How can you assess whether your portfolios are resilient enough to weather periods of volatility and deliver outperformance over the long term? And, more importantly, how can you evaluate whether your investment manager is the right captain to navigate troubled waters? Nomi Bodlani offers some suggestions.

After a turbulent six months, investors could be forgiven for looking to eliminate risk altogether. But eliminating risk entirely is not possible (or a good idea): Successful long-term investing is about balancing the risk of loss and the risk of losing out. Instead of retreating, a more advisable response is to assess whether your investment manager is striking this balance well in their pursuit of returns that achieve their funds’ objectives. Consider whether you can answer yes to each of these three key questions:

- Does the way your manager defines and manages risk resonate with you?

- Does your manager consistently apply a rigorous and disciplined approach in deciding which assets to include in your portfolio?

- Does your manager’s investment approach deliver real results over the intended time horizon?

Below we tackle these questions and provide examples to help you assess your investment manager’s approach and results.

Does the way your manager defines and manages risk resonate with you?

Market participants use different definitions of risk. Many equate risk to volatility, which is how much an investment’s return varies from its average over time. Another popular definition of risk is being different – i.e. looking and performing differently from the benchmark.

At Allan Gray, we define risk as the probability of a permanent loss of capital. The word “permanent” is important because when you invest in high-risk assets, such as equities, you may experience losses (on paper) as prices move up and down every day – but these are temporary losses. To reduce the risk of permanent capital loss, we avoid overpaying for individual assets and construct portfolios that are positioned to do well under a wide range of possible scenarios.

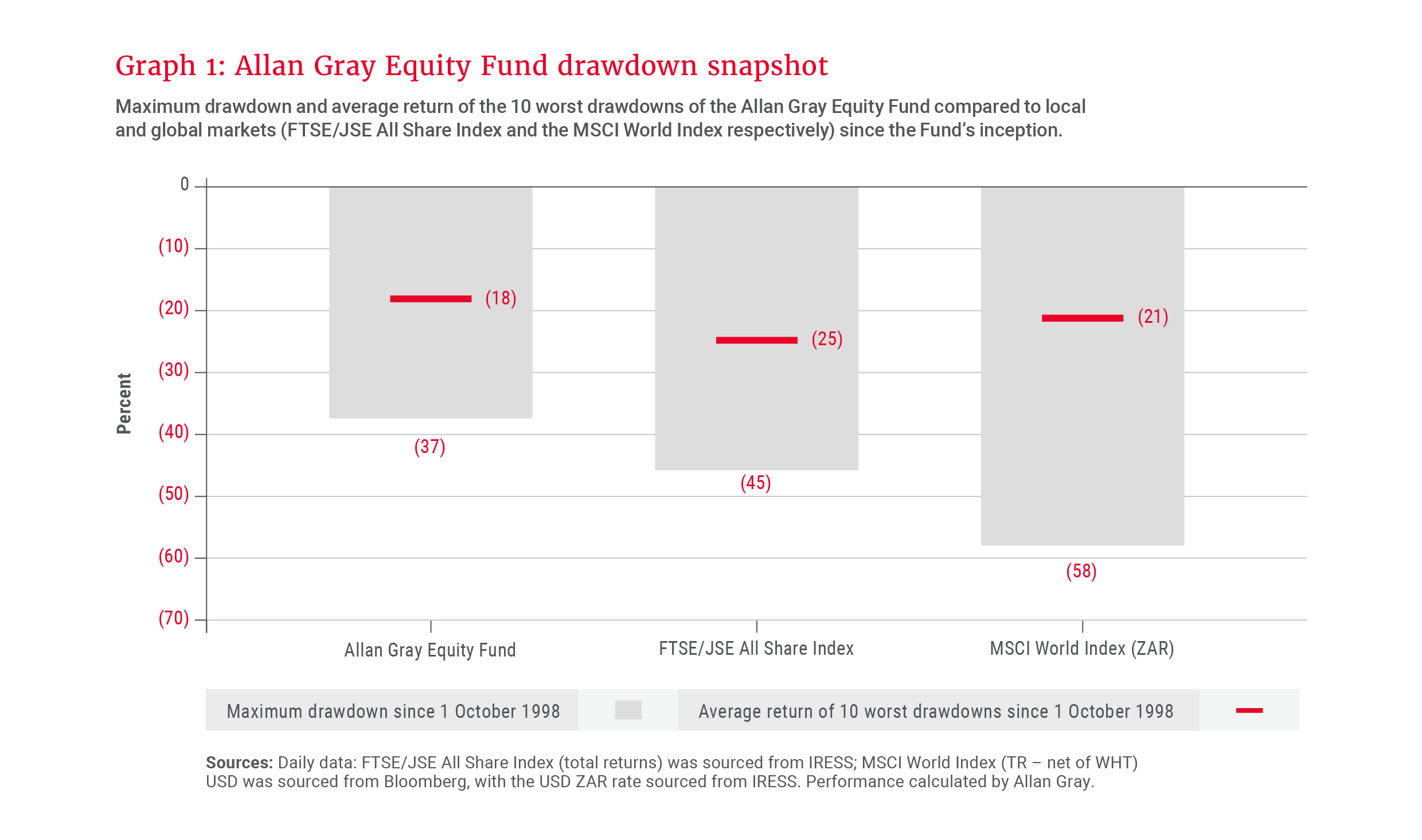

To assess how we perform in managing the risk of permanent capital loss, you can review how well the Allan Gray Equity Fund has protected your capital during market drawdowns (periods when the market falls from its most recent peak to a trough), as shown in Graph 1, as well as how long it took the Fund to recover.

Some observations:

Maximum drawdown: The grey bars show that our Equity Fund’s worst drawdown since inception was -37%, compared to -45% for the FTSE/JSE All Share Index (ALSI) and -58% for the MSCI World Index.

10 worst drawdowns: The maximum drawdown is only one data point; looking at the 10 worst drawdowns since the Fund’s inception, the Fund has experienced shallower drawdowns on average (-18%) than the ALSI (-25%) and the MSCI World Index (-21%), as indicated by the red lines.

In addition to the above, the Fund recovered from these drawdowns in 44 weeks on average – faster than the ALSI (51 weeks) and the MSCI World Index (89 weeks).

Looking at this a different way, since inception, our Equity Fund has lost an average of R53 for every R100 the market lost, while its peers lost R76. The compounding effect of losing less during down months and recovering faster means less ground to make up. Losing less, and therefore starting in a stronger position, has resulted in overall outperformance: Since inception, the Fund has delivered R128 in average monthly returns for every R100 delivered by its peers, and R120 for every R100 delivered by the ALSI.

Does your manager consistently apply a rigorous and disciplined approach in deciding which assets to include in your portfolio?

Resilience is more than defence. Protecting capital during turbulent times is only one part of the equation; this alone will not help you build wealth. Your manager must also grow your capital through absolute real returns – i.e. returns that beat inflation. This requires the ability to find opportunities (regardless of market conditions) and having the conviction to hold them in the face of criticism, consensus and short-term underperformance.

Understanding your investment manager’s investment approach, and assessing their commitment to it, is important because this is an indicator of whether their performance will be replicable over time. In addition, if you understand and buy into your investment manager’s approach, you are more likely to stay the course.

At Allan Gray, our proprietary, fundamental research gives us a deep understanding of a broad range of companies. Core to our investment philosophy is assessing a company’s true worth. This anchors our ability to invest in companies and other assets at a discount when negative sentiment drags their price down, and conversely informs us when to sell.

Our portfolios often look different from the index and our peers. This should be expected, given our contrarian investment approach: We are not afraid of being different. We focus on selecting individual assets that provide the most attractive expected returns for a given level of risk, and avoid overpriced assets, irrespective of their size or weighting in a benchmark. And just because a particular asset class or share is not performing well today, doesn’t mean it should be abandoned or excluded in the future.

Ultimately, an investment strategy must be judged by whether it delivers real results over the period it promised to …

We are not contrarian for the sake of being contrarian; investors can assess our performance by looking at holdings that have contributed to or detracted from our performance relative to our peers. For example, going into 2024, our Equity Fund held a smaller percentage of domestically focused businesses (“SA Inc.”) than the market, despite attractive valuations, given the potential binary election outcomes and higher-than-usual risk of permanent capital loss. Instead, we positioned the Fund for a range of potential post-election outcomes.

Following the formation of the government of national unity in June 2024, SA Inc. shares strongly outperformed multinational rand-hedged shares, driven mostly by a change in sentiment rather than any material improvement in the operating environment. This resulted in our Equity Fund underperforming its peer group benchmark in 2024. Subsequently, the Fund further reduced its exposure to SA Inc. names as they rallied in the second half of 2024, and further increased holdings in rand-hedged shares such as brewer AB InBev. Favouring international companies detracted from performance last year – but supported performance in 2025.

This example illustrates the discipline of sticking to an investment thesis even when it temporarily hurts performance, and only adapting when the underlying opportunity set changes. Ultimately, an investment strategy must be judged by whether it delivers real results over the period it promised to, which leads us to the last question.

Does your manager’s investment approach deliver real results over the intended time horizon?

Understanding the time horizon your manager applies to their different funds is key to aligning expectations and evaluating performance. At Allan Gray, we are long-term investors, and we encourage our clients to take a long-term approach. In the face of short-term downturns, it is easy for investors to panic, chase trends or make hasty decisions. We prefer to maintain our contrarian stance, tilting the portfolio towards overlooked or underappreciated opportunities that we believe will reach their potential in the fullness of time.

While there will be periods when we underperform, especially over the short term, our Equity Fund has outperformed its benchmark (measured monthly) 61% of the time across all rolling one-year periods, 73% of the time across all rolling five-year periods, and 98% of the time across all 10-year periods since inception.

Overall evaluation

You may be wondering where to find the answers to the questions discussed, and what to evaluate your manager against. A good starting point is the minimum disclosure documents, also known as factsheets, that investment managers produce for each unit trust.

You can consult Allan Gray’s factsheets, which are available on this page and updated monthly, to assess whether we have been true to our word – i.e. if your chosen unit trust is performing according to what it says on the tin.

True resilience requires not only surviving market stress, but also thriving once the dust settles. We apply our investment philosophy and process with unwavering discipline in our bid to continue delivering long-term outperformance for our clients.

Explore more insights from our Q2 2025 Quarterly Commentary:

- 2025 Q2 Comments from the Chief Operating Officer by Mahesh Cooper

- Allan Gray Stable Fund: Celebrating a quarter of a century by Radhesen Naidoo and Danielle Nissen

- Rebuilding the global monetary order with bricks of gold by Umar-Farooq Kagee

- Crouching tiger, hidden value by Andrew McGregor

- Orbis Global Equity: Discipline in the face of volatility by Adam R. Karr

- How to think about beneficiary nominations for your retirement funds by Ian Barow

To view our latest Quarterly Commentary or browse previous editions, click here.