Finance Minister Ipumbu Shiimi, MP delivered his Budget speech on Wednesday, 22 February 2023. In acknowledging the continued hardships endured by most citizens across the country, Minister Shiimi noted that this year’s Budget focused on balancing fiscal sustainability, promoting sustainable economic growth and job creation, while providing for the most vulnerable and marginalised residents.

The 2023/2024 Budget, therefore, is as much about macroeconomic stability as it is about sustaining livelihoods and supporting economic recovery.

Minister Shiimi stated that the Budget maintains three interlinked fiscal pillars: pro-sustainability, pro-poor and pro-growth.

Firstly, the Budget is pro-sustainability as it reinforces the budgetary framework outlined in the 2022/2023 Mid-Year Budget Review concerning the government’s continued endeavour to reduce budget deficits and promote fiscal sustainability.

Secondly, the Budget is pro-poor as it provides support to the most vulnerable members of society by boosting social safety nets in light of depreciating real incomes, high inflation and rising interest rates.

Lastly, the Budget is pro-growth as it continues to advocate for the implementation of policy reforms that optimise economic outcomes by improving the ease of doing business, boosting business confidence and entrenching policy certainty.

Below we highlight some of the 2023/2024 Budget proposals that may impact investors.

What has not changed?

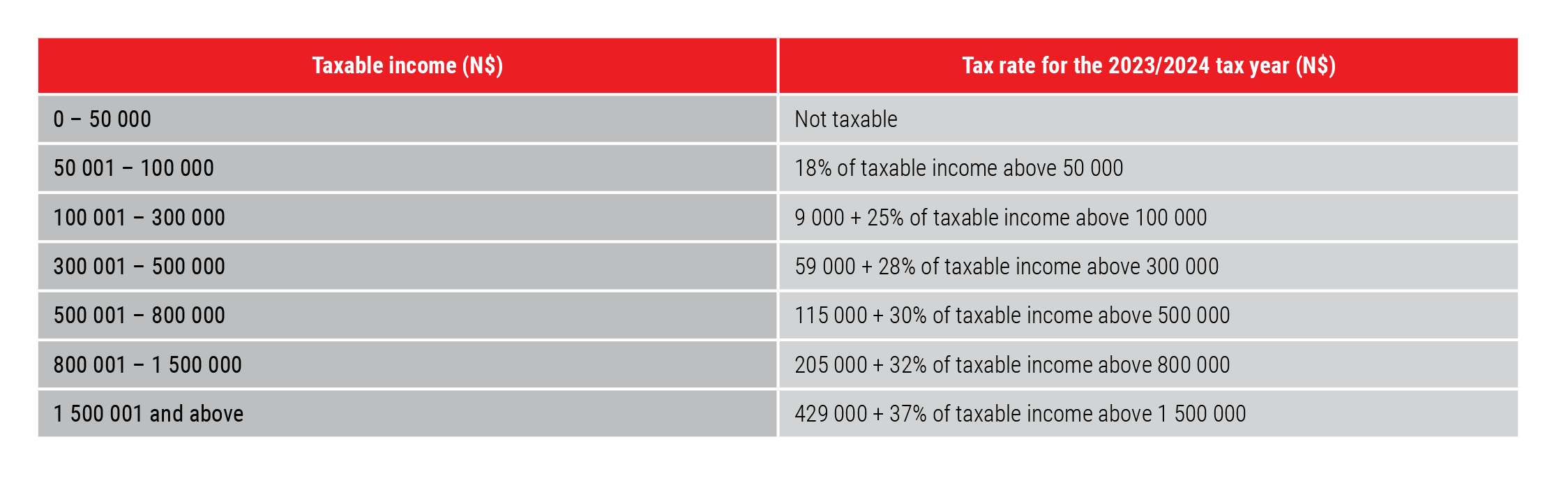

Personal (including trusts and deceased estates) income tax rates

There were no adjustments to the tax brackets or the tax-free thresholds. The highest marginal tax rate for individual taxpayers remains unchanged at 37%. The personal income tax rates for the 2023/2024 tax year are listed below.

Tax thresholds

Tax thresholds have remained the same at N$50 000 per annum for all individuals.

Estate duty and donations tax

There continues to be no estate duty or donations tax.

Interest withholding tax

The Namibia Revenue Agency (NamRA) continues to impose a 10% withholding tax on taxable interest earned from Namibian banks and unit trusts paid to any person other than a Namibian company.

Interest exemptions

The following interest earnings remain exempt from interest withholding tax:

- Interest earned on NamPost Savings Bank deposits

- Interest earned on stocks or securities (including treasury bills) issued by the government, or any regional council or local authority in Namibia

Dividends

Dividends, other than those received from a building society, remain exempt from income tax.

Capital gains

Namibia does not generally impose a tax on capital gains. Where capital gains are taxable, they are taxed as ordinary income.

Value-added tax (VAT)

The standard VAT rate remains unchanged at 15%.

Companies

The corporate income tax rate remains unchanged at 32%.

What has changed?

Increase in excise levies and duties

The following increases were implemented from 22 February 2023:

- A pack of 20 cigarettes will cost an extra 98c

- A kg of cigars will cost an extra N$237.79

- Unfortified wine will cost an extra 23c per litre

- Fortified wine will cost an extra 41c per litre

- Sparkling wine will cost an extra 12c per litre

- Spirits will cost an extra N$12.08 per litre

- Clear malt beer will cost an extra N$5.99 per litre

- Cider and alcoholic fruit beverages will cost an extra N$5.99 per litre

Future tax proposals

Minister Shiimi has reiterated his sentiment that the economy, as well as individual and corporate balance sheets, has not yet sufficiently recovered to warrant the consideration of new tax policy proposals. Increasing tax burdens at this stage would hamper economic recovery and compromise growth opportunities. Therefore, the short-term focus will be on tax administration reforms to ensure revenue enhancement through tax compliance.

Tax relief for companies

The non-mining company tax rate will be reduced by 2% over the following two years. The tax rate will be reduced to 31% effective 1 April 2024 and 30% effective 1 April 2025.

Tax relief for individuals

The tax relief aims to reduce the tax rates of individual taxpayers earning less than N$100 000. Individuals in this income bracket will no longer be subject to tax.

NamRA interest and penalties debt relief

NamRA will continue with the final instalment of the tax arrears relief programme, whereby interest and penalties will be fully written off if outstanding capital is fully settled by 30 October 2024. This is the final extension of the programme.

Tax proposals previously announced that are still under consideration

The following previously announced tax proposals are still under review:

- The introduction of a 10% dividend withholding tax on dividends paid to Namibian tax residents.

- The introduction of VAT on the management and administrative fees of listed asset managers.