What does 2024 have in store for loadshedding? Raine Adams investigates whether there is any light at the end of the dark tunnel.

The past year was a particularly tough one for South Africans as we plunged deeper into an electricity crisis: Loadshedding took place on 335 days in 2023. The resultant economic destruction has been substantial – it is estimated to have subtracted 1.8% from real GDP growth, resulting in a tepid 0.8% growth for the year.

The impact is clear when we look at examples at a company level: Shoprite spent R1.3bn on diesel for its generators during the financial year, while Astral suffered its first ever loss on the back of R1.7bn in loadshedding-related expenses. The SMME sector also came under significant strain. From contractors and galvanisers to bakers and ceramicists, loadshedding has hampered productivity, increased losses, and highlighted how essential reliable energy supply is to modern economies.

Securing our energy supply is key.

Eskom's power generation fleet

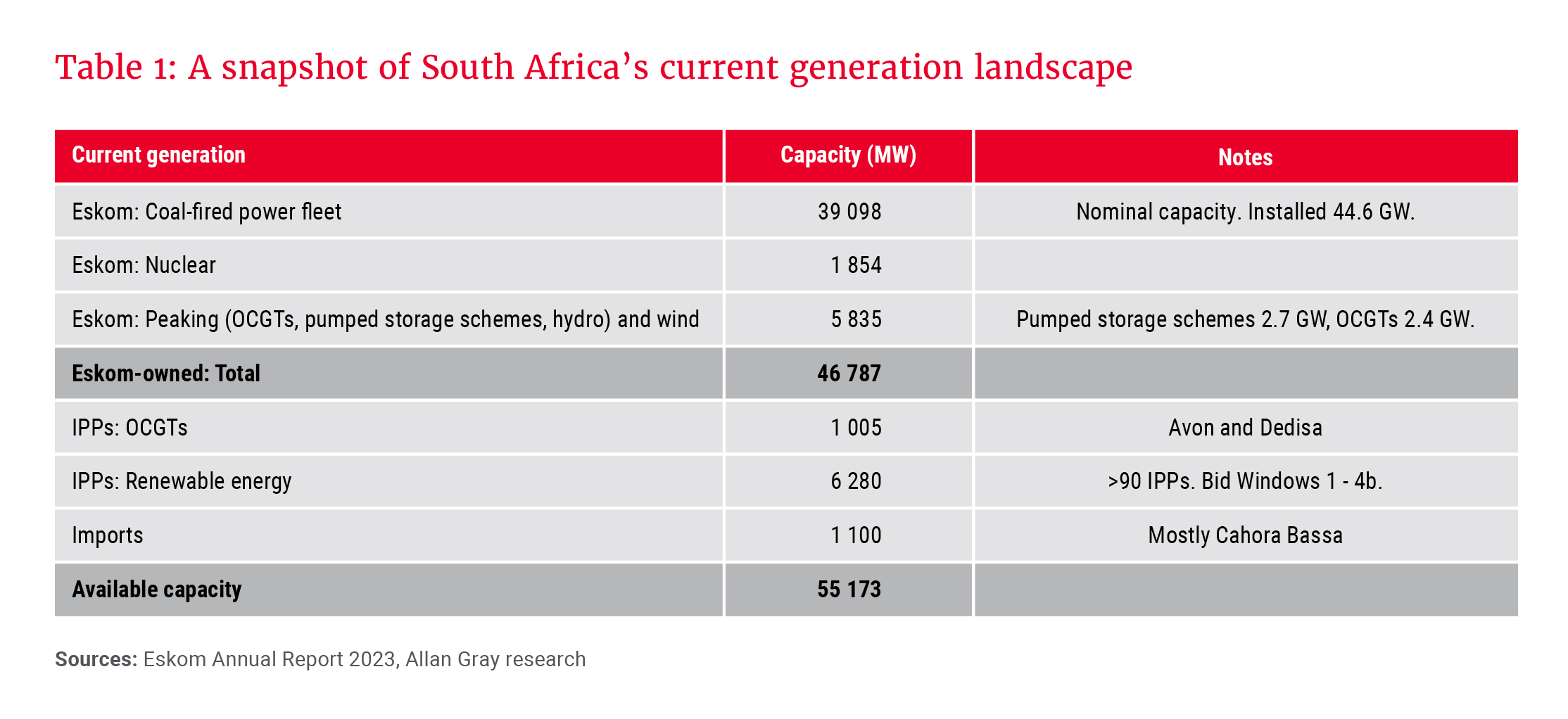

South Africans may have become familiar with the term “energy availability factor” (EAF), which is the percentage of Eskom’s generation fleet that is available for operation, out of roughly 47 gigawatt (GW) of nominal capacity. As demonstrated in Table 1, this 47 GW excludes generation capacity from the renewable energy and open-cycle gas turbine (OCGT) independent power producers (IPPs), as well as international imports, which account for another ±8 GW. Two key factors reduce the EAF: unplanned outages (both partial and full load losses) and planned outages, the latter being when units are taken offline for planned repairs and maintenance.

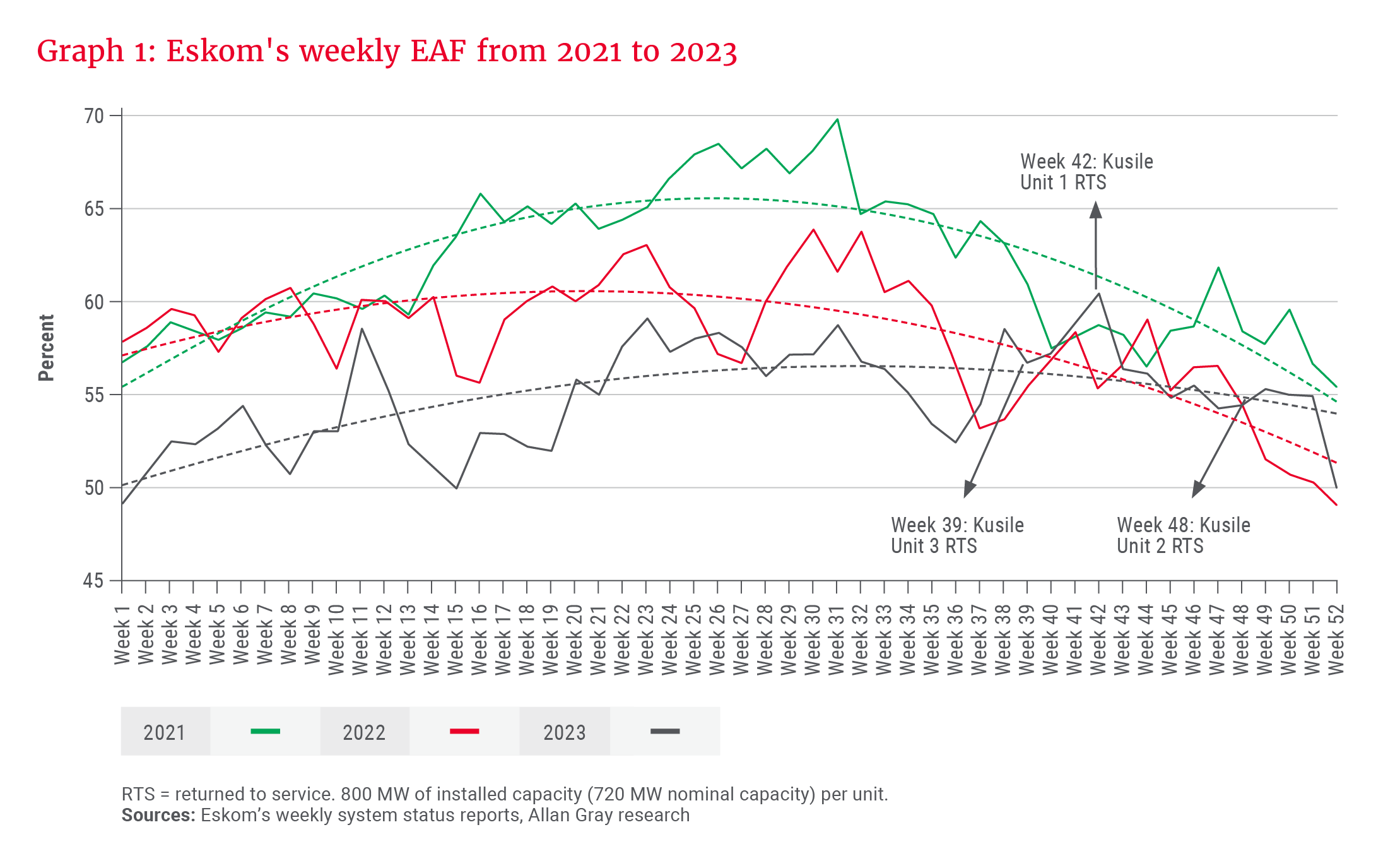

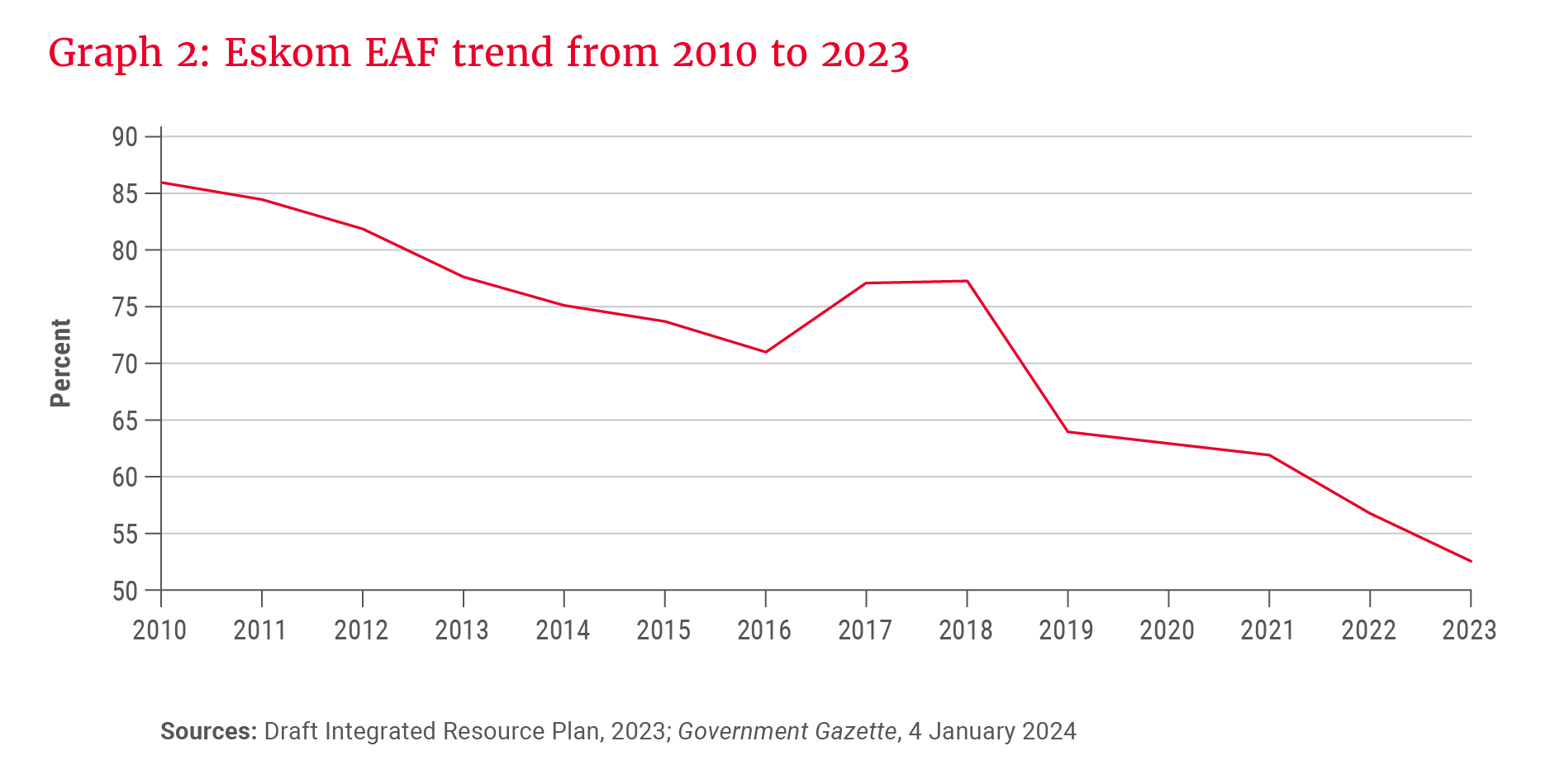

Graph 1 shows Eskom’s EAF over the past three years, highlighting the deterioration in performance. The decline is even more stark over a longer period, as demonstrated by the downward trend in Graph 2 from the recently published draft Integrated Resource Plan, 2023. In the last week of 2023, only 50% of Eskom’s generating capacity was operating, with unplanned losses at 31% and planned outages at 19% of nominal capacity respectively.

As Graph 1 shows, there is some seasonality in the EAF, with planned maintenance ramping up from lows of 5% in winter (when peak demand is higher and requires more available supply) to 20% in summer.

Recent announcements from Eskom offered some cause for optimism that unplanned outages may decline. From September to November 2023, Eskom returned three Kusile units to service, each at 720 megawatt (MW) of nominal capacity. These had been taken offline in 2022 following a major flue duct collapse at Unit 1, which compromised all three units. However, subsequent unplanned outages have been erratic rather than showing a distinct improvement (see Graph 3), owing to Eskom’s dry-cooled power stations struggling with a heat wave, among other issues. One could argue that there was an improvement over the full year: Unplanned losses declined from 17 GW to 14.5 GW.

At the same time, Graph 3 demonstrates the volatility of unplanned outages. Eskom’s generation capacity is still dominated by coal power, and the coal fleet is ageing. The median age of Eskom’s 14 coal power plants is 39 years, while the capacity-weighted average is 33 years, owing to the size of Kusile and Medupi at 4.8 GW each.

… Eskom continues to forecast an unchanged 16 GW of unplanned outages for the duration of 2024 …

Eskom’s troubles have not arisen overnight. For over a decade, Eskom’s failure to build new generation capacity timeously meant that it had to create “virtual capacity” by running its ageing coal units much harder than it should. Eskom also significantly underinvested in performing the necessary maintenance, creating a vicious cycle in which unplanned losses shot up.

Keen observers may have noticed that Eskom continues to forecast an unchanged 16 GW of unplanned outages for the duration of 2024, despite multiple units’ return to service. Management’s reason for this is that the fleet’s age and wear and tear mean that it remains unreliable and unpredictable, and they prefer to plan conservatively.

In December 2023, Eskom synchronised Kusile Unit 5 to the grid for the first time. It will supply electricity intermittently over the next six months while Eskom performs testing and optimisation, after which full commercial operation will be achieved. In turn, Kusile Unit 6 will synchronise in August 2024 and should reach commercial operation by early 2025. Finally, Medupi Unit 4, which was damaged in an explosion in 2021, will be returned to service by August 2024. Each of these units contributes 720 MW of additional nominal capacity. This is something of a milestone: Medupi and Kusile were scheduled to be completed in 2014. Instead, their 12 generating units (six at each plant) should be online simultaneously for the first time in 2025. Even more staggering is their cost, estimated at over R470bn and nearly three times the initial budget when including capitalised interest during construction.

South Africans ultimately bear the cost of these and other failures. Eskom’s average selling price per kilowatt-hour (kWh) of electricity was R1.79 for the six months to 30 September 2023. An 18.5% tariff increase was implemented in April 2023, with another 13% escalation planned for April 2024. In 2008, the average selling price was 19.5 c/kWh, highlighting how tariff escalations since have substantially exceeded inflation. In addition, individuals have incurred further expenses to install alternative power sources, as well as due to losses as a result of food spoilage, damage to appliances and more. To be fair, historically the cost of electricity in South Africa was too cheap, as the real costs (such as proper maintenance and expansion capital expenditure) were not appropriately factored in.

The pipeline of new generation capacity

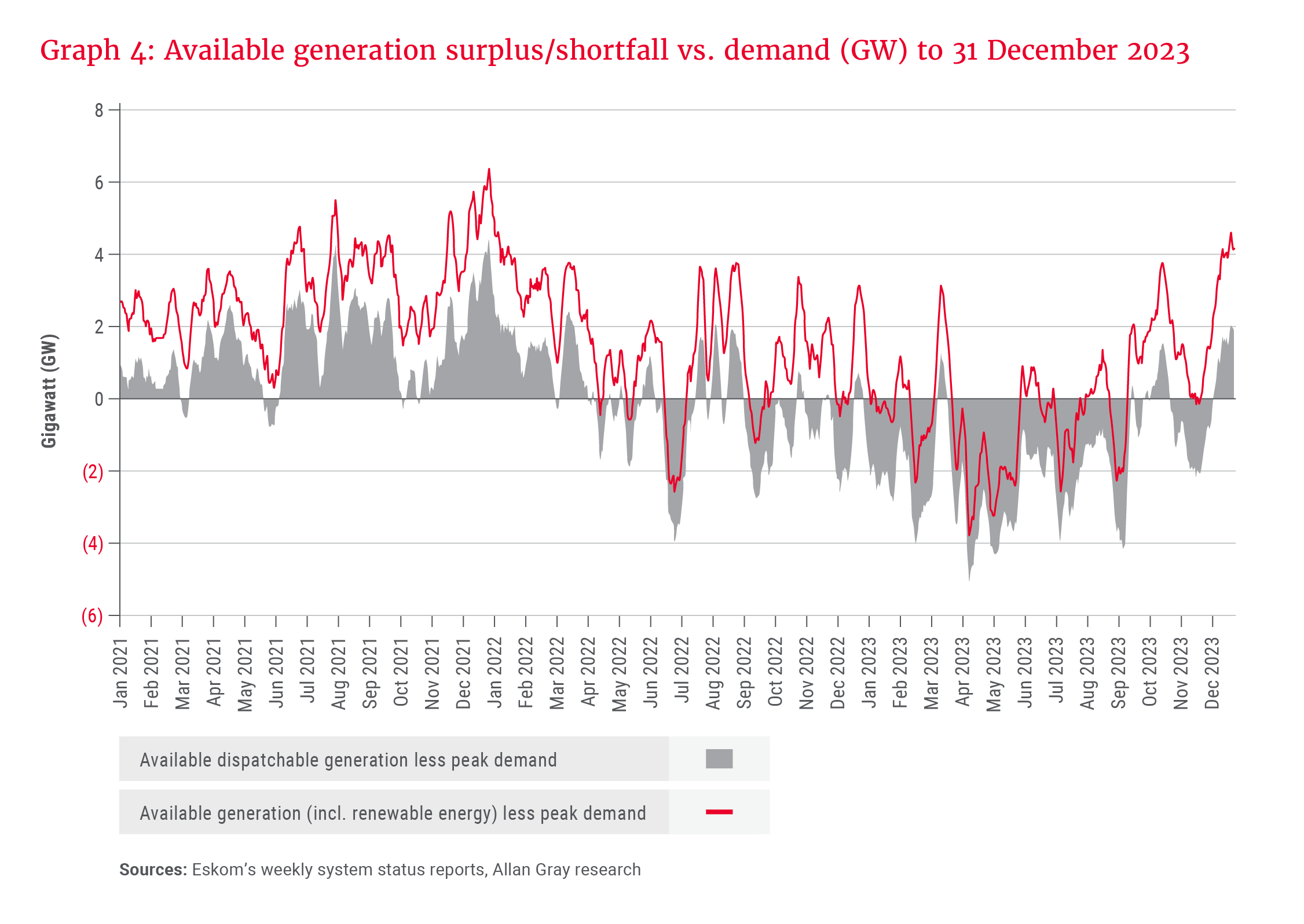

Graph 4 shows how South Africa’s electricity supply has largely failed to meet demand since mid-2022. That said, the red line (versus the grey line) shows the important contribution that 6.3 GW of operational renewable energy, procured via the Renewable Energy Independent Power Producer Procurement Programme (REI4P), has made to reduce the deficit.

Each stage of loadshedding corresponds to an additional ±1 GW shortfall in available supply. Eskom typically sees a ±2 GW variance in unplanned losses within a one-week period, and an operating reserve of 2. 2 GW is maintained to avoid a blackout scenario. If the system is already in deficit, Eskom will initiate two further stages of loadshedding to create this reserve. Frequent Stage 6 loadshedding in the first half of 2023 demonstrates that South Africa urgently needs 6 GW of additional generation capacity.

So what is in the pipeline? From a government perspective, very little in the short term. For example, the 2 GW Risk Mitigation Independent Power Producer Procurement Programme (RMI4P), intended to get megawatts onto the grid urgently from 2020 through public-private partnerships, has seen only 150 MW commence operations. The three awarded Karpowership projects, floating gas to power plants that accounted for 1.2 GW, were mired in controversy from the start, and had their allocated grid access from Eskom revoked in January 2024.

A combined 3.5 GW was awarded following REI4P Bid Windows (BWs) 5 and 6, yet only 1.2 GW is under construction and will start coming online in the second half of 2024 (bear in mind that South Africa’s operating renewable energy has a ±30% average load factor versus its capacity). Macroeconomic changes rendered many of the REI4P projects awarded unviable at the tariffs bid and some developers are pivoting to the private sector, where tariffs can be negotiated bilaterally.

While the short-term government-led generation pipeline has been underwhelming, the private sector is showing promise.

BW7 was finally launched in December 2023, with bid submissions due by April 2024 and the intention to award up to 5 GW of projects. The Independent Power Producers Office will be more selective by only awarding projects that can be connected to the grid speedily (accounting for grid constraints), but no later than 24 months after commercial close, i.e. these will likely come online from 2026. Eskom has also launched standard offer programmes for local and cross-border purchases.

Eskom’s Just Energy Transition (JET) pitch under the JET Partnership was that it would retire up to six coal plants by the end of 2030 and another two in the early 2030s. Given South Africa’s current position, Eskom needs to extend the life of plants where feasible. However, these old power plants are also major polluters, as Eskom has not had the funds for necessary retrofits. Minimum emission standard (MES) compliance postponements were obtained for some, provided they shut down by specified dates, while civil society organisations are taking Eskom to court over various MES violations.

On the other hand, the National Union of Mineworkers, the largest trade union at Eskom, recently called for a suspension of the JET plan until there was further consultation with labour, given the imminent risks to jobs. Eskom is stuck between a rock and a hard place. Finally, the National Nuclear Regulator is reviewing the safety of Eskom’s requested 20-year life extension of Koeberg Nuclear Power Station, the result of which will be announced in July 2024. Related work means that only one of the two Koeberg units will be operational at a time to mid-2025, with a possibility of both units being offline simultaneously for some of this time.

… the private sector will ultimately bring over 8 GW onto the grid in under four years …

While the short-term government-led generation pipeline has been underwhelming, the private sector is showing promise. South Africa has seen rapid growth in rooftop solar – from 2.3 GW in July 2022 to 5 GW in December 2023, as well as a boom in private generation plans since lifting the embedded generation cap from 1 MW to 100 MW in 2021, and subsequently removing it altogether. For example, members of Minerals Council South Africa have 6.5 GW of projects (89 projects by 29 mining companies, worth >R100bn) at various stages. The government recently estimated that 5.6 GW of new private capacity should be online by 2025.

Between rooftop solar and these larger generation projects, the private sector will ultimately bring over 8 GW onto the grid in under four years (despite significant constraints), highlighting the remarkable resilience and innovation that South African companies and individuals continue to demonstrate in the face of government service failures.

Eskom surveyed renewable energy project developers in Q1 2023: 66 GW of wind and solar is at various stages of development in South Africa, with 18 GW at an advanced stage, i.e. it could reach commercial operation within three years. Currently there is no grid capacity left in the best resource provinces – the Western, Eastern and Northern Cape – although initiatives are underway to “free up” some capacity. Insufficient transmission infrastructure is a longer-term impediment to a large renewable energy roll-out if the execution of transmission expansion plans disappoints.

Longer term (to 2030), the recent draft Integrated Resource Plan (IRP) suggests that the government is pinning its hopes on gas, with the proposed build-out increasing from 3 GW in the 2019 IRP to 7.2 GW in the latest publication. The new IRP has also forecast confusingly low solar photovoltaics (PV) and wind additions versus other commentaries. Clearer, more consistent planning and execution are needed.

Leadership, culture and corruption

“Sabotage at Eskom is of grave concern and catastrophic proportions with highly organised attempts at undermining the country’s electricity supply.” – Electricity Minister Kgosientsho Ramokgopa, June 2023.

Eskom has suffered a leadership crisis, with 13 CEOs in the last 16 years and 10 chairs of the board since 2005. The head of generation role has also seen a high turnover. Sweeping changes were made to the board in late 2022, with all 13 non-executive director positions being filled for the first time in three years. Eskom had been operating with five non-executive directors, four of whom were replaced.

Criminality and sabotage at Eskom power plants range from low-level opportunistic crimes to highly sophisticated criminal networks and syndicates. Theft of fuel oil and diesel seems widespread, while examples of sabotage include “mysterious” failures (to secure further work for contractors and procurement companies), oil leakages, attempts to cut off conveyor belts feeding coal to power stations and other equipment being knocked out. Corruption relating to coal quality has also been a key cause of Eskom’s troubles by leading to more breakdowns, such as boiler tube leaks. Many employees are implicated in criminality and corruption, while a number of those not involved have been threatened.

The reality is that many good employees and candidates do not want to put themselves and their families at risk by remaining in or taking on these roles, given the known security threats, and this may continue to weigh on Eskom’s ability to resolve the problem so long as anticorruption efforts remain inadequate. It is also important to emphasise that there are still many smart, good people working at Eskom, and we should be grateful for their hard work.

Eskom’s recent base case forecasts Stage 3 loadshedding every month into 2025 …

On a positive note, the unbundling of Eskom into three units, namely Generation, Transmission and Distribution, first announced in 2019, took a step forward in January 2024 with the Eskom board announcing the appointment of a board of directors for the National Transmission Company of South Africa. The Transmission unit is the first of Eskom’s divisions to achieve legal separation, and we believe this unbundling is important to foster a competitive generation landscape in South Africa.

Forecasting loadshedding

Our own modelling of Eskom’s supply versus forecast demand for the year ahead suggests that 2024 loadshedding will range from Stage 1 to Stage 3 – if gains from Kusile and Medupi units can be sustained, and the rest of the fleet’s performance remains roughly the same. However, this is, of course, unlikely. As Eskom has stated, the coal fleet is unreliable and unpredictable. While there are various initiatives underway to augment skills and the control environment within Eskom, the risk of further large-scale negative events and issues associated with an ageing, poorly maintained coal fleet remains. Leadership instability and corruption weigh on this outlook. Eskom’s recent base case forecasts Stage 3 loadshedding every month into 2025 (still an improvement from frequent Stage 6 in 2023), while the latest IRP models unserved energy of approximately 13.5 Terawatt-hours (TWh) in 2024 versus 17.3 TWh in 2023.

Finally, Eskom’s loadshedding forecasts budget for unplanned outages that may occur due to technical issues, but do not cater for power station disruptions that could arise due to industrial action or other employee protests. This, together with an escalation in sabotage attempts, is a risk during an election year. In our view, private sector projects are most likely to reduce pressure on the grid up to 2026, but loadshedding over this period can only be solved by a sustained improvement in the existing coal fleet’s EAF.

We are hopeful that peak loadshedding is behind us, but, unfortunately, we are not out of the woods yet.