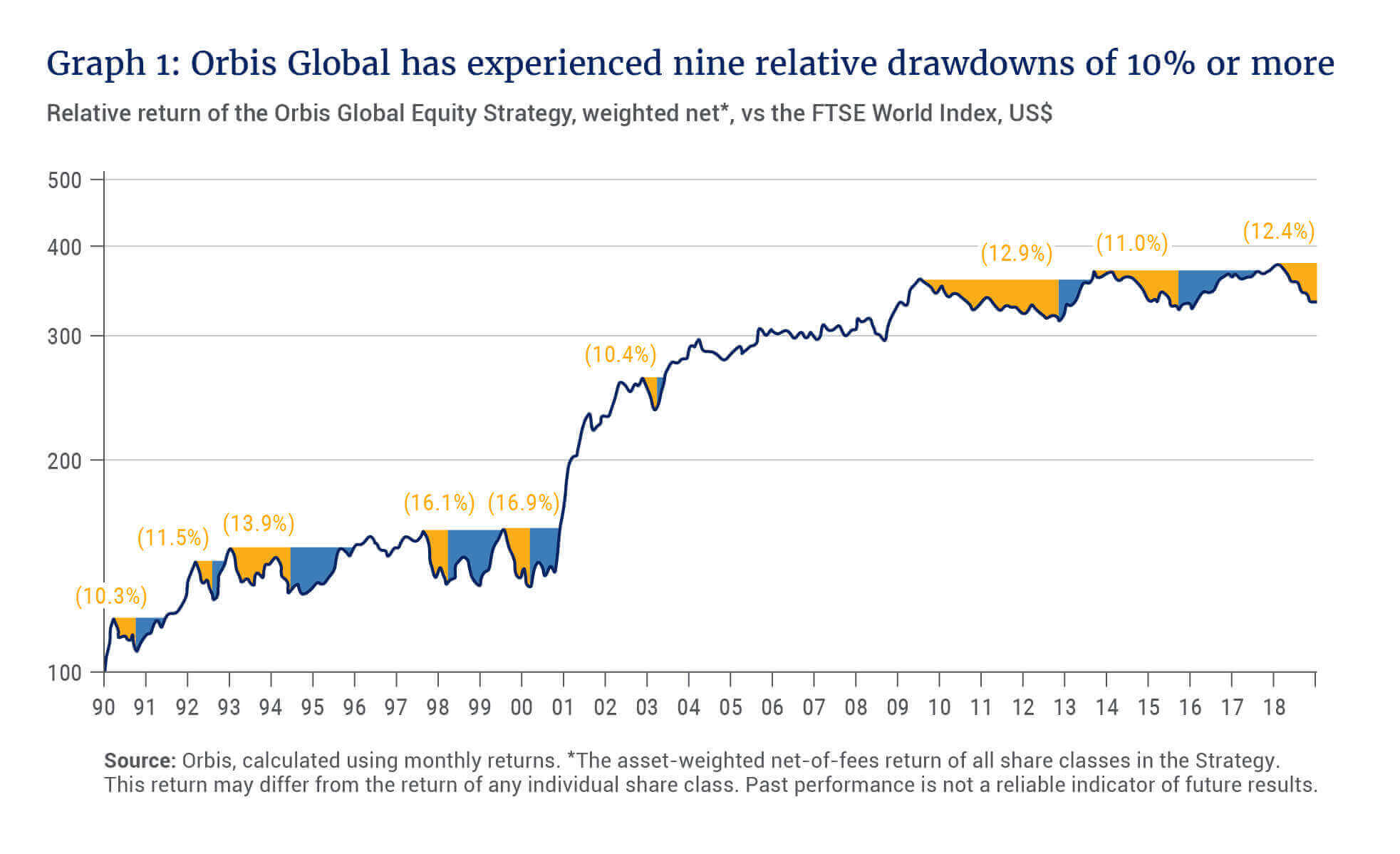

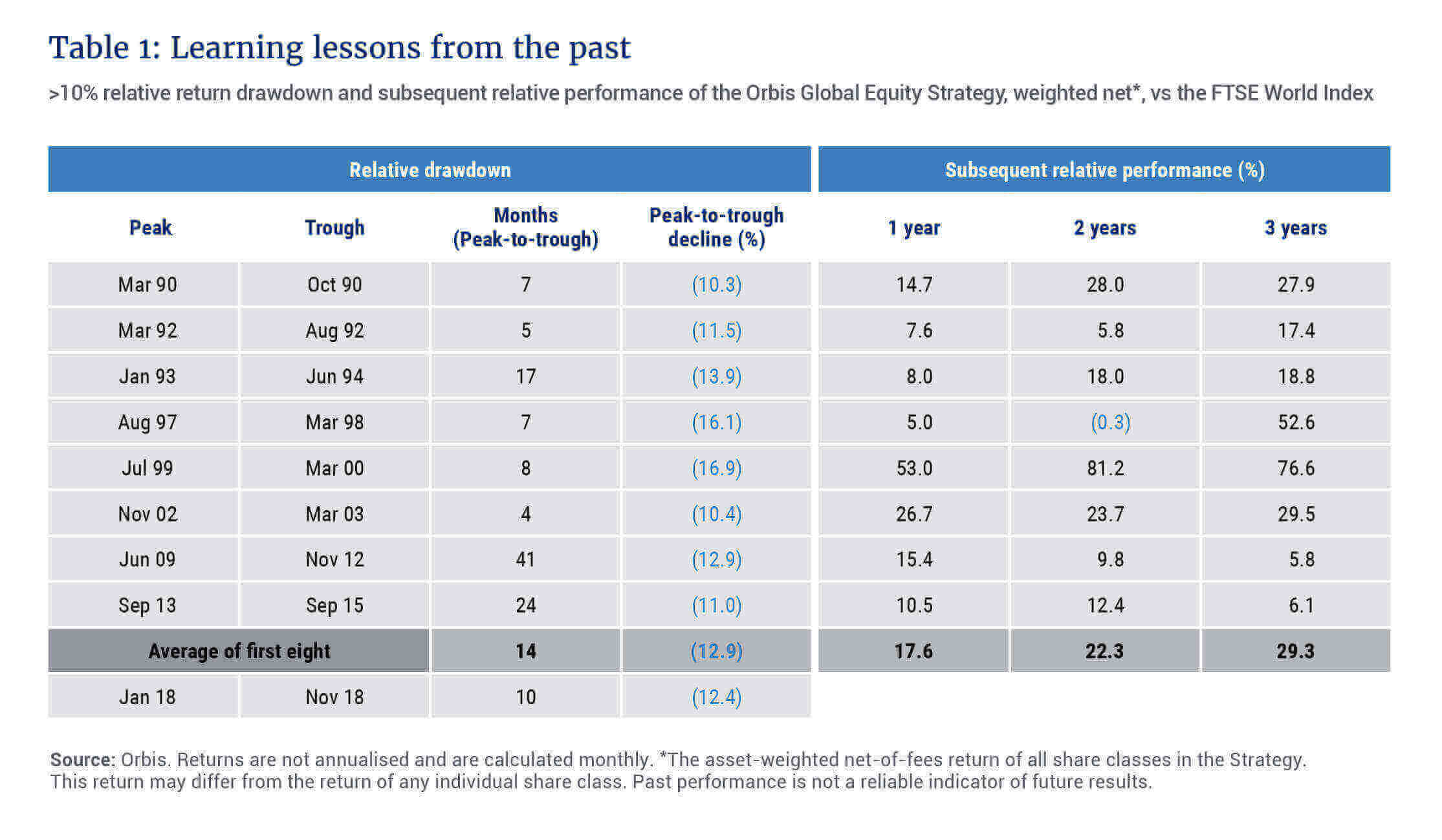

History is no predictor of the future, but lessons can be learnt. Graph 1 shows some of the worst periods of underperformance for the Orbis Global Equity Strategy in the past, and Table 1 shows the subsequent relative performance of the Orbis Global Equity Strategy after those periods. These often corresponded with extremes in broad market trends such as the TMT bubble and the accompanying exodus of value-oriented investors at that time.

Focus on the long term

Investing is ultimately about putting the power of compounding to work in your favour over the long term. The benefit of focusing on intrinsic value is that the pain of an acute share price decline is more often than not accompanied by greater conviction in future returns.

We have not delivered on our purpose recently, yet it is gratifying to see the resilience you have shown in your investments with Orbis. We are determined to prove once again that your trust and confidence in us is well-placed.