Finance Minister Tito Mboweni delivered the Budget speech on Wednesday, 24 February. Against the backdrop of the COVID-19 pandemic, the Budget was more optimistic than expected, with tax increases kept to a minimum.

It is important to understand the context. South Africa is benefiting from a commodity price boom. Compared to the predictions in the October 2020 Medium-Term Budget Statement, tax collections are now expected to be higher by R100bn in 2020/21 and R86bn in 2021/22. Higher revenues have provided space for the Treasury to cancel a proposed R40bn tax increase in 2021/22 and provide some tax relief for companies. Most important is the government’s decision to persist with its fiscal stabilisation programme, including the freeze on public service wages.

Ensuring access to COVID-19 vaccines is the government’s immediate priority. Access to vaccinations will be provided free of charge, with funding for the vaccine procurement and roll-out being drawn from the national budget.

Below we highlight some of the key aspects of the 2021 Budget that may impact investors. These changes come into effect on 1 March 2021, unless otherwise indicated.

What were the key changes?

The highlights from this year’s Budget are summarised below:

- The government will not raise additional tax revenues. The expected revenue loss will be offset by the increase in excise taxes (see below).

- An above-inflation increase of 5% in the personal income tax brackets and rebates, which is expected to provide relief of R2.2 billion.

- The corporate income tax rate will be lowered to 27% for companies with years of assessment commencing on or after 1 April 2022.

- The Unemployment Insurance Fund (UIF) ceiling will be increased to R17 711.58 per month from 1 March 2021.

- There will be an inflation-linked general fuel levy increase of 15 cents per litre for petrol and diesel, and an above-inflation increase of 11 cents per litre in the Road Accident Fund levy, with effect from 7 April 2021. The carbon tax rate will increase by 1c to 8c per litre for petrol, and 9c per litre for diesel, also from 7 April 2021.

- Excise duties have been increasing by more than inflation in most recent years, and this continues, with excise duties on alcohol and tobacco increasing by 8%. The policy framework for both alcohol and tobacco will be reviewed during 2021/2022.

- Plastic bags are currently taxed at 25 cents per bag. To support a greener economy, a reduced level of 12.5 cents per bag will apply for bio-based plastic bags, from a date to be announced later in the year.

- Increases of just over 4% have been made to the medical tax credits.

The following applies for the period from 1 March 2021 to 28 February 2022:

Individuals and special trusts

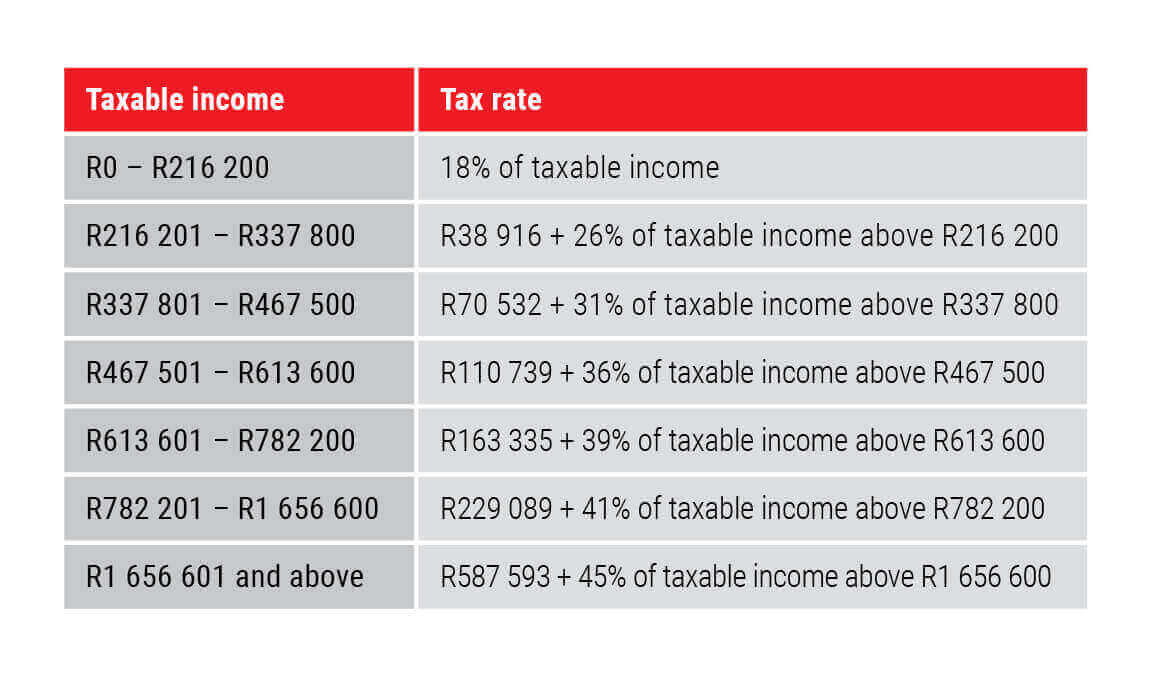

An above-inflation increase has been made to the personal income tax brackets, which means that taxpayers earning above R216 200 will fall into the 26% tax bracket. The highest marginal tax rate for individual taxpayers remains unchanged at 45%. The personal income tax rates for the 2021/2022 tax year are listed below.

Tax thresholds

There has been an above-inflation increase to the tax-free thresholds for personal income taxes to the following:

- R87 300 for taxpayers younger than 65

- R135 150 for taxpayers age 65 to 74

- R151 100 for taxpayers age 75 and over

Rebates

The primary, secondary and tertiary rebates (deductible from tax payable) were increased to the following:

- R15 714 per year for all individuals

- R8 613 for taxpayers age 65 and over

- R2 871 for taxpayers age 75 and over

Medical tax credits

Monthly tax credits for medical scheme contributions were increased by just over 4% to the following:

- R332 per month per beneficiary for the first two beneficiaries

- R224 per month for each additional beneficiary

What has not changed?

Tax-free savings account

The annual cap on contributions to tax-free savings accounts remains at R36 000 from 1 March 2021, with the lifetime limit also remaining at R500 000.

Companies and trusts

The income tax rates for companies and trusts (other than special trusts) remain unchanged at 28% and 45%, respectively.

Interest exemptions

The local interest exemptions remain unchanged:

- The exemption on interest earned for individuals younger than 65 years remains R23 800 per annum.

- The exemption for individuals 65 years and older remains R34 500 per annum.

Foreign interest remains fully taxable.

Dividends tax

Dividends tax remains at 20% on dividends paid by resident and non-resident companies in respect of shares listed on the JSE.

Foreign dividends received by individuals from foreign companies (shareholding of less than 10% in the foreign company) are taxable at a maximum effective rate of 20%.

Interest withholding tax for non-residents

Interest withholding tax remains at 15% on interest from a South African source payable to non-residents. Interest is exempt if payable by any sphere of the South African government, a bank or if the debt is listed on a recognised exchange.

Retirement lump sum taxation

At retirement

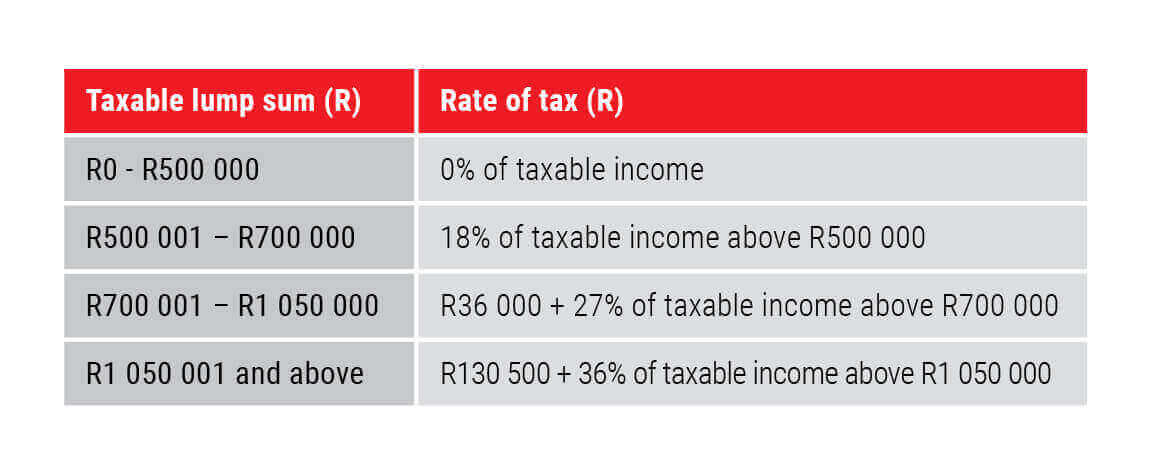

The first R500 000 of a retirement lump sum remains tax-free. The table below illustrates how retirement lump sums will be taxed:

Pre-retirement

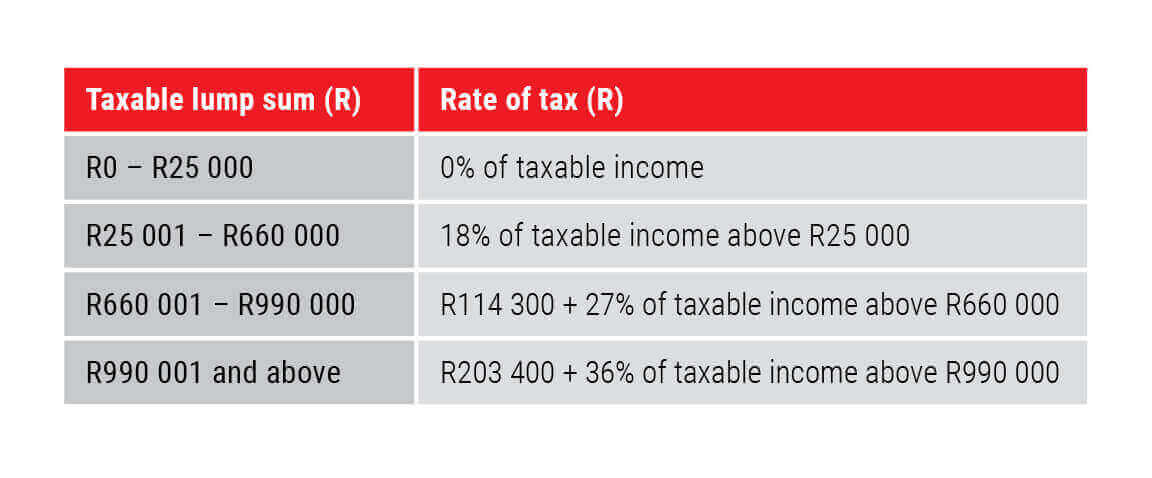

The first R25 000 of a pre-retirement lump sum withdrawal remains tax-free. The table below illustrates how withdrawal lump sums will be taxed:

Capital gains tax (CGT)

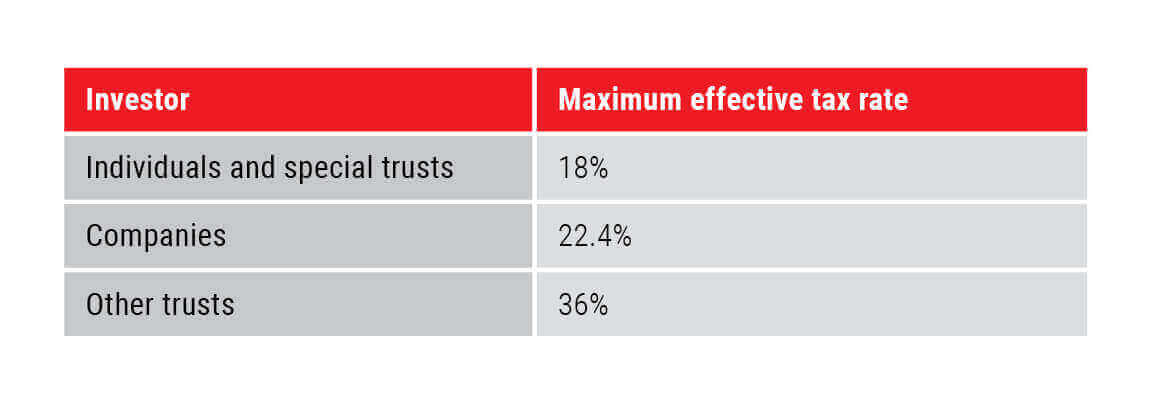

The capital gains tax inclusion rate for individuals and special trusts remains at 40%, and for other taxpayers at 80%.

The annual exclusion for a capital gain or loss granted to individuals and special trusts remains at R40 000. The exclusion granted to individuals remains R300 000 in the year of death.

Value-added tax (VAT)

VAT is charged on the supply of goods and services provided by registered vendors. It remains at 15%.

Estate duty

Estate duty is levied on property of residents and South African property of non-residents, less allowable deductions. The duty is levied on the dutiable value of an estate at a rate of 20% on the first R30 million and at a rate of 25% above R30 million.

A basic deduction of R3.5 million is allowed in the determination of an estate’s liability for estate duty.

Donations tax

Donations tax is payable at a flat rate on the value of property disposed of by donation. It is levied at a flat rate of 20% on the cumulative value of property donated since 1 March 2018 not exceeding R30 million, and at a rate of 25% on the cumulative value of property donated since 1 March 2018 exceeding R30 million.

The first R100 000 of property donated in each year by an individual is, however, exempt from donations tax. This amount remains unchanged from last year.