Many local investors are understandably worried about what the future holds and how the election may affect their wealth. Keeping perspective throughout your financial journey can help you navigate market volatility. Marise Bester draws on history and behavioural principles to help us get some perspective.

Perspective is relative and shapes how we see and understand the world. The closer you are to an object, the larger it seems. In the investment context, the uncertainty about an event is greatly enhanced when you are in it, but there are ways to broaden one’s perspective to get a clearer view of the picture.

Gaining perspective from history

The uncertainty about the upcoming election, the first since 1994 of which the results are unpredictable, is unsettling, but also positive, as it is a true reflection of a healthy democracy. Given the wide range of political views, it is difficult to call a positive or negative outcome. We are not in the business of predictions. However, what we can do is consider a range of market-positive and market-negative outcomes and position our portfolios for different scenarios. We can also gain some perspective by looking at other periods of uncertainty, and resultant market and fund performance. While past performance is not necessarily indicative of future performance, historical trends can provide perspective and help us navigate turbulent times by remaining focused on the bigger picture.

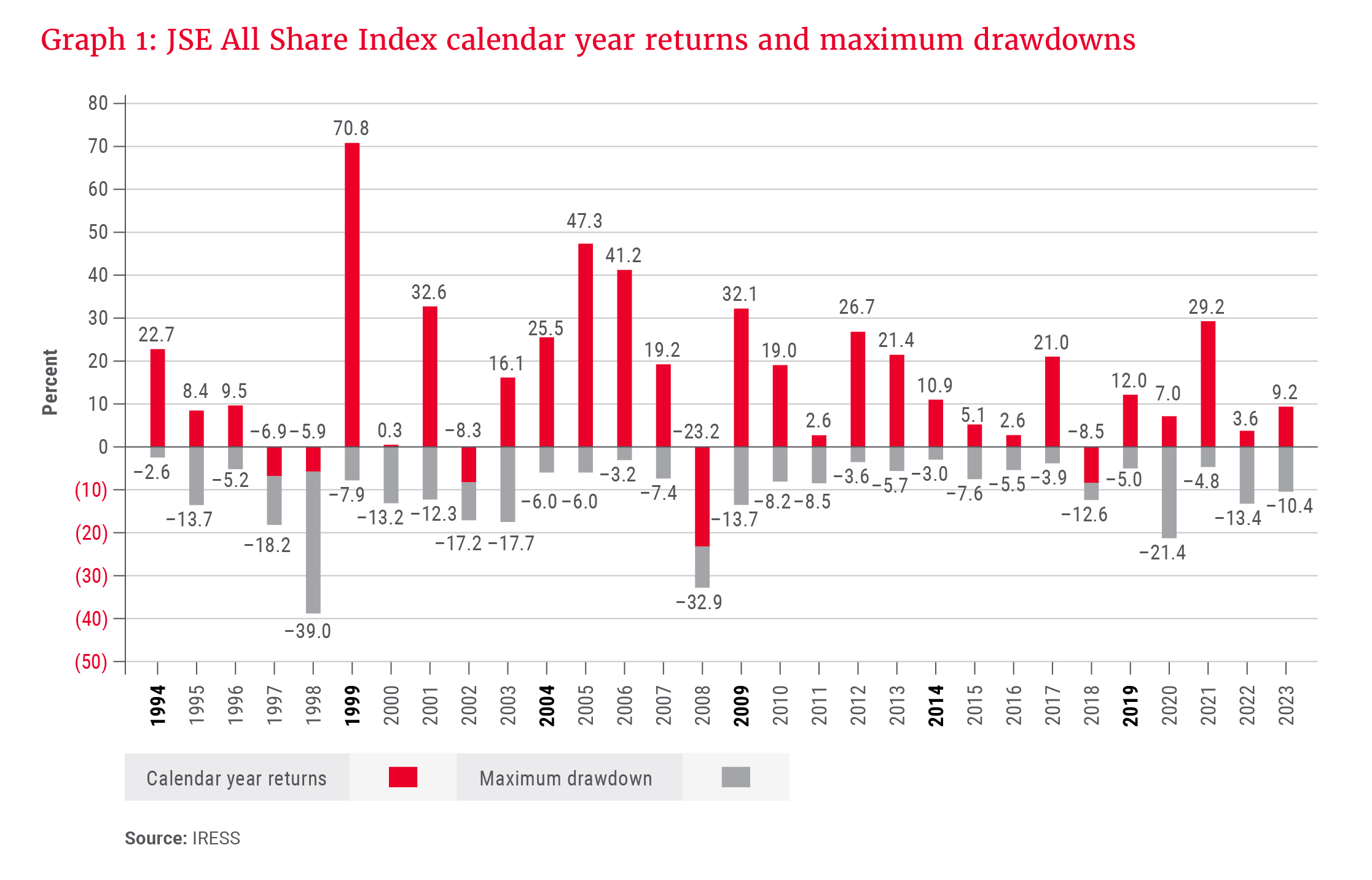

Graph 1 reveals that, over the 30-year period coinciding with South Africa’s democracy, the FTSE/JSE All Share Index (ALSI) has experienced a drawdown every year, as shown by the grey bars in the graph illustrating maximum market drawdowns per calendar year. Markets are cyclical, and short-term volatility, which is an inherent feature of achieving real returns, also leads to fluctuating returns with no clear pattern, even during repeat events such as election years – marked in bold on the graph.

As the red bars show, there have been far more years with positive returns over this 30-year period. Indeed, only five calendar years in this period delivered a negative return, and none of these coincided with an election year. New York Times bestselling author Morgan Housel captures this sentiment well, noting that the biggest economic risk is the one no one talks about, because if no one talks about it, no one is prepared for it. And if you are not prepared, the damage is amplified when it hits you.

Markets and sentiment can be temporarily affected by various external dynamics, including macroeconomic and political factors and unpredictable events. This is true of 2024. We are not in a typical election cycle; the outcome of the May election could drastically change many policies that could affect companies in different ways. But the same was true in 1994, and the ALSI achieved a return of 23% that year. Despite a number of market shocks and rebounds, if you had invested for the long run, you would have compounded your wealth by 13% per annum over the last 30 years.

We stay focused … ignore the noise, fear and popular sentiment, and remain disciplined in our pursuit of higher returns with lower risk of loss.

This serves as a reminder that, while short-term fluctuations are likely to occur around the election, history suggests that the long-term trajectory of the market is driven by broader economic factors and company fundamentals. History has also taught us that investors who have endured the tough periods and adopted a longer-term view at the most uncomfortable of times, tend to be rewarded for their patience. Of course, simply focusing on the long term is not without risks; sometimes long term is longer than the time we have. And the period we need to endure may see changes and reforms, and more pain, before there is recovery. It is often darkest before dawn.

Perspective leads to clarity of focus

Investors with perspective tend to focus more on what they can control than on what they cannot. As shown in Graph 1, we cannot control, or predict, when the market will move up and down, so trying to perfectly time an entry and exit from the market is a near impossible task. Similarly, we cannot control the outcome of an election or its impact on the markets or our investments. What we can control is how we react both in the run-up to and after the election – although keeping emotions in check is easier said than done. This has been illustrated over time by investors switching out of equities into cash during times of uncertainty, often locking in losses.

Knowing that emotions can get the best of us, it may make most sense to outsource asset allocation decisions to a professional investment manager by investing in a diversified, multi-asset class fund, such as the Allan Gray Balanced Fund. Our experienced investment professionals weigh up the long-term opportunities of different assets and build the portfolio for a range of possible outcomes, rather than a single forecast or expectation.

It is not to say that our Balanced Fund returns will not be volatile in the wake of the election, but our portfolio managers carefully consider multiple variables to give your investment the best chance of performing in multiple scenarios. The Balanced Fund has exposure to offshore assets, locally listed shares that are international businesses, attractively valued domestic businesses, high-yielding cash and bonds, as well as precious metals. The different assets held give the Balanced Fund the opportunity to earn returns from different sources, in different scenarios.

It is important that you know your risk appetite and are honest at the outset about how much volatility you will be able to tolerate.

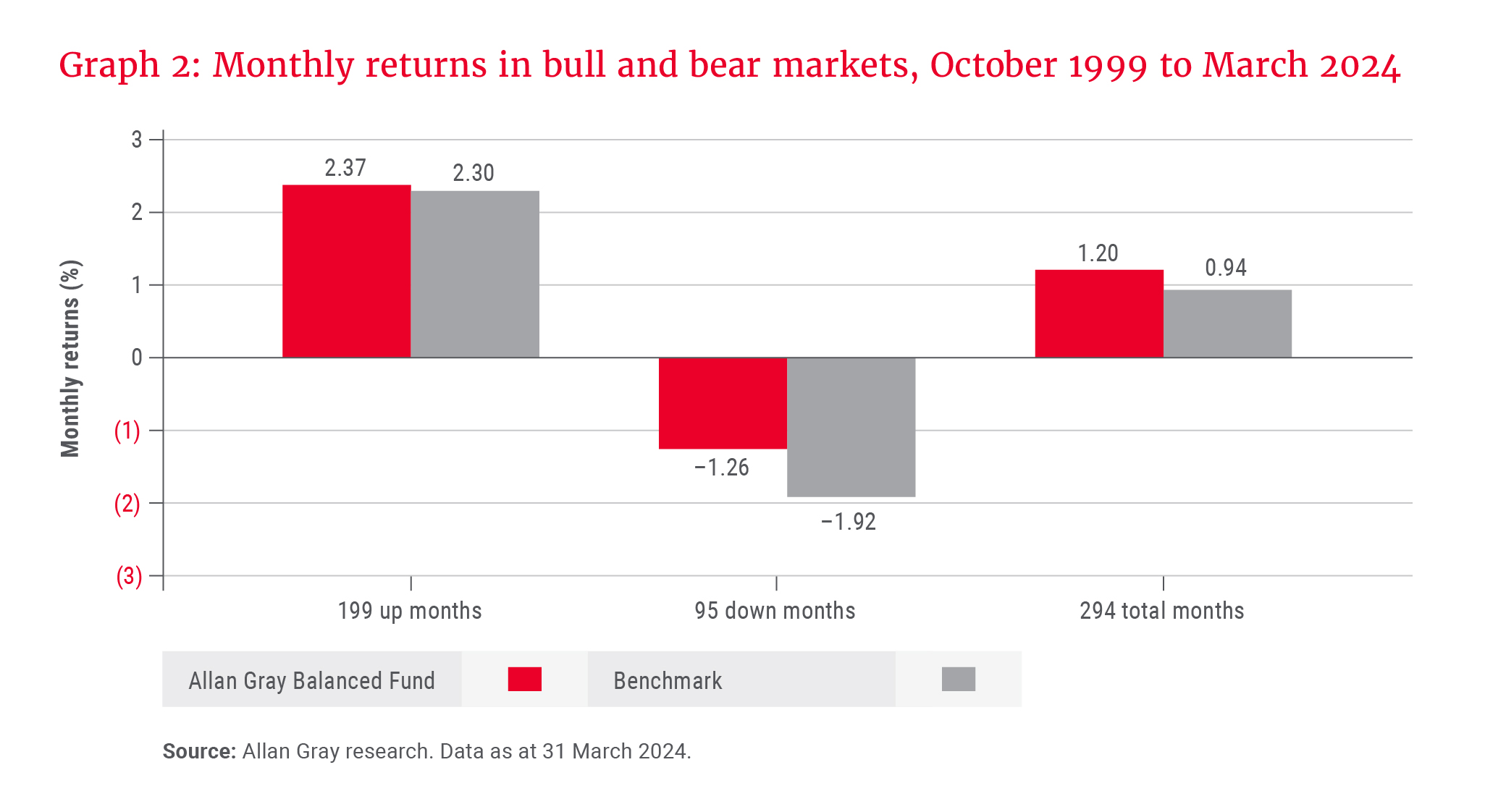

The Balanced Fund is managed to protect your investment in down markets, while still delivering returns when markets are performing. As shown in Graph 2, since the Balanced Fund’s inception in October 1999, it has delivered reasonable returns during positive markets (largely in line with its peer group benchmark) and experienced smaller negative returns on average when the market has fallen. The red bars reflect the average monthly performance of our Balanced Fund, and the grey bars the performance of our peer group. Consistently implementing our investment approach, which aims to limit the impact of losses while focusing on generating good long-term returns, has allowed us to translate the theoretical benefits of capital protection into reality.

Perspective shapes a resilient investment strategy

Perspective also brings a deeper understanding of challenges and their underlying causes, which can build resilience and prevent knee-jerk behaviour. Resilience is all about building capacity to withstand difficulties.

In an investment context, adopting a resilient investment strategy includes establishing your investment plan and goals, perhaps with the help of an independent financial adviser, being clear about what you expect from your chosen investment manager, and aligning your expectations with your chosen funds’ stated objectives, return expectations, time horizon and risk positioning. It is important that you know your risk appetite and are honest at the outset about how much volatility you will be able to tolerate.

When selecting an investment manager, look for a track record of performance that indicates that the manager has consistently applied their philosophy and process through various cycles.

As investors, we are best served by taking a bird’s-eye view and focusing on the long-term fundamentals of investing …

Our investment team continues to apply the same philosophy we have for the last 50 years in managing your hard-earned savings. We gradually tweak and improve our investment process, which ultimately leads to a lasting competitive advantage. While different opportunities have presented themselves to us in each environment over the past 50 years, our approach remains the same: We stay focused, while being cognisant of the times in which we must invest, ignore the noise, fear and popular sentiment, and remain disciplined in our pursuit of higher returns with lower risk of loss.

But what of 2024?

In our view, the year 2024 has above-average political risk. Although we have no unique insights and cannot predict the outcome of national elections or expected returns, we can focus on the factors that are within our control: buying out-of-favour companies at below fair value and selling them when they reach our estimate of true worth. Rather than hedging our bets on one or two scenarios prevailing, we try to understand what is discounted in current asset prices.

While many interpret this as simply buying low and selling high, there are important nuances, the most important of which is to understand whether a company is temporarily out of favour with the market or whether it is facing insurmountable challenges, such as the huge structural changes in business models brought about by a shift in the political landscape.

Benjamin Graham, often referred to as the father of value investing, shared the following words of wisdom that fit well with what we are currently experiencing: “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”

As investors, we are best served by taking a bird’s-eye view and focusing on the long-term fundamentals of investing rather than making investment decisions based on short-term uncertainty.